BDSwiss

-

💵 CurrenciesUSD, EUR, GBP, SEK, PLN

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 1.7 EURUSD: 1.2 GBPEUR: 1.3 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

My Opinion On BDSwiss

I have been trading forex at BDSwiss and several things stand out. Firstly, the trading software and research tools are top-tier with MT4, MT5, Trading Central and Autochartist, though I also enjoy using the BDSwiss WebTrader. Additionally, I have been impressed with the flexible accounts and dynamic leverage, ensuring a range of strategies are catered for.

The major sticking points for me are the weak regulatory credentials and trading fees in the entry-level account. BDSwiss is not authorized by a trusted regulator and spreads in the Classic account came in above average during my tests.

Overall though, BDSwiss meets most of my criteria for forex trading. I explain where it stands out and where it falls short throughout this review.

Summary

- Instruments: 250+ CFDs including 50+ currency pairs, stocks, indices, commodities, crypto

- Live Accounts: Classic, VIP, Zero

- Platform & Apps: MT4, MT5, WebTrader, App

- Deposit Options: Wire Transfer, Credit/Debit Card, Skrill, Neteller, Astropay, Global Pay, MPesa, Korapay, Crypto

- Demo Account: Yes

Pros & Cons

- I think the BDSwiss WebTrader platform is well-designed with strong charting features

- The education for beginners is top-rate with forex e-books and weekly webinars

- I find the market research tools excellent with Trading Central, Autochartist and forex heatmaps

- There are accounts to suit a range of strategies and forex traders

- The dynamic leverage feature helps me manage risk

- Customer support is available around the clock

- BDSwiss offers fast execution speeds of 70 ms

- My testing show that spreads on the Classic account trail the cheapest brokers

- BDSwiss operates with limited regulatory oversight in some jurisdictions

- VPS hosting costs between €30 and €70 per month

- The FCA took regulatory action against BDSwiss

Is BDSwiss Regulated?

Trading forex with a trusted broker is critical. Unfortunately, BDSwiss’ regulatory stance is a weak point, with the brokerage authorized by the Financial Services Authority of the Seychelles (license SD047) and the Financial Services Commission of Mauritius (license C116016172). These are not top-tier regulators so traders will have limited access to safeguarding initiatives or compensation schemes in the case of business disputes.

Worryingly, I also uncovered a red mark in the broker’s history. BDSwiss Holding Plc was banned from providing services to UK clients in 2021 due to non-compliance with FCA restrictions on the marketing of CFDs to retail investors.

After investigating the issue, I learned that the broker had been using enticing social media promotions to encourage UK traders to open an account, however these investors were then registered under offshore entities where they weren’t provided with FCA protections.

Despite these negatives, I am reassured to some degree to learn that over 1.6 million clients have opened an account with the forex broker, executing more than 11.8 million trades each year.

Forex Accounts

One of the key things I rate about signing up with BDSwiss is the choice of accounts: Classic, VIP, and Zero.

I carefully compared the different accounts to find the right solution for me. Based on my findings, I would recommend the VIP account for traders who want commission-free trading and can afford the $250 minimum deposit as the spreads are tighter, starting from 1.1 pips instead of 1.5 pips in the Classic solution.

The Zero account would be my pick for traders who want the tightest spreads, which start from 0.0 pips alongside a reasonable commission of $6. The minimum deposit is also relatively accessible at $200.

Below is my comparison of the different accounts, showing where key features and services differ.

| Classic | VIP | Zero | |

|---|---|---|---|

| Minimum Deposit | $10 | $250 | $200 |

| Average Spread (EUR/USD) | 1.5 | 1.1 | 0.0 |

| Commission (Forex) | $0 | $0 | $6 |

| Leverage | Default: 1:400 Dynamic: 1:2000 | Default: 1:400 Dynamic: 1:2000 | Default: 1:400 Dynamic: 1:2000 |

| Trading Alerts | Limited Access | VIP Access | VIP Access |

| Trade Companion | No | Yes | Yes |

| VIP Webinars | No | Yes | Yes |

How To Open A BDSwiss Account

BDSwiss has one of the slickest sign-up systems I have seen. I rate the short quiz to help traders find the right account for their needs, which isn’t something I have found at many alternatives. To get started:

- Fill out the 5 multi-choice questions which include markets of interest, investing frequency and trading size

- Provide the requested information in the application form, including name and password

- Verify the account using the PIN sent to the registered email or telephone number

- Sign in to the client dashboard to start trading

Trading Fees

I analyzed the trading fees on popular currency pairs and compared them to suitable alternatives. My findings show that BDSwiss offers average to low fees, depending on the account.

Spreads on the Classic account came in on the average to high side during my tests. For example, I got a 2 pip spread on the GBP/USD, 1.7 pip spread on the USD/CHF and 1.7 pip spread on the USD/JPY.

The VIP account is more competitive. I got a 1.5 pip spread on the GBP/USD, 1.3 pip spread on the USD/CHF and 1.3 pip spread on the USD/JPY. I compared these with alternatives and found they rival other low-cost forex brokers, such as OANDA.

The Zero account also offers relatively low fees. Spreads are tight from 0.0, similar to most raw-spread accounts, while the $6 commission is very competitive.

Non-Trading Fees

BDSwiss is one of the more affordable brokers I have used when it comes to non-trading fees. Crucially, there are no deposit or withdrawal fees, which I always find frustrating to see.

And, while there is a €10 monthly fee for accounts inactive for six months, this is longer than the grace period at most forex brokers I use. Also, the charge is relatively low and will only impact casual investors.

Payment Methods

I can’t fault BDSwiss when it comes to payment methods. Not only is the funding process seamless, but there is a wide range of payment options available, with local and international methods plus cryptocurrency. The majority also provide instant funding.

Deposit options include Skrill, Neteller, AstroPay, Global Pay, MPesa and Korapay. Alternatively, I found the broker supports standard payment solutions like bank transfers plus Visa and MasterCard credit/debit cards.

I also looked at the withdrawal times as I don’t like having to jump through lots of hoops before receiving funds. Fortunately, I found that withdrawal requests are processed by BDSwiss within 24 hours, and although the time it takes for funds to reach accounts can vary depending on the method, it normally takes just a few working days.

How To Make A Deposit

BDSwiss has a slick payment interface which can be navigated in a few clicks:

- Sign in to the client area

- Select the account you wish to make a transfer to and click ‘Deposit’

- Choose a payment method to use, such as Neteller or bank transfer

- Follow the on-screen instructions to complete the transaction

Forex Assets

There are 50+ major, minor, and exotic currency pairs available. This is a decent line-up compared to other forex brokers I have tested, falling only slightly short of rivals like Pepperstone (60+) and IC Markets (60+), which offer more exotics.

Importantly, all currencies are available to trade as CFDs. This means opportunities to speculate on rising and falling prices while using leverage to increase buying power and prospective returns (and losses).

I checked BDSwiss’ platforms to make sure many of the most popular forex pairs are available:

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

BDSwiss offers a modest selection of non-forex instruments, with commodities, shares, indices, and cryptos.

While not the largest product portfolio, I think it provides enough for most aspiring traders, with access to popular global assets, such as the S&P 500, Gold and Bitcoin.

However, the main limitation in my view is that only CFDs are available. So longer-term investors looking for additional vehicles like share dealing aren’t catered for.

I checked the BDSwiss platform to find the different markets available:

- 4 commodities including gold and Brent crude oil

- 13 index funds including the AUS 200, NAS 100, FTSE 100, and US 30

- 27 crypto/fiat currency pairs including the BTC/GBP, ETH/EUR, and XRP/USD

- 125+ company stocks including BP, Amazon, Netflix, BNP Paribas, and Telefonica

Execution

I have found that BDSwiss offers fast and reliable execution. The broker offers direct access to liquidity providers with 99% of orders executed in less than one second, and a 0.07-second average execution speed.

I consider anything below 0.1 seconds fast, helping to reduce slippage. This is supported by the fact that 74% of orders at BDSwiss are completed with no or positive slippage.

Leverage

The leverage model is a key benefit of trading forex at BDSwiss in my view. This is because while 1:400 leverage is provided as default, dynamic leverage up to 1:2000 is available.

Dynamic leverage is a flexible solution that caters to different strategies and market conditions. Essentially, leverage will automatically adjust depending on open position sizes and market events, helping to ensure traders aren’t over-exposed.

All live accounts have a 50% margin call and 20% stop-out level, which aligns with competitors.

Platforms & Apps

BDSwiss offers an above-average selection of trading tools. Traders can access the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as a proprietary web terminal and mobile app.

Importantly, I find that all platforms provide a stable interface, with excellent charting features and analysis tools. I share my key findings from testing each platform below.

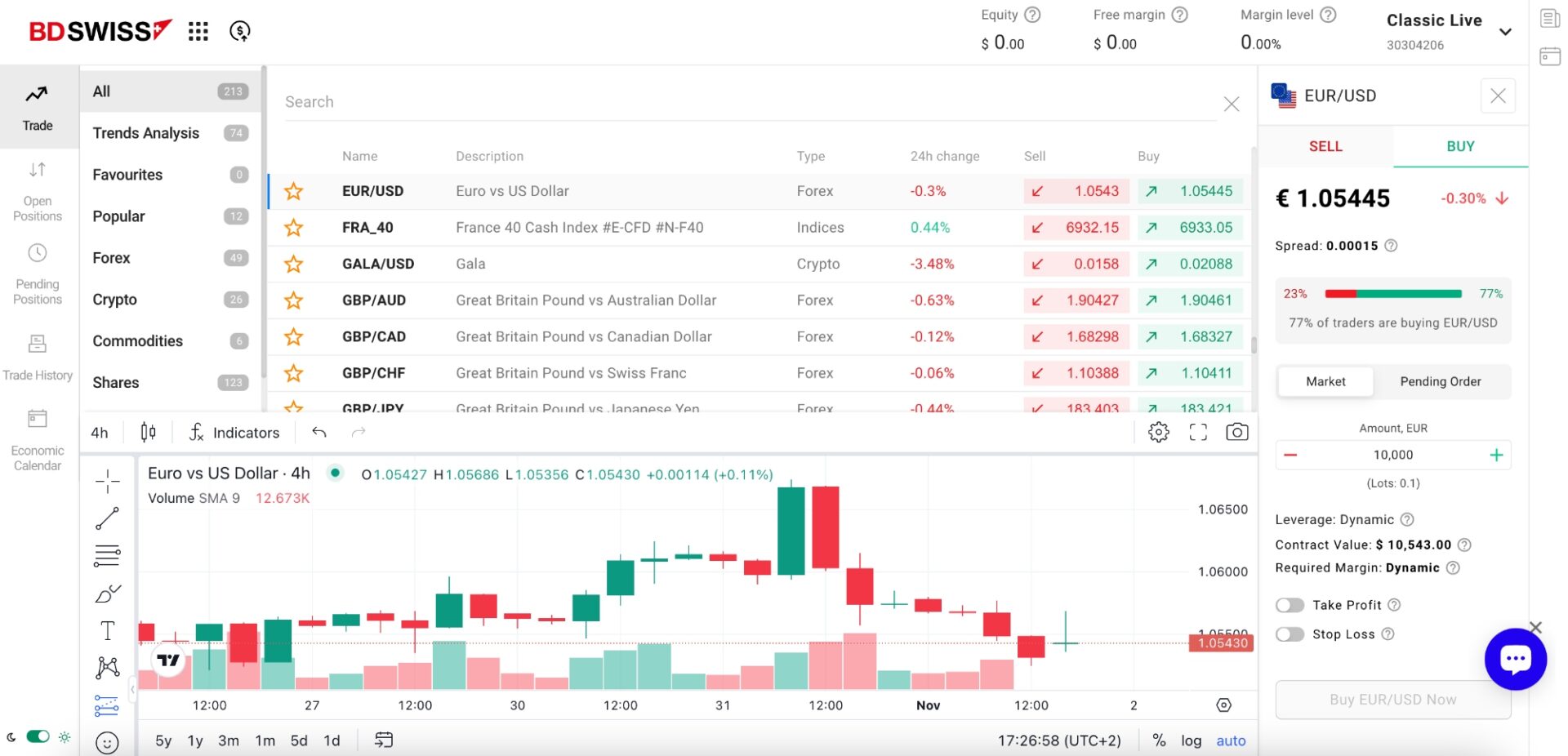

WebTrader & App

I really enjoy using BDSwiss’ web platform and think it will suit traders of all experience levels. The key strengths for me are the intuitive layout with a crisp chart and instrument menu, plus a clear order panel on the right-hand side.

It also performs well in terms of technical analysis. There are 12 charting styles, plus dozens of indicators and drawing tools.

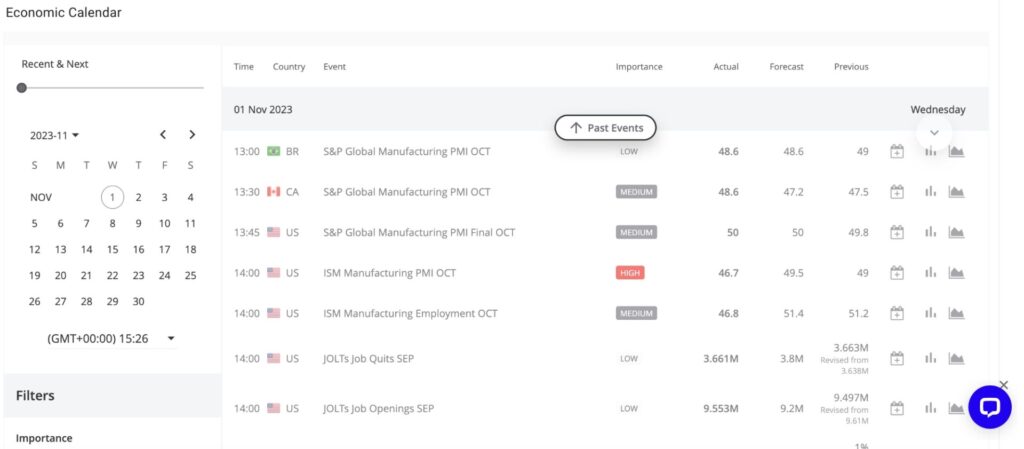

I think the integrated economic calendar is a nice touch too, making it easier to track key events from one dashboard.

Alternatively, the broker’s mobile app provides access to all the popular tools and functions available on the desktop solution, optimized for iOS and Android devices.

I appreciate the same visually appealing interface with dynamic charting and straightforward order management. It is also very easy to navigate the platform using the functional menu at the bottom.

MT4 & MT5

The MetaTrader platforms are leading solutions in the forex trading space, and for good reason. I have placed many trades on MT4 and MT5, and both promise an excellent trading environment for serious investors.

The design is definitely more outdated than BDSwiss’ web platform, but MetaTrader excels when it comes to automated trading, with support for expert advisors (EAs). These can work particularly well in conjunction with the broker’s VPS solution, which I share more details of below.

The other advantage of opting for the MetaTrader platforms in my opinion is access to the MetaTrader Market. There are thousands of indicators, EAs and custom solutions that traders can download for free or for a charge, making it a stand-out resource for serious traders.

One thing I would point out is that MT5 is the better pick in my view. As you can see from my comparison of platform features below, it outguns its predecessor, MT4, in almost all areas. Having said that, traders familiar with MT4 may prefer to stick with the software they know.

| Features | MT5 | MT4 |

|---|---|---|

| Analytical objects | 44 | 31 |

| Chart timeframes | 21 | 9 |

| Technical indicators | 38 | 30 |

| Pending order types | 6 | 4 |

| Economic calendar | Yes | No |

| Strategy backtesting | Multi-thread | Single-thread |

How To Open A Forex Trade

During my tests of BDSwiss, I found it very easy to open and close forex positions through both MetaTrader platforms:

- Find a forex pair from the watchlist menu on the left

- Double-click on the asset to refresh the price data and charts

- Right-click on the currency pair and select ‘New Order’

- Add your trade parameters in the order pop-out, including trading volume, order type, and stop loss/take profit risk management

- Select ‘Buy’ or ‘Sell’ to confirm the direction of the position

Forex Tools

BDSwiss is up there with the best forex brokers I have used when it comes to tools that elevate the trading experience.

This is because of its access to popular third-party services alongside forex calculators, a heatmap, an economic calendar, VPS hosting, and Telegram alerts.

Autochartist

This powerful pattern-recognition software plug-in for the MetaTrader platforms can be used to identify upcoming market opportunities.

I highly rate the flexible alerts for finding trading ideas. This means I don’t have to monitor the markets continuously.

Autochartist also provides some useful visual aids including support and resistance levels, consecutive candles, and Fibonacci patterns.

Trading Central

Trading Central is another great tool to have in the trading arsenal. It offers a suite of forex screening services, market insights, and projections with the latest news.

The tool also provides its interpretation of worldwide market-moving events, to help traders make more informed investment decisions, and I feel this pairs well with the market buzz feature to generate regular trading ideas.

I also appreciate the modern design and easy-to-use interface while using Trading Central.

VPS

BDSwiss also offers VPS hosting, with 24/7 market connectivity and a 100% uptime guarantee.

This is ideal for investors looking at automated trading strategies, as the VPS server provides low-latency execution with no connection issues.

However, access to the VPS does come with a cost regardless of account status or monthly trade volumes. Fees range from €30 to €70 per month depending on configurations.

This is a notable drawback, as some of the largest forex brokers I have tested provide free access to customers depositing or trading over a threshold, including FXTM.

Trade Companion

Trade Companion is a performance dashboard and toolkit for VIP account holders. What I like about this is the personalized insights and other feedback it provides. As a result, I think it’s great for improving trading skills and fine-tuning strategies.

Some of the more helpful pointers I rate include average winning/losing trades and average trade duration.

What I’d Like To See

I think BDSwiss could improve its rating by introducing a social trading solution for aspiring forex traders.

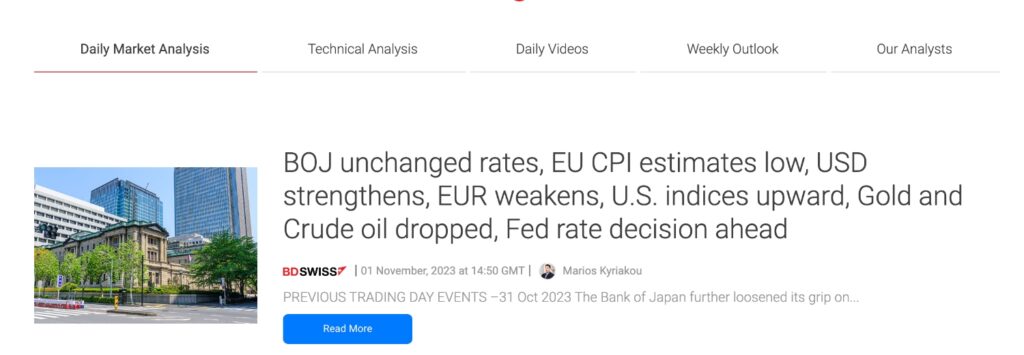

Forex Research

BDSwiss customers won’t be left looking for more when it comes to market research. The forex broker provides plenty of insights including market analysis, weekly outlooks, and daily videos, all with supporting expert commentary.

I find the technical analysis posts particularly useful, with bitesize snippets of information highlighting key economic influences and news from the day. The winners and losers present in the daily analysis articles are another helpful touch.

Forex Education

I score BDSwiss’ educational materials highly. I have been impressed by the range of resources available, especially the forex e-books and on-demand videos. This provides plenty for beginners to sink their teeth into while some of the topics will be good for more experienced traders.

The other notable feature in my view is the weekly webinars. Some are presented for educational purposes, and others for trading tips. They are hosted in English and German and discuss various topics such as weekly market outlooks, technical indicators, and market movers. If I was new to online trading, I would try my best to attend these.

Demo Account

BDSwiss offers a free demo account. This is a great resource, especially for new forex traders. Traders can choose the virtual balance, up to $10,000 and the leverage, up to 1:2000.

My tip is to start here if you haven’t used the BDSwiss web platform before. All the same features and functionality are available, plus it’s a great opportunity to customize the dashboard to personal preferences.

How To Open A Demo Account

It took me less than two minutes to sign up for a paper trading account. I followed these steps:

- Select ‘Trading’ from the top menu of the BDSwiss website and then ‘Account Types’

- Click ‘Try Demo Account’ under the account types

- Add personal details and contact details

- Create a password and use the slider to choose a trading platform

- Agree to the T&Cs and hit ‘Submit’

- From the dashboard interface, choose ‘Add New Account’

Bonus Offers

I confirmed with the customer support team during my review that BDSwiss does not offer any bonus rewards or financial incentives to new traders.

I don’t consider the lack of a welcome bonus a major drawback as it shouldn’t be a key consideration when you open an account.

What I’d Like To See

I think offering a cashback scheme with rebates for high-volume traders would be a good addition.

Trading Restrictions

During my testing of BDSwiss, I have not come across any trading restrictions. This means traders are free to use hedging, scalping, and algo strategies on the broker’s platforms.

Customer Service

I have mixed feelings about the customer support based on my first-hand experience.

Looking at the positives, the broker offers 24/5 support, with local telephone numbers providing multilingual assistance, as well as help via email and live chat. During my tests, the automated bot was also effective in categorizing my queries and transferring me to an agent.

Considering the negatives, the customer service agents aren’t all knowledgeable. I spoke to them on multiple occasions and they struggled with important questions, especially around regulatory protections.

Contact details for the BDSwiss are:

- Email: support@global.bdswiss.com

- Live Chat: icon found bottom right of all webpages

- Online Contact Form: via the ‘contact us’ webpage

- Telephone (not limited to the following): +44 2036705890 (English), +49 3021446991 (German) and +34 910756937 (Spanish)

Company Details

BDSwiss has been providing online trading services since 2012. The broker has an office presence in 10+ locations and has grown its client base to 190+ countries.

Today the forex and CFD provider executes an impressive $119 billion in quarterly trading volume and has over 1.6 million registered accounts.

Reassuring for me is that the company has also been recognized for its trading environment, including the ‘Best Broker for Investor Education’ at the Fazzaco Business Awards and the ‘Best Mobile Trading Platform Europe’ at the Global Banking & Finance Awards.

In addition, BDSwiss has sponsored some major sporting brands and events, including the Mercedes Cup ATP 250.

Trading Hours

The forex market is open to trade 24/5 with a daily break between 23:58 and 00:02. I have found that BDSwiss follows the same trading times.

My tip is to make use of the broker’s economic calendar, where it publishes announcements and upcoming events that may impact the markets.

Who Is BDSwiss Best For?

My time using BDSwiss has shown the broker is a great fit for a range of forex traders. With that said, I think it’s best for active traders thanks to the raw spread account, fast execution speeds and access to the MetaTrader suite. Algo traders can also make use of VPS hosting and expert advisors.

Additionally, BDSwiss is good for beginners. Traders only need a $10 deposit with the Classic account, which offers transparent spread-only pricing. New investors also get a fantastic suite of forex trading tools, plus comprehensive education.

Alternative Brokers for US

FAQ

Is BDSwiss Legit Or A Scam?

My experience using BDSwiss shows that it is a legitimate forex broker. The multi-award-winning firm has a good reputation in the industry with millions of registered users.

Can I Trust BDSwiss?

My research suggests that BDSwiss is a trustworthy forex broker. It has been operating since 2012 and offers important safeguards like negative balance protection. My only complaint is the weak regulatory oversight in some jurisdictions.

Does BDSwiss Offer Low Forex Trading Fees?

After comparing forex trading fees at BDSwiss with alternatives, I found them to be average to low.

The Classic account does not offer particularly low spreads based on my tests, but the VIP account is competitive with a 1.7 pip spread on the USD/CHF. Equally the raw spread account offers ultra-tight spreads from 0.0 with a lower-than-average commission of $6.

Is BDSwiss A Regulated Forex Broker?

BDSwiss is regulated offshore by the Financial Services Authority of the Seychelles, license SD047. It is also an authorized Investment Dealer with the Financial Services Commission of Mauritius, license C116016172.

However, these are not well-regarded regulators so traders should not expect access to measures like investor compensation.

Is BDSwiss A Good Forex Broker For Beginners?

My review of BDSwiss shows that it is a good forex broker for beginners. The minimum deposit is accessible at $10, the educational materials are excellent and the WebTrader is beginner-friendly. The only thing thing missing in my opinion is a social trading solution.

Does BDSwiss Have A Forex App?

Yes, BDSwiss has a proprietary mobile app. It can be downloaded to Android and Apple devices, both mobile and tablet. The application syncs with the desktop software and offers account management features, including deposits and withdrawals.

How Long Do Withdrawals Take At BDSwiss?

I have found that withdrawal times at BDSwiss can vary depending on the payment method. With that said, the firm aims to process requests within 24 hours, which is on the fast side of forex brokers I have reviewed.