Vantage

-

Currencies

USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN -

Platforms

MT4, MT5, TradingView, DupliTrade -

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.0 GBPEUR: 0.5 -

# Assets40+

-

Minimum Deposit

$50 -

Bonus Offer

50% Welcome Deposit Bonus

Our Opinion On Vantage

Vantage is a suitable forex broker for traders of all experience levels. We found the sign-up process straightforward and appreciate the selection of fast, low-cost deposit options. Advanced charting software and high-quality copy trading tools also enhance the forex trading experience for us. On the negative side, withdrawal timelines are slower than some alternatives and regulatory protection at the offshore branch is weak. Overall though, Vantage is a good destination for online forex trading.

Summary

- Instruments: 1000+ including 49 forex pairs, stocks, indices, commodities, bonds, ETFs

- Live Accounts: Standard STP, Raw ECN, Pro ECN

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, ProTrader, Vantage App, Vantage Copy Trader, DupliTrade, ZuluTrade, MyFXBook Autotrade

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- No restrictions on forex strategies with scalping and hedging permitted

- 24/7 customer support with fast response times based on our tests

- A choice of copy trading platforms including the broker’s own solution

- Fast, fee-free and accessible account funding with 10 base currencies

- Caters to automated forex trading through MetaTrader Expert Advisors

- Award-winning brand with good reputation and over 900,000 clients

- It only takes a few minutes to open an account and start trading

- Multi-regulated including licenses from the ASIC & FCA

- Accessible minimum deposit for beginners at $50

- Tight spreads on forex pairs from 0.0 pips

- Weak regulatory oversight from the offshore entity

- A $10,000 deposit is needed for the Pro ECN account

- Withdrawals can take up to 5 working days

- Traders from the USA are not accepted

- PayPal is not supported

Is Vantage Regulated?

Our team are comfortable with the broker’s regulatory status, especially Vantage Global Prime Pty Ltd and Vantage Global Prime LLP, which are overseen by tier-one regulators – the Australian Securities & Investments Commission (ASIC) and the UK Financial Conduct Authority (FCA). This adds credibility to the brand.

Our experts are also reassured that this broker segregates client funds from business capital with an AA-rated bank, which should provide peace of mind for traders.

The firm’s membership with the Financial Commission and Compensation Fund is also a good sign. This protects clients with a maximum compensation of 20,000 EUR in the case of an unresolved dispute with the broker.

On the downside, the broker’s offshore entity operates with less regulatory scrutiny. Vantage Global Limited is registered with the Vanuatu Financial Services Commission (VFSC), license number 70027. This is not a well-regarded regulator.

Traders may opt for this entity for access to higher leverage beyond the 1:30 limit available under the ASIC-registered branch. However, we are disappointed to see that negative balance protection is not provided as default; instead, you must apply for this feature if your account equity falls below zero, and there is no guarantee the brand will reset your balance.

On a lighter note, our experts didn’t find any reports of scams or malpractice across the group. This also includes Vantage Markets (Pty) Ltd, which is regulated by the South African Financial Sector Conduct Authority (FSCA), license number 51268.

Forex Accounts

Vantage offers two live accounts for retail traders with varying pricing structures: Standard STP and Raw ECN.

I would recommend the Standard STP account for beginners – fees are transparent with no commission and a variable spread. The Raw ECN profile is a better fit for experienced traders looking for ultra-low spreads and a competitive commission.

Importantly, both accounts have a low minimum deposit of $50, which will appeal to those on a budget. This is also cheaper than many forex brokers we have reviewed, including IC Markets, which requires $200.

The firm stands out for its accessible account conditions for global traders. With 10 base currencies, traders from various regions can deposit, trade and manage accounts in their local currency.

Our team have pulled out the key features of each account:

Standard STP Account

- Spreads – from 1.0

- Commission – $0

- Minimum trade size – 0.01 lot

- Base account currencies – AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, PLN

Raw ECN Account

- Spreads – from 0.0

- Commission – from $3

- Minimum trade size – 0.01 lot

- Base account currencies – AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, PLN

Muslim traders will appreciate that swap-free Islamic accounts are available which puts the forex broker on an even footing with rivals like AvaTrade.

Professional traders and money managers also have the option of the Pro ECN Account. This offers some of the lowest pricing around, with spreads from 0.0 pips and commissions from $1.50 per side.

Our only major criticism is the hefty minimum deposit of $10,000. Whilst this won’t deter many high-volume traders, it is noticeably higher than most of the pro forex trading accounts we have assessed.

How To Open An Account

I found it quick and easy to register for an account with Vantage, with the whole sign-up process taking me less than five minutes:

- Enter your email address in the application form

- Alternatively, you can sign up quickly using your Google account

- Enter your personal details and select your chosen trading account

- Provide the required ID and address verification documents

- Once verified, your account credentials will be emailed to you

- Make a deposit and start trading

Trading Fees

Vantage offers relatively low trading fees.

The Standard STP account offers commission-free trading with spreads from 1.0, while the Raw ECN account has lower spreads from 0.0 pips with a commission of $3 per lot per side.

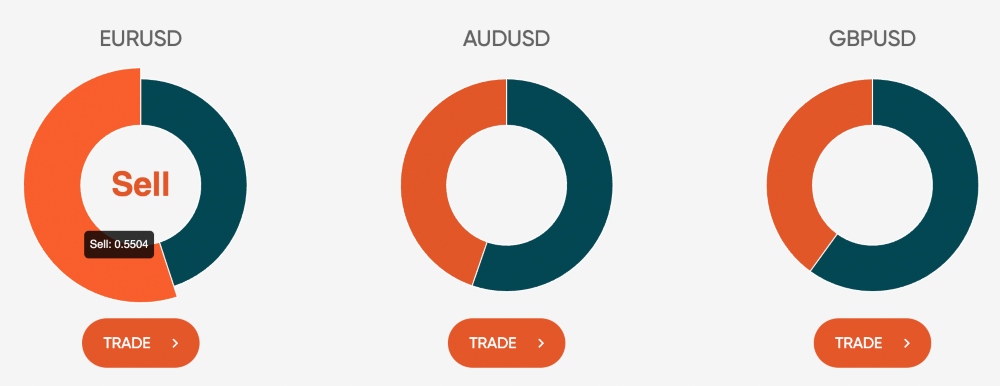

These prices stand up well against most forex brokers we have evaluated, especially the Raw ECN profile. I got spreads of 0.0001 on EUR/USD and 0.0003 on GBP/USD, which is competitive. I also like that the broker displays five-digit pip pricing compared to the four digits typically offered by forex brokers, providing more transparency.

The Standard account is not quite as competitive, though typical spreads are still tighter than average and provide good value for forex traders. While using the Standard account, I got spreads of 1.4 on EUR/USD and 1.6 on GBP/USD.

Non-Trading Fees

The broker also scores well when it comes to non-trading fees.

There are no deposit or withdrawal fees, which is an advantage over firms like eToro, which charges $5 per withdrawal. Moreover, the broker will cover the first 20-unit fee from international bank transfers every month which helps keep transfer costs down.

No inactivity fees are charged by Vantage, which is an advantage over rivals like Admiral Markets and IG Index. This is good news for casual traders who don’t need to worry about being stung for not trading for a few months.

The only other important fees to be aware of are the industry-standard overnight swap charges (except for Islamic accounts). Those with Islamic accounts should note that an administration fee is charged in place of a swap fee.

Payment Methods

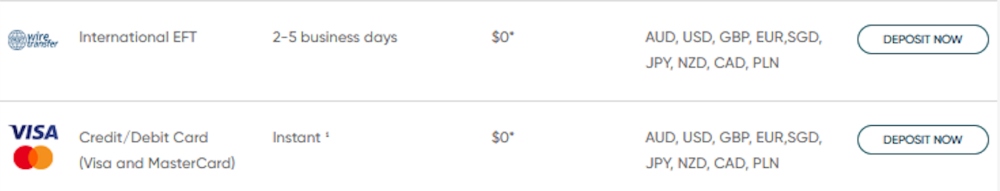

Our team rate the variety of payment methods supported as it makes the broker easy to use globally.

Supported funding methods include bank wire transfer, credit/debit card, Neteller, Skrill, AstroPay, FasaPay and broker-to-broker transfer. The only downside is that PayPal is not supported.

Processing times vary depending on the method you choose. For instant funding I would recommend card payments; bank wire transfers can take up to five days, which is longer than ideal.

Fees vary depending on the chosen funding method. I appreciate that the broker charges no deposit or withdrawal fees but some payment methods have third-party charges, for instance, international wire transfers as outlined above.

Withdrawals can be made with the same methods as deposits, with additional support for Bitwallet and Perfect Money.

Importantly, withdrawal times vary between payment methods. It was good to see that e-wallet withdrawals process almost instantly. However, other methods require longer to process with bank wire withdrawals taking up to five working days. This is slower than some alternatives.

We also note that withdrawals are only processed Monday to Friday, so traders should be aware of this when requesting funds.

How To Make A Deposit

I found funding my account easy and appreciated the straightforward interface, which required just a few intuitive steps to complete a transaction:

- Go to the deposit page on the broker’s website

- Select the payment method you want to use

- Click the ‘Deposit Now’ icon on the right-hand side

- Log in to your client portal

- Confirm the payment method and amount

- Finalize the deposit by completing the on-screen instructions

Forex Assets

The range of forex assets offered by Vantage is not the widest, with 49 currency pairs available. This is quite far behind rivals like Forex.com with its 80+ pairs.

We like the extra flexibility that a larger suite of forex pairs brings, but realistically most traders will be satisfied with the 49 on offer from Vantage, which includes all majors plus minors and exotics.

Traders can access forex via contracts for difference (CFDs), which is fairly standard at popular brokers. These derivatives work by allowing the trader and broker to exchange the difference in price of the instrument between the open and close of the contract. These types of instruments allow you to go long or short on currencies. CFDs can also be traded with leverage which increases trading power but also risk.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Vantage offers a decent selection of assets beyond forex. This includes stocks, indices, commodities, metals, energies, ETFs, and bonds. The 800+ list of equities is particularly strong, with exposure to blue chip stocks from the US, Europe, Australia and beyond.

One minor drawback is the limited access to popular cryptos like Bitcoin. These are only available to Australian clients – the offshore entity does not offer digital currencies, which is unusual.

Overall though, there is good depth of market in a wide range of asset classes, and this sets Vantage apart from many brokers out there, which often offer around 200 or fewer instruments.

Supported assets include:

- Indices – trade 25 index CFDs including the DAX, FTSE and NASDAQ

- Precious metals – trade gold, copper, silver, platinum and palladium

- Commodities – trade 7 soft commodity CFDs including cocoa, sugar, cotton and orange juice

- Energies – speculate on the price of 7 energies including oil, natural gas and gasoline

- ETFs – trade 51 ETF CFDs including Vanguard ESG US Stock and First Trust Dow Jones Internet Index Fund

- Shares – trade 800+ share CFDs including Tesla, Netflix, L’oreal and Apple

- Bonds – a range of European, US and ICE bonds are available

Execution

Vantage is a no-dealing-desk broker that offers varying execution models depending on the account you choose.

The Raw account uses an electronic communications network (ECN). This system acts as a kind of hub for different liquidity providers and allows traders to enjoy tighter spreads but also incurs a commission. We recommend this model if your strategy needs fast execution speeds and the guarantee of fixed commissions.

The Standard account uses a straight-through processing (STP) model. Here, the processes involved are fully automated with no manual input, with orders being routed directly to a liquidity pool. Costs may be higher in the long run, but this will suit traders looking for zero commissions and competitive spreads.

Leverage

Leverage at the Australian entity is in line with local regulations, so it is capped at 1:30. This is the same limit imposed by EU and UK regulators and is designed to help protect retail traders from excessive losses.

Vantage’s offshore branch, however, offers much higher leverage up to 1:500. This means a $100 deposit can provide you with $50,000 in buying power.

Importantly though, traders should be aware that while higher leverage offers the chance of boosting revenue it does come with the risk of greater losses. With this in mind, I recommend employing risk management tools. I also suggest beginners think carefully before trading forex with such high leverage.

Also note that Vantage will issue a margin call when your account drops below 80%. The stop-out level is automatically triggered when your account is below 50% of the required margin. At this point, the broker will start closing out your positions.

Platforms & Apps

Vantage has an excellent variety of trading platforms. Third-party platforms such as MetaTrader 4 and MetaTrader 5 are supported as well as a ProTrader terminal powered by TradingView and a Vantage App.

MT4 & MT5

Both MT4 and MT5 are well-regarded forex trading platforms that provide powerful tools including advanced technical indicators, customizable charts and signals.

MT4 is better suited to beginners while more experienced traders will appreciate the additional analysis tools, pending orders and faster processing speeds of MT5.

Both platforms offer algorithmic trading robots, known as Expert Advisors (EAs), that can be used for automated trading strategies.

The standout features for me include:

MetaTrader 4

- 9 timeframes

- 31 graphical objects

- 30 technical indicators

- 4 pending order types

- Single-thread strategy testing

- In-depth pricing history

- Expert Advisors (EAs) for auto forex trading

MetaTrader 5

- 21 timeframes

- 44 graphical objects

- 38 technical indicators

- 6 pending order types

- Multi-thread strategy testing

- Built-in economic calendar

- Expert Advisors (EAs) for auto forex trading

Both MT4 and MT5 can also be accessed via a WebTrader through major web browsers without the need to download software, and we appreciate this feature as it allows newer traders to start forex trading through the familiarity of popular browsers.

ProTrader

For traders interested in precision charting, or that don’t like the MetaTrader suite, I would opt for ProTrader.

This TradingView-enabled platform has a slick interface and premium analysis tools. This includes over 20 different chart layouts, 8 timeframes, and a large selection of drawing tools. I thought the integrated news stream was a useful extra too.

The standout features for me include:

- 50+ drawing tools including Fibonacci retracements, trend lines and Gann & Elliott waves

- 12 chart types including candlestick, Renko and Kagi

- 100+ technical indicators

- 8 timeframes

Vantage App

The Vantage App is fine for managing your account and keeping track of positions on the move, but it isn’t suitable for advanced charting and technical analysis in my opinion. It is a better fit for casual traders who will appreciate the custom watchlists and news updates.

The standout features for me include:

- Technical indicators including moving averages, Bollinger bands and MACD

- Customizable watchlist

- News and alerts

- Basic charting tools

The app can be downloaded to iOS and Android devices.

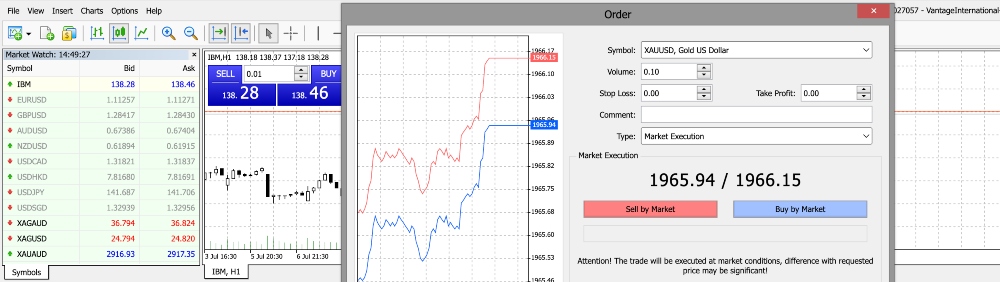

How To Make A Forex Trade

Making a trade on the MetaTrader platforms is a straightforward process and I find the no-frills interface intuitive and simple to navigate:

- Sign in to your MT4 or MT5 account

- Click on the “New Order” icon from the menu at the top of the screen

- Use the search button to find the forex asset you want to trade

- Input the trade volume you desire

- Enter stop-loss or take-profit levels as needed

- Press “Buy” or “Sell” to confirm the trade

Note that you can also activate one-click trading on these platforms.

Forex Tools

We are impressed with the variety of useful forex tools available, which goes far beyond the offerings of most brokers and provides excellent resources for newer traders and seasoned investors.

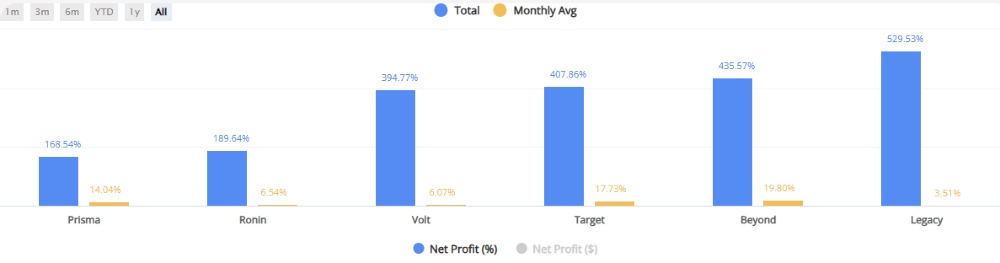

In particular, Vantage stands out for its choice of copy trading platforms, with multiple in-house and third-party solutions.

DupliTrade

This social trading platform is attractive as it will continue to copy forex trades even when I’m not connected to the platform.

The downside is the minimum deposit of $2000 which might be out of reach for traders on a budget, but it is a handy and easy-to-use addition to the toolkit of those who do have the necessary funds.

I was also impressed with the ease and speed of registering and using DupliTrade via Vantage, which has integrated the sign-up process into the user interface on its site. The process involves only a few steps that can be completed in 15 minutes or less:

- Fund your Vantage account with $2000

- Register for a DupliTrade account

- Log in to your Vantage account

- Link your Vantage and DupliTrade accounts by requesting, completing and returning a request

- Choose a strategy to follow and copy

- Enter your funds and risk tolerance and confirm copy trading

- Track the performance through the dashboard

ZuluTrade

ZuluTrade is another leading third-party copy trading solution which can easily be integrated into the MT4 and MT5 platforms.

The program allows users to follow and copy more experienced traders while accessing a community of other forex traders. I like that you can find other like-minded traders with similar goals and portfolios and easily share information and advice.

Additionally, the lower price point of $200 to join the program makes it more accessible.

MyFXBook Autotrade

This is another great copy trading platform that offers users access to more than 90,000 forex traders to mirror.

As well as providing analytical tools and complete control over copied trades, it can also act as an automated trading journal by tracking and analyzing your trading history. This is a really great function that sets this tool apart from other copy trading apps.

I also rate that this platform carefully checks its forex traders before allowing copy trades to be made. All traders are verified and their track record is assessed before being added to the site and low-performing accounts are not available for copy trading. This allows users to feel secure that they are mirroring knowledgeable and experienced traders.

Vantage Copy Trading

One thing that I think works very well is the gamification of this application, with benefits and commission earned from the program scaling up depending on your success. This allows copy traders to ‘level up’ their status from ‘Explorer’ to ‘Legend’, and the playful nature of this program makes it fun while also providing ambitious traders with clear goals to aim for.

It also doesn’t have the hefty deposit of DupliTrade, making it better for traders on a budget.

Joining Vantage Copy Trading is very simple:

- Create a social trading account through your live Vantage account

- Set your profile to Public so other traders can view your trading activity

- Enter information into your profile to attract copy traders

- Trade as normal

VPS

Vantage supports a forex virtual private server (VPS). This uses an external server to manage trading connectivity meaning your account is running without the downtime caused by computer problems.

This is a particularly useful tool for experienced forex day traders who automate strategies, as it allows them to set their algorithms to work 24 hours a day with the fastest connectivity available.

This service can also be accessed for free once you have deposited at least $1000 in your account as the broker will refund the cost of your chosen VPS up to $50. This gives traders the added flexibility to choose their own VPS provider.

We are also pleased to find that the $1000 minimum deposit is considerably less than the amounts required to access free VPS services from some rivals.

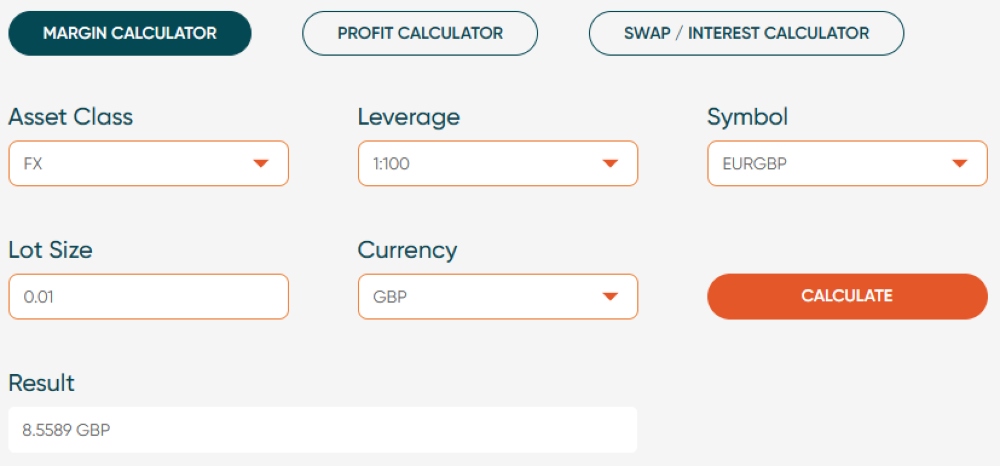

Calculator

There is a free calculator on the broker’s website that traders can use to calculate margin, profit and swap/interest before taking financial risk when trading forex.

This is helpful, though also fairly standard at the top brokers so it doesn’t separate Vantage from the competition.

TradingView

If the trading criteria are met Vantage offers access to TradingView Pro, Pro+ and Premium and will refund your monthly membership costs.

The criteria vary depending on the account type you want to open but traders should be aware that for access to TradingView Pro, you need $500 in a live account and to trade a minimum notional volume of $1 million per calendar month.

This will price out some traders, but it is another very attractive perk for serious forex traders, allowing access to powerful tools, custom watchlists and indicators on one of the best and most attractive charting systems on the market.

Smart Trader Tools

Our experts rate this package from Vantage as it allows retail traders access to an upgraded version of the MetaTrader platforms. The benefits include an alarm manager, a correlation matrix, and an Excel RTD link.

Traders should note that a minimum of $1000 is required to access this feature, which again may be high for traders on a lower budget but provides yet more value to those able to deposit this amount.

Forex Research

While using Vantage, we get a wealth of real-time market data to help make forex trading decisions. This includes an economic calendar, technical analysis, market news, sentiment indicators and daily forex signals from Trading Central.

Importantly, we find it easy to access all of these tools quickly through our client dashboard and trading platform. This variety of market research also compares well to competitors and puts Vantage on a level with rivals like Plus500.

Forex Education

I am impressed with the educational resources offered by Vantage. The academy includes specific categories allowing you to cycle through forex articles, webinars and online educational resources easily from the broker’s website.

Although not as extensive as some competitors such as eToro, the varied collection of resources mean we can recommend the broker to beginners looking to learn more about forex trading.

Demo Account

Vantage offers a free demo account, with $100K in virtual funds and no financial risk. Prospective traders can also sign up for this account to find out if the broker suits their style before committing real funds.

The good news is that the demo account is available to new and existing clients with no time limit, making this one of the best tools available for practising forex strategies. We mark firms down when they impose a 30-day limit or similar on paper trading accounts.

How To Open A Demo Account

I found it extremely easy to open a demo account with Vantage. It only took me a few minutes to get started:

- Click on the “Demo Account” icon in the top right-hand side of the broker’s website

- Sign up with your email or through an existing Google account

- Enter personal details such as your name and phone number

- Customize your account (platform, account type, currency, leverage, balance)

- Sign in with the login details sent to the registered email address

Bonus Offers

Vantage offers a selection of promotions through its offshore entity. However, we do not recommend picking a forex broker based on their financial incentives – this can encourage over-trading and excessive risk-taking. Other comparison factors, such as trust, safety, tools and fees are more important.

With that said, the following list covers the promotional schemes available at the time of writing:

- 100% rebate on overnight fees when you trade US shares up to $100 ($50 per month)

- Earn Vantage rewards in the form of V-points when you trade. Once you have accumulated enough you can redeem them for rewards such as cash, a profit booster voucher, a deposit rebate voucher or a loss protection voucher

- A deposit bonus of up to $20,000 depending on the amount you deposit in your account (the minimum amount deposited to apply is $500 and you will receive a 50% bonus)

- A 5% rebate on your first USDT deposit capped at $5000 (rebate varies depending on the amount deposited in your account)

- A refer-a-friend bonus with perks and conditions that change over time

For us, the fee rebates and perks through V-points will be the most useful for active traders. These will have the greatest impact on your forex trading experience.

The deposit bonuses should be approached with caution due to withdrawal restrictions and volume requirements that make it difficult to remove the funds.

Customer Service

I have been impressed with the customer service at Vantage. Support is available 24/7, providing amongst the best coverage available on the market thanks to the broker’s live chat, telephone hotline and email contact options.

We tested the live chat three times and found it quick and easy to use with responses in less than one minute once connected with an agent. Before then, a queue counter lets you know roughly how long to expect to wait, and we did not experience waiting times of more than a few minutes in any of our tests.

The broker also provides an extensive FAQ page, which is where I recommend starting if you have a basic query. The search bar makes finding relevant information intuitive, and there is enough content to deal with standard account and product conditions.

Contact Details

- Live chat: bottom right-hand side of the broker’s website

- Email: support@vantagemarkets.com

- Phone number: +1 (345) 7691640

The brand is also active on social media, including Facebook, Instagram, Twitter, YouTube and LinkedIn.

Company Details

Vantage was launched in 2009 and has established itself as a reputable global forex broker based in Sydney, Australia.

The company now has over 1000 employees in over 30 offices and it serves traders from 172 countries. The broker is also the official partner of McLaren MX Extreme E.

The broker has won various awards including the Global Business and Financial Magazine’s Best CFD Broker in APAC 2023, the Global Forex Awards’ Best Trade Execution 2023 and International Business Magazine’s Best CFD Trading Platform 2023.

Another promising sign of its legitimacy is the 900,000-strong client base.

Trading Hours

The trading hours offered by Vantage vary depending on the instrument you are trading. For forex trading, the opening hours are 00:001 – 23:58 Monday to Thursday and 00:01 – 23:57 on Fridays (GMT+3).

Opening hours for each asset can be found in the respective instrument section on the broker’s website.

Information on upcoming holidays and market closures can also be viewed on the website via the news page.

Who Is Vantage Best For?

Vantage has a lot to offer forex traders at all levels of experience.

The $50 starting deposit, low fees, unlimited demo account, copy trading and educational resources will suit beginners.

Equally, the Raw ECN account, fee rebates, premium MetaTrader and TradingView packages, and VPS support, will allow more experienced traders to get the most out of their membership with the broker.

On the negative side, the lack of crypto trading for global clients means it isn’t the best choice for dedicated crypto investors. We also don’t recommend Vantage if you want to deposit and withdraw using PayPal.

FAQ

Is Vantage Legit Or A Scam?

Vantage is a legitimate forex broker that does not appear to be operating a scam. The company holds a license with a top-tier regulator, the Australian Securities & Investments Commission (ASIC). Our experts are also reassured to see that Vantage is a member of the Financial Commission Compensation scheme and uses segregated client accounts.

However, we do note that negative balance protection is not automatically applied by the broker’s offshore entity. This adds an element of risk to traders who register with this branch.

Can I Trust Vantage?

Given its large user base, reputation and regulatory oversight – we consider this a trustworthy forex broker. Over 900,000 traders have signed up with the brand and the firm has a string of industry awards and accolades to its name.

Is Vantage A Regulated Forex Broker?

Yes, Vantage is overseen by several regulatory bodies. The forex broker holds licenses with the Australian Securities & Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), the Vanuatu Financial Services Commission (VFSC), and the South African Financial Sector Conduct Authority (FSCA).

On the downside, our team do highlight that the VFSC is not a well-regarded regulator and the FSCA is not on the same level as the ASIC or FCA. Ultimately, this means Australian and UK clients will get the best regulatory coverage.

Is Vantage A Good Or Bad Forex Broker?

Overall, Vantage is an excellent forex broker. It offers traders access to 49 forex pairs with tight spreads and low to no commission. The account options suit different types of traders and have a low minimum deposit of just $50.

Moreover, the firm stands out for its wide selection of educational resources and trading tools, including copy trading and premium platform packages, helping traders of all experience levels to get the most out of forex trading.

On the negative front, our team score the broker down for its average withdrawal processing times. The firm’s offshore entity also offers less in terms of regulatory scrutiny and account security.

Is Vantage Good For Beginners?

Yes, Vantage is a good forex broker for beginners. Opening an account takes less than 5 minutes and the starting deposit is low at $50. There is also a free demo account for prospective users and an almost unrivalled selection of copy trading tools.

Does Vantage Offer Low Forex Trading Fees?

Vantage’s forex trading fees are fairly low, but not the best in the industry. Clients can choose between an STP account with zero commissions and floating spreads from 1 pip or an ECN account with low spreads from 0.0 pips and a $3 commission per lot per side.

Based on our assessment – the ECN account is the best option if you are an active forex trader looking for the lowest fees.

Does Vantage Have A Forex App?

Vantage offers its own mobile app alongside the MT4 and MT5 apps. These applications can all be downloaded to iOS or Android devices. You can use these apps to execute trades, view news and charts and create custom watchlists.

I find the Vantage app to be more user-friendly than the MetaTrader options, but this will ultimately come down to trader preference.

How Long Do Withdrawals Take At Vantage?

Withdrawal times vary depending on the payment method you choose. Once verified the funds will be transferred to your account almost immediately in the case of e-wallets and within five days if you send funds by wire transfer.

On the downside, some forex brokers offer same-day withdrawals. It should also be noted that Vantage does not process withdrawals over the weekend so traders should bear this in mind when moving funds.

Can You Make Money Trading Forex With Vantage?

Vantage is a highly-rated forex broker with a good variety of assets, useful tools and low fees. However, there is no guarantee of making money when trading forex online regardless of the broker you trade with.

We always recommend that users approach forex trading with a sensible risk management strategy.