Best Debit Card Forex Brokers

Forex brokers that accept debit cards allow traders to conveniently and securely fund their trading accounts. In this guide, we have ranked the best debit card forex brokers, considering:

The minimum deposit

The presence of any transfer fees with debit cards

The processing times for deposits and withdrawals

The quality of forex trading conditions and tools

The regulatory status and reputation of the forex broker

List of Best Forex Brokers Accepting Debit Cards 2025

These are the top 5 forex brokers who support debit cards based on our findings:

- Vantage: Best Overall Debit Card Forex Broker

- Skilling: Best For Fast Deposits & Withdrawals

- AvaTrade: Best MetaTrader Forex Broker

- eToro: Best For Forex Copy Trading

- Forex.com: Best For US Forex Traders

| Vantage | Skilling | AvaTrade | eToro | Forex.com | |

|---|---|---|---|---|---|

| Minimum Deposit | $50 | $100 | $100 | $10 | $100 |

| Minimum Withdrawal | $0 | $50 | $0 | $30 | $100 |

| Transfer Fees | $0 | $0 | $0 | $5 (Withdrawals) | $0 |

| Processing Times | Deposits – Instant Withdrawals – Up to 5 Days | Deposits – Instant Withdrawals – Up to 1 Day | Deposits – Instant Withdrawals – Up to 2 Days | Deposits – Instant Withdrawals – Up to 10 Days | Deposits – Instant Withdrawals – Up to 2 Days |

| Regulated | Yes | Yes | Yes | Yes | Yes |

Vantage: Best Overall Debit Card Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN

-

🛠 PlatformsMT4, MT5, TradingView, DupliTrade

-

⇔ Spread

GBPUSD: 0.5 EURUSD: 0.0 GBPEUR: 0.5 -

# Assets40+

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer50% Welcome Deposit Bonus

Why We Recommend Vantage

We recommend Vantage because it is a top-rated forex broker with powerful trading software, an excellent reputation and low fees.

The broker also offers a straightforward funding process and there are no fees for debit card deposits and withdrawals.

Below we explain why Vantage tops our list of the best forex brokers that accept debit cards.

Pros/Cons of Vantage

Pros

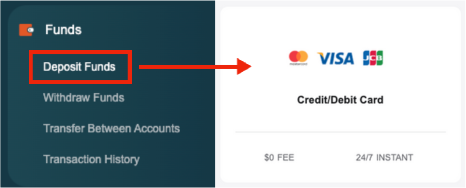

Debit card deposits are processed instantly and securely

We found that debit card payments are deposited immediately to Vantage accounts and are processed using 3D Secure Authentication, ensuring a high level of security.

The process is also convenient. Simply log in to your Vantage account, click on the ‘Deposit’ icon and select the amount you wish to transfer before entering your debit card details.

Low minimum deposit of $50

Vantage only requires a $50 minimum deposit for their Standard and RAW ECN accounts, which is lower than other forex brokers on this list, making it accessible to a range of traders.

We also rate that the broker supports 10 base currencies, helping global traders with debit cards avoid currency conversion fees.

Low forex trading fees, plus zero deposit and withdrawal charges

Forex traders looking to keep costs down will appreciate that Vantage charges no deposit or withdrawal fees as well as zero inactivity fees.

Furthermore, tight spreads are available on currency pairs starting from 0.0 pips in the Raw ECN account with low commissions from $3 per side. This makes Vantage one of the cheapest debit card forex brokers that we evaluated.

Excellent range of forex tools, including MT4, MT5, TradingView and a VPS

Vantage impresses for its choice of high-quality trading software. As well as industry-leading platforms MetaTrader 4, MetaTrader 5 and TradingView, the forex broker offers a selection of extra tools.

Highlights for us are forex copy trading through ZuluTrade and DupliTrade, which will appeal to hands-off traders, plus access to a VPS for 24/7 market connectivity, which will serve active forex traders.

The AI-powered Market Buzz feature, which offers market coverage of over 35,000 assets, including currency pairs, is also a stand-out tool that we didn’t find at any other brokers we reviewed.

Cons

Withdrawal times can take up to 5 days

Withdrawals with debit cards can take up to 5 working days. While not a dealbreaker for us, as this is in line with much of the industry, some forex brokers we assessed offer faster withdrawals.

Why Is Vantage Better Than The Competition?

Vantage is our best all-round debit card forex broker thanks to its convenient and secure funding process, low minimum deposit, and zero transfer fees.

It is also heavily regulated and trusted, with excellent trading conditions on its 40+ currency pairs, including spreads from 0.0 pips.

In addition, Vantage stands out from the competition for its large suite of forex trading tools, from MT4, MT5 and TradingView to multiple copy trading platforms, a VPS and Market Buzz.

Who Should Choose Vantage?

Vantage is a great option for forex traders of all stripes. Beginners will appreciate the $50 minimum deposit, forex copy trading tools and secure trading environment.

Experienced forex traders will rate the low fees on the ECN account, access to a VPS, and zero restrictions on trading strategies.

Vantage will also serve traders familiar with the MetaTrader platforms, as both MT4 and MT5 are available.

Who Should Avoid Vantage?

We don’t recommend Vantage for forex traders who want the fastest withdrawals with debit cards – you will need to wait for up to 5 days.

Other forex brokers we reviewed are a better option here, especially Skilling, which processes withdrawals in 1 working day.

Skilling: Best For Fast Deposits & Withdrawals

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, SEK, NOK

-

🛠 PlatformsMT4, cTrader, TradingView, AutoChartist

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.1 GBPEUR: 0.1 -

# Assets70+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Skilling

We recommend Skilling for its quick deposits via debit cards, as well as low forex fees. The broker is also overseen by a trusted regulator and offers high-quality trading tools.

We explain why Skilling makes our rankings of the best debit card forex brokers below.

Pros/Cons of Skilling

Pros

Instant deposits and fast 1-day withdrawals via debit card

Skilling offers instant deposits via debit card, as well as very fast withdrawals of one business day.

We like that the process to withdraw funds is also seamless. Simply log in to your account, select ‘Withdraw’ from the menu and choose debit card, then enter the payment details before confirming. The broker will send you a confirmation email once the request has been received.

Strong forex coverage with 70+ currencies and competitive fees

Skilling’s suite of 70+ currency pairs is above average and will appeal to serious forex traders.

Fees are also competitive, dropping as low as 0.1 pips for the EUR/USD pair, with a commission of $35 per million.

Coupled with no deposit or inactivity fees, forex traders can keep their costs down with Skilling.

Excellent proprietary platform plus MT4 and cTrader

Skilling offers flexibility to forex traders looking for reliable platforms. Alongside a very good proprietary solution, Skilling Trader, the broker offers the market-leading MetaTrader 4 and cTrader platforms.

We recommend Skilling Trader for beginners while MT4 and cTrader will appeal to experienced forex traders looking for more advanced charts and tools.

Cons

€5000 minimum deposit is required to open a Premium account

While the €100 minimum investment to open a Standard account is competitive, to access the best trading conditions, which are available in the Premium profile, you need to load your account with €5000. This will be a steep initial deposit for many forex traders.

2.5% charge on subsequent daily withdrawals

While your first withdrawal each day is free, any further withdrawals will cost you 2.5%. However, this is a minor complaint for us – not many traders will be looking to make multiple withdrawals a day.

Why Is Skilling Better Than The Competition?

Skilling offers faster withdrawals than almost every other forex broker we tested. You can receive funds by debit card in one working day.

Skilling also stands out for its impressive suite of 70+ forex pairs with tight spreads from 0.1 pips.

Who Should Choose Skilling?

Skilling is a good choice for forex traders looking for fast debit card deposits and withdrawals.

Serious forex traders will also appreciate the wide range of currency pairs, reliable trading software and low fees in the Premium account.

Who Should Avoid Skilling?

Traders who think they will make more than one withdrawal a day should avoid Skilling – you will be charged 2.5% and can avoid this fee by signing up with another forex broker on our list.

Forex traders looking for high-quality market research should also avoid Skilling, as the broker trails alternatives like Forex.com in this area.

AvaTrade: Best MetaTrader Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, AlgoTrader, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus OfferWelcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

We recommend AvaTrade because it offers an excellent trading environment for forex traders, including access to MT4 and MT5 with helpful add-ons.

It also boasts fast processing times with debit cards and a user-friendly dashboard for making deposits and withdrawals.

Our team discuss why AvaTrade is one of the top forex brokers that accept debit card deposits below.

Pros/Cons of AvaTrade

Pros

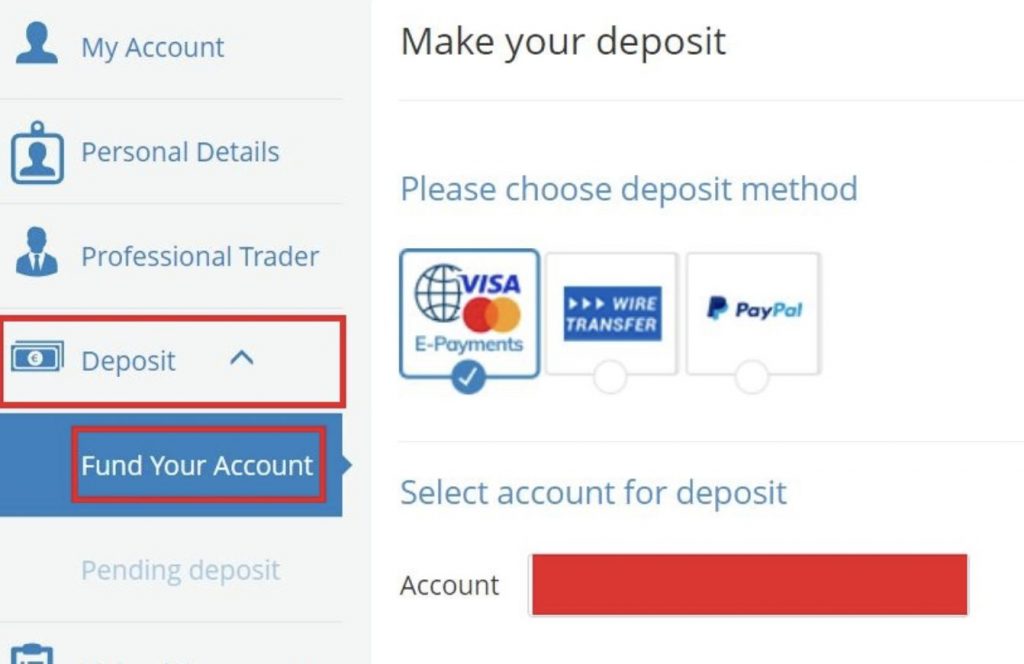

Fast, convenient and secure deposits with debit cards

AvaTrade’s client dashboard is one of the easiest to navigate. After signing up for an account, you can fund your account in just a few clicks. Simply select ‘Deposit’ on the left of the dashboard and enter your Visa or Mastercard details.

AvaTrade ensures that funds are credited to forex trading accounts instantly. We also found faster than average withdrawal times, with funds received within 1-2 days using bank cards.

Access to MT4 and MT5 with add-ons to improve the forex trading experience

AvaTrade offers access to two of the best forex trading platforms – MetaTrader 4 and MetaTrader 5. We consider these the gold standard for forex trading, with advanced charts, multiple order types and support for algo trading.

We especially rate the additional plug-ins, including Guardian Angel, a risk management tool that offers immediate feedback on trades. It can show where you are taking on large risks, among other useful metrics.

50+ currency pairs with CFDs and spread bets

AvaTrade offers more forex pairs than many brokers we use, with majors, minors and exotics. This provides opportunities for both new traders and seasoned investors.

AvaTrade is also one of the few brokers to offer both forex CFDs and forex spread bets (UK clients only).

Cons

Average forex trading fees with spreads from 1 pip on the EUR/USD

While AvaTrade doesn’t charge deposit or withdrawal fees, it does trail the cheapest brokers in terms of forex trading fees.

We got average spreads of 1 pip on the EUR/USD and 1.5 pips on the GBP/USD during testing. These are reasonable but not the lowest we see.

Why Is AvaTrade Better Than The Competition?

AvaTrade stands out for its seamless deposit and withdrawal process using debit cards. You can sign up, fund your account and start trading forex in minutes.

The range of platforms and forex trading tools, including MT4 and MT5, also stand above many competitors.

Who Should Choose AvaTrade?

Traders looking to speculate on foreign exchange markets using the MetaQuotes software should choose AvaTrade. You can access the MetaTrader platforms on desktop, web and mobile with useful add-on packages.

AvaTrade will also serve traders looking for a regulated and reliable forex broker. The company holds licences with multiple financial bodies, including the ASIC, CySEC and the FSCA.

Who Should Avoid AvaTrade?

We don’t recommend AvaTrade if you want the lowest forex trading fees. While its spreads rival many competitors, they do trail some forex brokers we have tested, including Forex.com.

eToro: Best For Forex Copy Trading

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD

-

🛠 PlatformsTradingCentral

-

⇔ Spread

GBPUSD: 2 pips EURUSD: 1.5 pips GBPEUR: 1.5 pips -

# Assets49

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer-

Why We Recommend eToro

We recommend eToro for its best-in-class copy trading solution. The process of depositing funds with debit cards is also smooth and fee-free through eToro’s user-friendly platform.

Below we outline why eToro is one of the best forex brokers supporting debit cards.

Pros/Cons of eToro

Pros

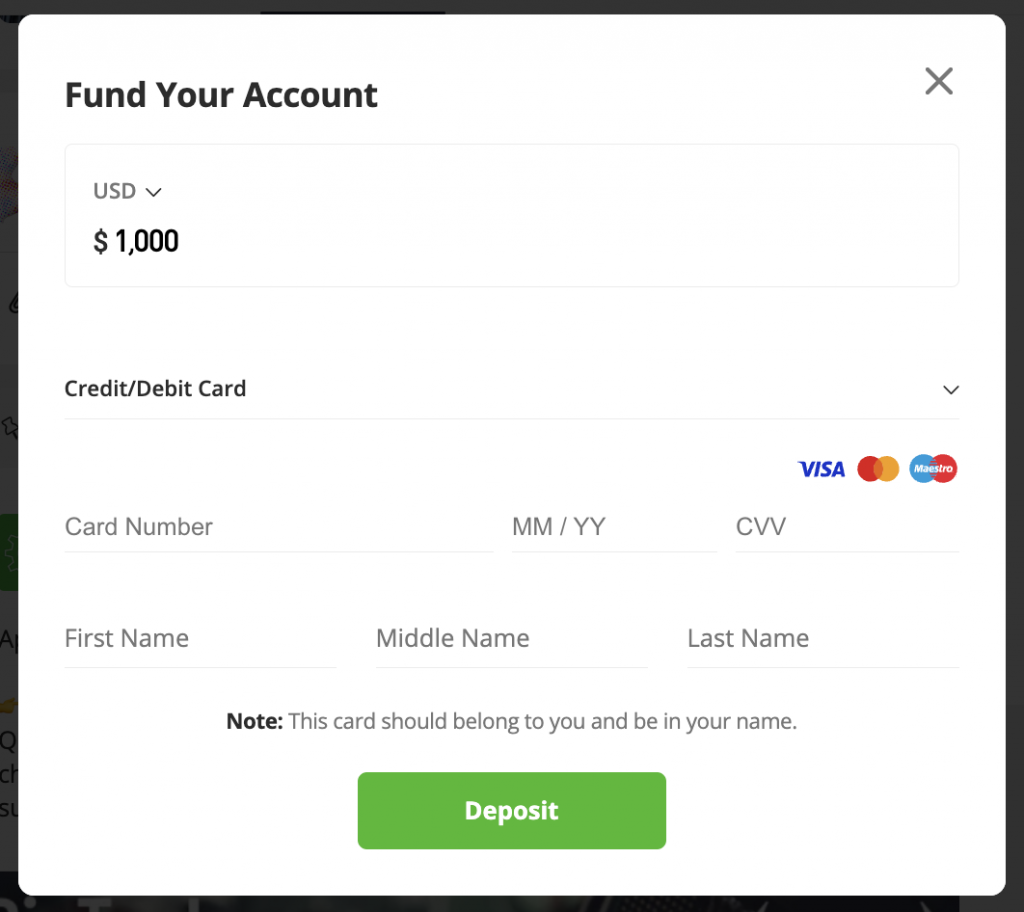

Fast debit card deposits and easy-to-navigate client dashboard

Alongside instant deposits, eToro ensures that the process to fund your account with debit cards is simple.

I can complete the process in just 5 steps by logging into my account, clicking on ‘Deposit Funds’, entering the transfer amount, selecting the ‘Debit Card’ option and entering my card details. Then I just need to hit ‘Deposit’ and my request is processed immediately.

World-leading social trading platform for hands-off investors

eToro offers one of the best copy trading platforms we have seen, with an accessible $1 minimum investment.

The real highlight for me is the huge global community. The platform is essentially a social network, where you can follow other forex traders and like, comment and share posts and trading ideas.

Easy-to-use mobile app for beginner traders

eToro offers an excellent mobile trading experience. The iOS and Android-compatible app is one of the best mobile platforms we have seen, with a slick interface, 50+ currency pairs and dynamic charting.

You will struggle to find a mobile app that rivals eToro when it comes to ease of use, making it a great option for investors new to forex trading.

Cons

Debit card withdrawals can take up to 10 days and have a $5 charge

eToro’s withdrawal time for debit cards is up to 10 days, which is slower than most other forex brokers we have evaluated.

eToro is also one of the few forex brokers to charge for debit card withdrawals, costing $5 per transaction. While not too hefty a charge, it may cut into the profit margins of traders making frequent withdrawals.

Why Is eToro Better Than The Competition?

eToro stands out from the competition for its market-leading copy trading platform and social network, with 20+ million users from 140+ countries.

The mobile trading app is also easy to use with dozens of popular currency pairs, a user-friendly interface and transparent fees.

Who Should Choose eToro?

New traders and casual investors should choose eToro. You won’t find a bigger social investing network with experienced forex traders whose positions you can copy into your account.

Mobile traders should also choose eToro. We can’t fault the slick design, stable interface and features that make trading forex on the go an enjoyable experience.

Who Should Avoid eToro?

Traders looking to withdraw funds frequently should avoid eToro. You will need to wait up to 10 days, pay a $5 fee, and request at least $30.

Forex traders looking for third-party platforms like MT4 and MT5 should also avoid eToro, as the broker does not offer these.

High-volume forex traders will also find more advanced tools like access to a VPS and tighter spreads at alternatives such as Vantage.

Forex.com: Best For US Forex Traders

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, eSignal, TradingView, AutoChartist, TradingCentral

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets80+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Forex.com

We recommend Forex.com because it offers excellent trading conditions for US traders with oversight from the NFA and CFTC. Debit card deposits are also fast and fee-free.

Below our team explains why Forex.com ranks as the best debit card forex broker for US traders.

Pros/Cons of Forex.com

Pros

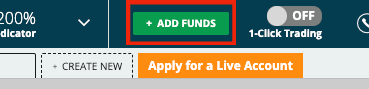

Fast debit card deposits and withdrawals with zero fees

Forex.com offers instant funding with debit cards and processes withdrawals in 1-2 days. We are also reassured to find no deposit or withdrawal fees.

Making a deposit in the client dashboard is easy. Simply log in to your Forex.com account and select ‘Add Funds’ at the top of your dashboard. Then select the bank card payment method and enter the deposit details before confirming the request.

Trusted forex broker regulated in the US and listed on the NASDAQ

Our experts consider Forex.com a reliable, trustworthy forex broker. StoneX Group Inc, the brand’s parent company, is NASDAQ-listed.

The firm is also regulated by nine financial bodies, including the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

Trade 80+ forex pairs with spreads from 0.0 pips and a $7 commission

Forex.com is one of the cheapest forex brokers we have tested. We got spreads from 0.0 pips on majors like the EUR/USD, alongside a very low commission of $7 per $100,000 traded.

The Active Trader program is also a good option for high-volume traders with cash rebates that can reduce trading costs by 15%.

In addition, we rate the free margin and pip calculators available, which make it easy to calculate potential profits and losses, plus margin requirements.

Wide range of forex trading tools including TradingCentral and NinjaTrader

The range of trading tools at Forex.com caters to all strategies and experience levels. Trading Central and NinjaTrader offer excellent features for technical traders, whilst Capitalise.ai and SMART Signals will serve algo traders.

We especially rate Performance Analytics, which allows us to analyze our trading patterns and forex strategies.

Cons

Negative balance protection is not available in the US

While common at some US forex brokers, negative balance protection is not provided to retail accounts as standard. This means if the markets move against you your account balance could drop below zero and you owe Forex.com money.

As a result, a careful approach to risk management is needed.

Why Is Forex.com Better Than The Competition?

Forex.com’s strong regulatory credentials, US listing and reputation outshines most competitors.

The fast and fee-free deposit process with debit cards also means that it’s hassle-free to start trading forex with the broker.

Who Should Choose Forex.com?

Forex.com is an excellent pick for US traders looking for a secure, regulated and top-rated forex broker.

It will also appeal to high-volume traders looking for raw spreads and low commissions, with some of the cheapest trading fees we have seen, especially through the Active Trader program.

Who Should Avoid Forex.com?

We don’t recommend Forex.com if you want negative balance protection, as the broker does not offer this.

We also don’t recommend Forex.com if you want to trade on MetaTrader 5, as this platform is not available to US traders.

Visit Forex.comHow To Compare Debit Card Forex Brokers

To find the best forex brokers that accept debit card deposits, we considered several key factors:

Minimum Deposit

The top debit card forex brokers have a reasonable minimum deposit. Our team view anything under $500 as accessible for most forex traders.

With that said, we weigh the benefits of paying more for better trading conditions, whether that’s lower spreads and fees or access to premium trading tools and market research.

Transfer Fees With Debit Cards

Most leading forex brokers do not charge at the deposit stage. However, in our experience, some firms levy a charge on debit card withdrawals. While this is often a small flat fee or a percentage of the transfer amount, we factor this into the broker’s cost rating.

Processing Times For Deposits & Withdrawals

We assess the time it takes to fund forex trading accounts with debit cards. Based on our tests, the top forex brokers offer near-instant account funding, while withdrawals can take several working days.

We also consider how straightforward and hassle-free the deposit process is. We favor user-friendly dashboards with clear payment instructions, which adds to a broker’s convenience and efficiency score.

Forex Trading Conditions & Tools

We evaluate the direct trading fees you can expect. This includes looking at minimum and typical spreads on major and minor currency pairs, any commissions, plus overnight swap fees.

The best debit card forex brokers also offer user-friendly, reliable and powerful trading tools. We look for access to MetaTrader 4, MetaTrader 5 and cTrader – three leading platforms for forex trading.

Our team also evaluate any additional tools available to enhance the trading experience, from copy trading apps and signals to automated trading services, advanced charting packages and access to a VPS.

Regulatory Status & Reputation

We only recommend forex brokers who hold licenses with trusted regulators.

Trading forex with a regulated broker will help protect you from scams while ensuring important safeguards are in place, including the use of segregated accounts and access to compensation schemes should the broker become insolvent.

Our team verify the regulatory credentials of all forex brokers that we evaluate.

Our Methodology

To rank the 5 best forex brokers that accept debit cards, our team used a mix of quantitative and qualitative analysis.

We compared factors like the minimum deposit, typical deposit and withdrawal speeds, and any transfer fees. We then supplemented these findings with the experience of our researchers in navigating the cashier portal and deposit process.

Finally, we considered the quality of the forex broker’s wider trading conditions, with a particular emphasis on coverage of the forex market, trading fees, investing tools and research.

Putting this all together enabled us to rank the top 5 debit card forex brokers.

FAQ

Which Is The Best Forex Broker That Accepts Debit Cards?

Vantage is the best forex broker that accepts debit card deposits. You can fund your account with bank cards in a few easy steps with no transfer fees and near-instant deposits. Vantage also offers excellent trading conditions for forex traders, from tight spreads to high-quality platforms.

Other leading debit card forex brokers based on our tests are AvaTrade, Skilling, eToro, and Forex.com.

Do Forex Brokers Accept Debit Card Deposits?

Yes, many leading forex brokers accept debit cards for both deposits and withdrawals.

The 5 best debit card forex brokers in 2025 are Vantage, AvaTrade, Skilling, eToro, and Forex.com.

How Do I Fund My Forex Trading Account With A Debit Card?

The process will vary between forex brokers. However, you typically need to log in to the client dashboard, navigate to the cashier portal, select ‘deposit’ or similar, choose ‘debit cards’ from the list of options and follow the on-screen instructions to enter your card details and confirm the payment.

Article Sources

Vantage – Debit Card Payment Conditions

AvaTrade – Debit Card Payment Conditions

eToro – Debit Card Payment Conditions