Best Forex Brokers in the US

The best US forex brokers provide a safe trading environment where investors can speculate on currency pairs, including those with the US Dollar (USD). Importantly, the top forex brokers that accept US traders are regulated by the National Futures Association (NFA) and Commodity Futures and Trading Commission (CFTC). To find the best forex brokers in the US, we considered:

The range and depth of currency trading products

The supported trading platforms and forex tools

The forex broker’s regulatory status in the US

The competitiveness of currency spreads and fees

List of Best Forex Brokers in the US 2025

These are the 5 best forex brokers in the USA based on our tests:

- Forex.com: Best Overall Forex Broker

- IG Group: Best Forex Broker For Beginners

- OANDA US: Best Forex Broker For High-Volume Traders

- Nadex: Best Forex Options Broker

- ForexChief: Best For High-Leverage Forex Trading

| Forex.com | IG Group | OANDA | Nadex | ForexChief | |

|---|---|---|---|---|---|

| Currency Pairs | 80+ | 80+ | 60+ | 10+ | 30+ |

| EUR/USD Spread | 1.0 | 0.8 | 0.8 | 0.25 | 0.4 |

| Minimum Deposit | $100 | $0 | $0 | $250 | $0 |

| USD Account | Yes | Yes | Yes | Yes | Yes |

| Regulated | Yes | Yes | Yes | Yes | Yes |

Forex.com: Best Overall Forex Broker

Why We Recommend Forex.com

We recommend Forex.com because this NFA- and CFTC-regulated broker offers excellent market coverage with low fees, MetaTrader 4 (MT4), plus advanced charts from TradingView.

We explain why Forex.com tops our list of the best US forex brokers below.

Pros/Cons Of Forex.com

Pros

Very low forex fees on the Standard and Raw accounts

Forex.com caters to a range of forex trading styles with a choice of competitive pricing models.

The Standard account will serve beginners looking for traditional, spread-only pricing, with tight spreads from 1.0 on the EUR/USD.

The Raw account will serve active traders looking for the lowest spreads from 0.0 pips alongside a $7 commission per $100K traded.

Another bonus for us is the cash rebate program, which offers up to 15% reductions on trading costs with spread rebates. This is a great perk for high-volume forex traders.

Strong forex coverage with 80+ currency pairs

Forex.com offers one of the widest selections of currency assets out of the forex brokers we reviewed.

As well as access to popular pairs like the EUR/USD, USD/JPY and GBP/USD, you can also speculate on less common pairs like the USD/ILS, USD/HUF and USD/THB. This provides more opportunities for serious forex traders.

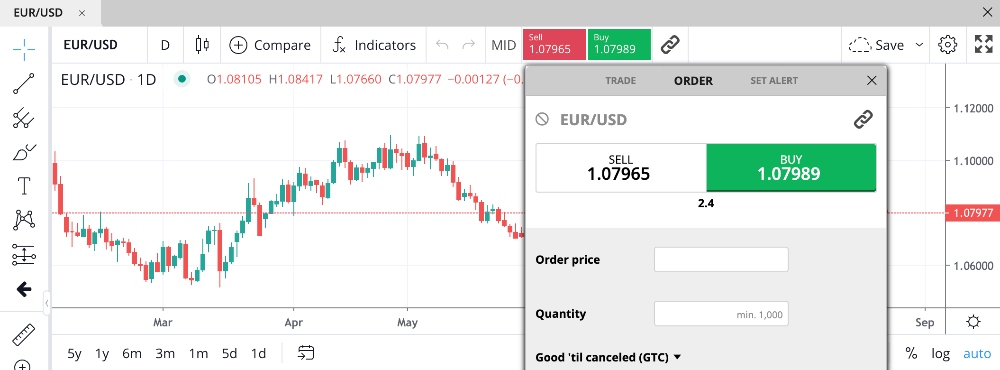

Excellent forex trading tools through MetaTrader 4, TradingView and Web Trader

We consider the MetaTrader 4 (MT4) platform the gold standard for forex trading. With dozens of technical indicators, customization capabilities, plus support for algorithmic trading, it will meet the needs of most currency traders.

Alternatively, we recommend TradingView if you want advanced charting and a more modern look and feel than the MetaTrader software.

For beginners and casual traders, the Web Trader is a high-quality, hassle-free option. No download is required and you can trade forex directly from charts with 14 time intervals and a personalized workspace.

24/5 customer support for US forex traders

Forex.com offers around-the-clock, responsive customer support. With US-specific contact numbers, including a toll-free telephone line, plus live chat and a contact form, the broker is on-hand to support new clients.

The live chat support was particularly strong during our tests. We sent three queries on different topics across the course of a week and received helpful responses within five minutes each time.

Cons

Narrow range of deposit and withdrawal methods

While Forex.com offers fee-free account funding and an accessible minimum deposit of $100, the selection of funding solutions is narrow.

You can only make a deposit using debit cards, wire transfers or ACH transfers.

Why Is Forex.com Better Than The Competition?

Forex.com offers excellent trading tools, market access and pricing for US forex traders.

It is also one of the most trustworthy forex brokers thanks to its regulation from the CFTC and NFA, plus the fact that the brand’s parent company, StoneX, is listed on the NASDAQ.

Who Should Choose Forex.com?

Forex.com is a great choice for new currency traders thanks to its low minimum deposit, easy-to-use web platform, and traditional spread-only pricing on the Standard account. There is also a free demo account and excellent educational materials.

Experienced forex traders will also rate Forex.com due to its Raw spread account, cash rebate program, and advanced charting software.

Who Should Avoid Forex.com?

Forex.com isn’t the best forex broker in the US if you want to fund your account with popular e-wallets like PayPal, as the firm does not accept these.

Visit Forex.comIG: Best Forex Broker For Beginners

Why We Recommend IG

We recommend IG because it offers a user-friendly forex trading platform and superb educational materials.

IG is also a respected forex broker with 310,000+ clients worldwide and authorization from the CFTC and NFA in the US.

Our team explains why IG ranks as the best US forex broker for beginners below.

Pros/Cons Of IG

Pros

The IG Academy offers excellent materials for new currency traders

IG has the best suite of training materials out of the forex brokers we evaluated.

The IG Academy offers multiple courses designed to upskill new traders, including a ‘A beginners guide to forex trading’. This 40-minute course covers everything you need to know to start trading currencies online.

The free demo account which can be set to never expire, also provides a risk-free place to test forex trading strategies.

User-friendly web platform and mobile app

IG offers an intuitive web platform with no download required. Standout features for us are the ability to trade forex directly from charts, customizable watchlists and trading alerts, plus straightforward account management features.

We are also pleased to see that the MetaTrader 4 is available to US forex traders.

Tight forex spreads from 0.8 pips with no hidden fees

IG offers a competitive fee schedule with spread-only pricing. Spreads on major currency pairs like the EUR/USD came in at 0.8 pips during our tests, which is lower than many alternatives.

This will appeal to beginners that only want to pay through the spread, with zero commissions.

Cons

Average customer support with frustrating chatbot

While IG offers 24/5 customer support during forex trading hours, the quality of support trails some rivals.

In particular, the chat support is operated by a bot that isn’t able to deal with basic queries. It was also a slow and uphill battle to be connected to a customer support agent during our evaluation.

Why Is IG Better Than The Competition?

IG offers best-in-class educational materials for new currency traders.

The unlimited demo account is also a great tool for aspiring traders and is not available at many US forex brokers.

Who Should Choose IG?

We recommend IG for beginner forex traders. The in-house academy is unrivalled, there is no minimum deposit via bank transfer, and the demo account is easy to sign up for.

The US forex broker will also serve traders looking to build a diverse portfolio with 17,000+ markets – more than almost every alternative.

Who Should Avoid IG?

The forex broker won’t appeal to investors looking for copy trading, as IG does not provide this service.

OANDA: Best Forex Broker For High-Volume Traders

Why We Recommend OANDA

We recommend OANDA for forex traders in the US because it offers powerful trading software, fast execution speeds and excellent discounts through the Elite Trader Program.

OANDA is registered as a Retail Foreign Exchange Dealer with the CFTC and is a member of the NFA.

Our team explains why OANDA is one of the best forex brokers in the US below.

Pros/Cons Of OANDA

Pros

Get up to a 34% reduction in trading fees through the Elite Trader scheme

OANDA offers one of the most attractive rebate programs for US forex traders. You can get cash rebates of between $5 and $17 per million traded.

Members also get additional benefits including access to free VPS hosting, priority customer service, and a dedicated account manager. These will all serve serious forex traders.

You can trade forex on the award-winning OANDA Web platform

OANDA Web is one of the best forex trading platforms that we tested.

As well as a clean look and feel, you get sophisticated analysis tools, from position ratios to news aggregators with a search function. Our team also rate the various risk management tools, including stop-loss orders and trailing stops.

VPS hosting for algorithmic trading and low-latency

OANDA has partnered with BeeksFX and Liquidity Connect. Both providers offer market-leading technology with low latency and uninterrupted access to the foreign exchange market.

Users can run automated trading strategies through OANDA Web, MT4 and partner APIs.

OANDA will also cover your VPS subscription if you are part of the Elite Trader program.

Cons

Pricing on the spread-only account trails some forex brokers

Currency traders who don’t qualify for the Elite Trader program can get more competitive spreads from other US forex brokers.

When we evaluated the platform, spreads came in at 1.4 on EUR/USD, 1.8 on USD/CHF, and 2.2 on USD/CAD.

Why Is OANDA Better Than The Competition?

OANDA offers a secure and regulated trading environment, with an attractive loyalty program for serious currency traders.

OANDA’s Web platform also stands out for us, with powerful charting and analysis tools.

Who Should Choose OANDA?

OANDA is a good choice for high-volume forex traders in the US, with spread rebates and great perks through the Elite Trader scheme.

Who Should Avoid OANDA?

OANDA isn’t a good option for US forex traders who want negative balance protection or guaranteed stop-loss orders (GSLOs), as these are not provided.

Nadex: Best Forex Options Broker

Why We Recommend Nadex

We recommend Nadex because it is a US-regulated forex broker that offers short-term options trading. Users can speculate on 11 popular currency pairs with a competitive $1 commission.

We explain why US forex traders should sign up with Nadex below.

Pros/Cons Of Nadex

Pros

Make a straightforward yes/no bet on popular currencies

Nadex’s forex options are popular with short-term traders looking for a straightforward financial instrument.

The broker offers a yes/no question, for example, will the USD rise in value in 24 hours? A correct prediction will see the trader take home a fixed payout. An incorrect prediction will see the trader lose their initial stake.

Trade intraday, daily and weekly options

Nadex offers flexible contract timeframes to suit different trading styles.

You can trade forex 23 hours a day, 5 days a week and choose from ultra-short-term options that span 5 minutes to trades that last weeks.

We also like that you have the flexibility to hold trades until expiry or exit early to reduce losses and lock in profits.

Cons

You can only trade 11 currency pairs

Nadex offers fewer currencies than most US forex brokers we tested.

While our team are reassured to see popular assets like the EUR/USD, GBP/USD, and USD/JPY you can only speculate on 11 key currencies.

You can’t invest in currencies directly or trade forex CFDs

Nadex does not offer traditional forex trading products, such as contracts for difference (CFDs).

Whilst we don’t consider this a dealbreaker – it does mean the US forex broker will only serve a niche group of traders looking for short-term options.

Why Is Nadex Better Than The Competition?

Nadex is the only US-regulated options exchange to make our list. It specializes in short-term options contracts that cannot be found at most alternatives.

Who Should Choose Nadex?

Short-term traders looking to make straightforward trades on key currencies with upfront profit and loss should choose Nadex.

Who Should Avoid Nadex?

Investors looking for forex CFDs should not open an account with Nadex, as the broker does not offer these.

The $250 minimum deposit is also higher than many forex brokers in the US, so those on a budget may prefer an alternative.

ForexChief: Best For High-Leverage Forex Trading

Why We Recommend ForexChief

We recommend ForexChief because it offers high leverage up to 1:1000 with STP/ECN execution and tight forex spreads from 0.0 pips.

There are no restrictions on forex trading strategies, with hedging, netting and automated trading permitted. We also like the rebates and rewards for high-volume traders.

Our team unpack the key reasons why ForexChief is a good forex broker for US traders below.

Pros/Cons Of ForexChief

Pros

Trade forex with very high leverage up to 1:1000

ForexChief offers flexible leverage up to 1:1000, which is among the highest we have seen.

This allows forex traders to seriously amplify their returns, though losses are also magnified so an effective risk management strategy is needed.

Trade forex with competitive ECN pricing

ForexChief offers very low spreads from 0.0 pips on major currency pairs, which will serve active day traders, scalpers and high-volume investors.

During testing, we got 0.4 pips on the EUR/USD, which rivals many alternatives.

No restrictions on forex trading strategies

ForexChief supports scalping, automated trading, hedging and netting strategies.

With no limits on trading systems, the US forex broker caters to a range of trading styles. Support for algorithmic trading and scalping will be particularly appealing to active traders.

Cons

Weak offshore regulatory status through the VFSC

ForexChief is regulated offshore by the Vanuatu Financial Services Commission (VFSC).

We do not consider the VFSC a reputable financial authority – it won’t provide US clients with the same safeguards as top-tier regulators like the NFA or CFTC, increasing the risks for retail investors.

Average education and market research

We found that ForexChief trails the best US forex brokers when it comes to educational materials. Apart from some basic forex articles, there is little to support new traders.

The quality of the forex broker’s daily and weekly market forecasts and analytics also falls short compared to firms like Forex.com.

Why Is ForexChief Better Than The Competition?

US traders will struggle to find the same levels of high leverage at alternatives forex brokers.

ForexChief also offers a very competitive environment for fast-paced trading setups with ECN pricing and zero restrictions on trading strategies, including forex scalping.

Who Should Choose ForexChief?

Day traders looking for high leverage in return for fewer regulatory protections should choose ForexChief, with rates available up to 1:1000.

Who Should Avoid ForexChief?

ForexChief isn’t a good pick for beginners. The firm trails other forex brokers in the US when it comes to education and market research.

Traders looking for a US-regulated forex broker should also avoid ForexChief – the broker is registered offshore with the VFSC. Forex.com is a better option here.

What To Look For In A US Forex Broker

To compile a list of the best forex brokers accepting US clients, our experts review and compare firms in several areas:

CFTC & NFA Regulation

The best forex brokers in the US are regulated by the Commodity Futures and Trading Commission (CFTC) and the National Futures Association (NFA).

Choosing a foreign exchange broker that is regulated by the NFA and CFTC will help protect you from scams and keep your money safe.

Most US-regulated forex brokers publish their NFA ‘Forex Dealer Member’ (FDM) registration details and CFTC ‘Retail Foreign Exchange Dealer’ (RFED) license number in the footer of their website. You can then verify their credentials on the respective regulator’s online database.

Range & Depth Of Forex Products

The best forex brokers in the US offer access to dozens of currency pairs with competitive terms.

We check that firms offer access to majors, minors and exotics with a good selection of currency pairs that include the US Dollar (USD).

Our team also consider how you can speculate on forex, whether that’s directly investing in currencies or speculating on prices through contracts for difference (CFDs).

Trading Platforms & Forex Tools

The top US forex brokers offer user-friendly and powerful trading software.

The key things we look for when we test forex trading platforms are a well-designed and stable interface, high-quality charting and analysis tools, plus value-add plugins.

We also check whether a demo account is available so prospective forex traders can test platform features before opening a live account.

Forex Trading Fees

The top-rated forex brokers that accept US clients offer low trading fees with no hidden charges.

To find the cheapest US forex brokers, we evaluate spreads on popular currency pairs, any commission fees, plus additional charges if they apply, including deposit and withdrawal costs, and inactivity penalties.

Only platforms with transparent and competitive pricing make our ranking of the best US forex brokers.

FAQ

Is Forex Trading Legal In The USA?

Yes, forex trading is legal in the United States. The forex industry is heavily regulated to protect traders from scams and unfair trading practices.

Who Regulates Forex Brokers In The USA?

US forex brokers are regulated by the Commodity Futures and Trading Commission (CFTC) and the National Futures Association (NFA).

You can check whether a forex broker is allowed to accept US forex traders by running their company name or license number in the respective regulator’s database.

Which Is The Best Forex Broker In The USA?

The best overall forex broker in the USA is Forex.com. This broker offers an excellent accessible trading environment for forex traders of all budgets and trading styles.

Runners up in our list of the top US forex brokers are IG Group, OANDA US, Nadex and ForexChief.

Article Sources

National Futures Association (NFA)