Best Forex Brokers In Canada

The best forex brokers in Canada offer excellent trading conditions and are authorized by a trusted regulator like the Canadian Investment Regulatory Organization (CIRO). In this guide, we reveal our pick of the top forex brokers in Canada, considering:

Whether the forex broker is regulated

The availability of a CAD account

The platforms and tools

The forex trading fees

List Of Best Forex Brokers In Canada 2025

Here is our ranking of the 5 top forex brokers for Canadian traders:

- AvaTrade: Highly trusted. Excellent platforms. Great education.

- Forex.com: Low fees. Reliable execution. Wide range of currency pairs.

- Interactive Brokers: Hugely respected. Advanced platforms. Unbeatable research.

- Eightcap: MetaTrader integration. AI-powered tools. Fast account opening.

- FXCC: Huge selection of currency pairs. Tight spreads. Algo trading tools.

| AvaTrade | Forex.com | Interactive Brokers | Eightcap | FXCC | |

|---|---|---|---|---|---|

| Accepts Canadian Traders | Yes | Yes | Yes | Yes | Yes |

| CAD Account | Yes | Yes | Yes | Yes | No |

| Regulated in Canada | Yes | Yes | Yes | No | No |

| Currency Pairs | 50+ | 80+ | 80+ | 50+ | 70+ |

| USD/CAD Spread | 1.5 | 0.3 | 0.6 | 1.0 | 1.0 |

| Minimum Deposit | $300 | $100 | $0 | $100 | $0 |

1. AvaTrade

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD -

Platforms

MT4, MT5, AlgoTrader, TradingCentral, DupliTrade -

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

Minimum Deposit

$100 -

Bonus Offer

Welcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

We recommend AvaTrade because it continues to deliver for traders of all levels – beginner, intermediate, and advanced. Its platforms offer a terrific user experience, the Academy is great for aspiring traders, and the company has earned the trust of our in-house experts.

AvaTrade operates in Canada through Friedberg Direct, a division of Friedberg Mercantile Group Ltd.

Pros/Cons Of AvaTrade

Pros

Outstanding reputation with 7 licenses and 400,000+ traders

AvaTrade has an office in Toronto and is a member of the Canadian Investment Regulatory Organization (CIRO) and Canadian Investor Protection Fund (CIPF), ensuring compliance with industry standards.

User-friendly and feature-rich platforms

AvaOptions delivers an excellent user experience with an intuitive display and a strong charting package with 5 chart types, 14 timeframes and dozens of indicators and drawing tools.

MetaTrader 4 was designed specifically for forex trading and continues to be the most popular software in the industry. Meanwhile, MetaTrader 5 caters to advanced traders with more sophisticated tools and faster processing.

Excellent education with forex courses and platform tutorials

The Academy’s forex courses impressed us. They break down essential topics for beginners, like understanding chart patterns and risk management.

However what sets them apart is the engaging mix of 150 lessons and 50 quizzes, supported by visuals, making the learning experience enjoyable.

Cons

Forex trading fees trail the cheapest brokers

In our tests, we got a 1.5 pip spread on the USD/CAD, notably higher than the 0.6 pip spread offered by the lower-cost alternative, Interactive Brokers, on the same currency pair.

$50 inactivity fee charged to casual investors

The charge applies after 3 months, followed by a $100 administration fee after 12 months. In contrast, Eightcap does not impose any fees for inactivity.

Why Is AvaTrade Better Than The Competition?

AvaTrade is one of the most trusted forex brokers accepting traders in Canada with a stellar reputation dating back to 2006 and a long row of awards.

It is also one of the few brokers that allows you to speculate on currencies through CFDs and FX Options. CFDs allow you to take long or short positions without owning underlying currencies, while FX Options give you the right but not the obligation to purchase a forex contract at a set price on a future date.

Who Should Choose AvaTrade?

AvaTrade stands out as an excellent choice for all traders but especially beginners. Its top-notch educational materials and the availability of an unlimited demo account make it a valuable resource for aspiring traders.

Who Should Avoid AvaTrade?

AvaTrade may not be the ideal choice for budget-conscious traders, as the $300 minimum for Canadian traders exceeds alternatives. In contrast, Interactive Brokers and FXCC have no minimum deposit.

2. Forex.com

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD, JPY, CHF -

Platforms

MT4, MT5, eSignal, TradingView, AutoChartist, TradingCentral -

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets80+

-

Minimum Deposit

$100 -

Bonus Offer

-

Why We Recommend Forex.com

We recommend Forex.com because it continues to deliver competitive pricing for active traders, fast and reliable execution, plus an extensive selection of 80+ currency pairs.

FOREX.com Canada Ltd is regulated by the CIRO and a member of the CIPF.

Pros/Cons Of Forex.com

Pros

Ultra-tight spreads from 0.0 pips in the RAW account

During testing, we got low spreads of 0.3 pips on the USD/CAD, coupled with a $7 commission per $100K.

Additionally, the Active Trader program offers rebates, potentially saving you between 5% and 15%, depending on monthly trading volumes.

Deep liquidity with fast execution speeds of 50 milliseconds

Forex pricing is sourced from tier-one banks while an impressive 99.83% of trades are executed in less than one second. This reliable execution allows clients to secure optimal prices in fast-moving forex markets.

80+ currency pairs including majors, minors and exotics

Forex.com stands out with its extensive selection of forex assets, featuring 9 pairs with CAD, including USD/CAD, CAD/JPY, and AUD/CAD, offering ample opportunities for Canadian traders.

Beyond forex, Forex.com excels with its large range of stocks, indices, commodities, and ETFs, enabling traders to build a well-rounded portfolio.

Cons

Average customer support with slow response times

While Forex.com offers 24/5 assistance and a local helpline for Canadian traders, we’ve found the support can be inconsistent. The live chat, in particular, is frustrating with an unhelpful chatbot and average wait times to connect with an agent exceeding 10 minutes during testing.

Canadian traders miss out on tools like NinjaTrader and Trading Central

Although the Performance Analytics provided are beneficial for analyzing trading performance, NinjaTrader stands out for its customizable forex watchlists and automated trading solutions.

Additionally, for clients of Forex.com in other countries, Trading Central can help identify potential opportunities by analyzing the markets for chart patterns.

Why Is Forex.com Better Than The Competition?

Forex.com is a compelling choice for serious forex traders with its low fees in the RAW account and Active Trader program.

Moreover, its extensive selection of currency pairs exceeds the industry average, with only Interactive Brokers matching it from our shortlist.

Who Should Choose Forex.com?

For serious traders, Forex.com is a great option, with tight spreads starting from 0.0 pips, a competitive $7 commission, and potential savings of up to 15% for high-volume trading.

Day traders should also choose Forex.com – order execution is fast and reliable, while advanced charting packages are available through MetaTrader, TradingView and WebTrader.

Who Should Avoid Forex.com?

If you are a new trader wanting an unlimited demo account and reliable support, we’d avoid Forex.com. AvaTrade scores better in both of these departments.

3. Interactive Brokers

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, HUF -

Platforms

eSignal, AlgoTrader, TradingCentral -

⇔ Spread

GBPUSD: Commission (.20 pts x trade value) EURUSD: Commission (.20 pts x trade value) GBPEUR: Commission (.20 pts x trade value) -

# Assets70+

-

Minimum Deposit

$0 -

Bonus Offer

-

Why We Recommend Interactive Brokers

We recommend Interactive Brokers because it maintains its status as one of the most respected forex brokers in the industry providing access to professional-grade platforms and a huge suite of research tools.

Interactive Brokers Canada Inc is regulated by the CIRO and has an office in Montreal.

Pros/Cons Of Interactive Brokers

Pros

Outstanding reputation with 40+ years of experience

Interactive Brokers earns our trust with its NASDAQ stock exchange listing, robust equity capital exceeding $13 billion, and oversight from tier-one regulators such as the CIRO in Canada, SEC in the US, and FCA in the UK.

Award-winning Traders Workstation (TWS) platform

TWS offers a comprehensive solution for active traders, with 150+ markets, including over 80 currency pairs. TWS Mosaic is great for its customizable workspace and streamlined order management, while TWS Classic provides advanced tools for algorithmic trading.

Research and education among the best in the industry

You can access real-time news and market research from reputable sources like Dow Jones, Reuters, Morningstar, and Zacks.

The diverse educational content, spanning podcasts, blogs, videos, webinars, and more, also delivers a comprehensive education for new forex traders.

Cons

Average payment methods with slow processing times

During our tests, Canadian traders had limited deposit options, restricted to wire transfer, online bill pay, and EFT bank connection.

Additionally, the deposit processing times, taking at least one day for some methods, lag behind alternatives that provide near-instant funding.

Complicated platforms with no MetaTrader integration

Interactive Brokers is one of the few forex brokers in Canada not to support either MT4 or MT5 – the most popular third-party platforms.

This limitation becomes more significant because its own software features a steep learning curve, especially for beginners.

Why Is Interactive Brokers Better Than The Competition?

Interactive Brokers excels with its professional-grade trading tools; TWS boasts over 100 order types and provides access to more than 200 research and news sources.

Additionally, it stands out among forex brokers accepting Canadian traders by offering interest on idle funds, reaching up to 4.83%.

Who Should Choose Interactive Brokers?

For advanced traders seeking a powerful platform, Interactive Brokers is our go-to choice. Its extensive array of markets, sophisticated tools, and comprehensive research solidify its position among the industry’s best.

That said, casual investors will also find Interactive Brokers appealing, thanks to the interest paid on uninvested cash. This feature makes Interactive Brokers an attractive option while identifying suitable trading opportunities.

Who Should Avoid Interactive Brokers?

Interactive Brokers is not the ideal choice for beginners, given its complex trading software, additional tools, and fee structure.

4. Eightcap

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD, NZD, SGD -

Platforms

MT4, MT5, TradingView -

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets50+

-

Minimum Deposit

$100 -

Bonus Offer

-

Why We Recommend Eightcap

We recommend Eightcap because it offers a strong platform line-up for Canadian traders, with MetaTrader 4, MetaTrader 5 and TradingView. It also offers user-friendly, AI-powered tools to help Canadian forex traders discover market opportunities.

Pros/Cons Of Eightcap

Pros

Industry-leading third-party platforms: MT4, MT5 and TradingView

Eightcap is one of the few forex brokers in Canada to integrate TradingView, which sports a sleek design and powerful charting tools, including 100 indicators, 5000 user-developed indicators and 50 drawing tools.

Alternatively, MT4 and MT5 are available, catering to advanced forex traders and algo traders, although they don’t match TradingView’s modern look and feel in our view.

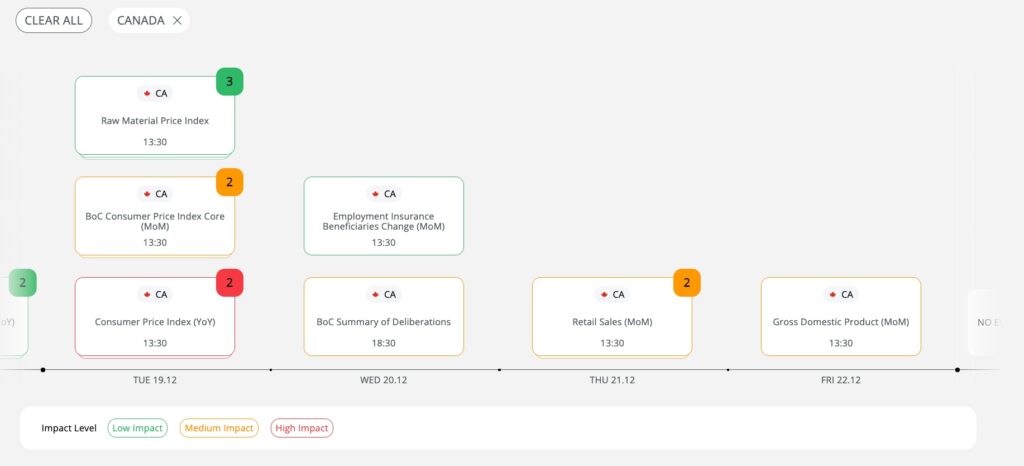

AI-powered tools to identify trading opportunities

The Acuity economic calendar, not available at most forex brokers, scans 1000+ macroeconomic events to generate daily trading ideas.

The platform’s high, medium, and low impact filters, coupled with the ability to drill down into specific countries like Canada, further enhance its value.

Smooth account opening with an accessible $100 deposit

The straightforward sign-up process at Eightcap took us less than 5 minutes, while verification is typically completed within 24 hours.

During registration, you have the flexibility to choose your platform, account type, and base currency, with CAD as a supported option.

Cons

Not regulated by the CIRO

Despite oversight from tier-one regulators – the Australian Securities & Investments Commission (ASIC) and the UK Financial Conduct Authority (FCA), 80,000 traders, and the confidence of our experts, Eightcap isn’t regulated in Canada, limiting investor protection for local traders.

Subpar education for beginners

Eightcap’s ‘Labs’ provides only basic content, significantly trailing behind resources offered by alternatives like Interactive Brokers.

We also find navigating the educational tools frustrating, with the forex section sometimes featuring unrelated topics.

Why Is Eightcap Better Than The Competition?

Eightcap offers excellent integration with MT4 and MT5, and is one of the few forex brokers in Canada to support TradingView, a 30-million strong social trading community with powerful charting tools.

Moreover, Eightcap offers user-friendly AI-enabled tools, fairly unique features not commonly found at alternatives.

Who Should Choose Eightcap?

For traders familiar with the MetaTrader suite, Eightcap is an ideal choice as it supports both MT4 and MT5.

Additionally, with a low $100 minimum deposit and the added benefit of TradingView access, Eightcap is a great option for beginners.

Who Should Avoid Eightcap?

Islamic traders seeking a swap-free account should steer clear of Eightcap, as it doesn’t offer this feature. AvaTrade is a better option here.

5. FXCC

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP -

Platforms

MT4 -

⇔ Spread

GBPUSD: 1.0 EURUSD: 0.2 GBPEUR: 0.5 -

# Assets70+

-

Minimum Deposit

$0 -

Bonus Offer

100% First Deposit Bonus Up To $2000

Why We Recommend FXCC

We recommend FXCC because it offers a compelling package for serious forex traders, from a wide range of currency pairs to ECN pricing and free virtual private server (VPS) hosting.

Pros/Cons Of FXCC

Pros

70+ currency pairs including majors, minors and exotics

FXCC stands out with an above-average selection of forex assets, offering ample trading opportunities. This includes 7 currency pairs with the CAD, including the USD/CAD, EUR/CAD, and AUD/CAD.

Tight forex spreads from 0.0 pips

In our analysis of FXCC’s floating spreads over a two-week period, they predominantly remained below 1 pip on popular assets such as the USD/CAD, putting them on par with other low-cost forex brokers.

Free VPS and support for Expert Advisors

FXCC has clearly designed its trading package for advanced traders, offering support for algo trading, permitting fast-paced strategies like forex scalping, and providing virtual private server (VPS) hosting for traders meeting minimum balance and volume requirements.

Cons

FXCC is not regulated by the CIRO

While the broker is regulated by the reputable Cyprus Securities & Exchange Commission (CySEC), Canadian traders must sign up with the offshore entity, Central Clearing Ltd. This branch will provide limited investor protection for Canadian traders.

Trails alternatives in education and research

The daily technical analysis at FXCC is limited to major currency pairs like EUR/USD, USD/JPY, and GBP/USD, lacking coverage of Canadian currencies.

We also downloaded the eBooks, and while some of the content is useful, it seriously trails the comprehensive and visually engaging education at AvaTrade.

Why Is FXCC Better Than The Competition?

FXCC stands out with its above-average selection of currency pairs and a no-fuss approach to online trading. With a $0 minimum deposit and a single ECN account, getting started is straightforward.

Who Should Choose FXCC?

Our tests show that FXCC is best for algo traders with support for MetaTrader 4 and virtual private server hosting. It also caters to serious traders with no restrictions on advanced strategies like forex scalping.

Who Should Avoid FXCC?

Our analysis shows that FXCC is not the best choice for beginners, as it significantly trails alternatives like AvaTrade and Interactive Brokers in terms of education and research tools.

What To Look For In A Forex Broker In Canada

To find the top forex brokers in Canada, there are several factors that we, and you, should consider:

Regulation And Trust

Choosing a forex broker regulated by a trusted regulator is critical to help protect your funds and ensure compliance with industry standards.

The chief regulatory body in Canada is the Canadian Investment Regulatory Organization (CIRO). This is a top-tier regulator that enforces various measures to protect Canadian traders, including capping leverage to 1:50 on forex, limiting potential losses.

Alternatively, Canadian traders can choose to sign up with forex brokers regulated by other trusted regulators, though they may not receive local protections, such as access to the Canadian Investor Protection Fund (CIPF), which can help return your capital should your broker become insolvent.

We have verified the regulatory credentials of every forex broker in our shortlist, while our in-house experts have assigned them all high trust scores.

Trading Accounts

The top forex brokers that accept traders from Canada offer versatile accounts that will meet the needs of a range of traders, from beginners to intermediate and advanced traders.

This typically entails providing a commission-free, floating spread account for newer traders and a raw spread solution with low, fixed commissions for more experienced traders.

We also consider whether forex brokers offer an account denominated in the Canadian Dollar. This is important because it means you can manage your trading activity in your native currency, while also helping to avoid conversion charges that can apply if you deposit to a USD account, for instance.

Trading Fees

Comparing fees is crucial when choosing a Canadian forex broker since this will impact your bottom line.

We evaluate minimum and average spreads on popular assets like the USD/CAD, EUR/CAD, and AUD/CAD, along with any commissions. Our team also examines non-trading costs such as deposit/withdrawal fees, inactivity charges, and swap fees.

This allows us to identify forex brokers that provide the best value for Canadian traders.

Platforms And Tools

The quality of the trading platforms, apps and tools matters a lot. Since you’ll be spending a good chunk of your time here, having a reliable and easy-to-use solution is a must.

When testing forex trading software, we carefully evaluate key components like the charts and analysis tools, order functions, and how customizable they are. But the most important thing? Making sure the tools are user-friendly and designed with forex traders in mind.

FAQ

Is Forex Trading Legal In Canada?

Yes – forex trading is legal in Canada. The industry is overseen by the Canadian Investment Regulatory Organization (CIRO), previously the Investment Industry Regulatory Organization of Canada (IIROC).

Which Is The Best Forex Broker In Canada?

AvaTrade tops our list of the best forex brokers in Canada thanks to its excellent reputation, reliable platforms for traders of all levels, and Academy with great educational tools.

Runners up in our shortlist are Forex.com, Interactive Brokers, Eightcap, and FXCC.