City Index

-

💵 CurrenciesUSD, EUR, GBP, AUD, CZK

-

🛠 PlatformsMT4, TradingView, TradingCentral

-

⇔ Spread

GBPUSD: 0.8 EURUSD: 0.5 GBPEUR: 0.8 -

# Assets84

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Our Opinion On City Index

City Index is an award-winning forex broker with 80+ currency pairs and no minimum deposit. Strong points for us are access to MetaTrader 4 and TradingView, plus the fast execution speeds of 20ms. We also rate the below average spreads, which came in at 0.7 pips on the EUR/USD during testing.

On the downside, there is no swap-free account for Islamic traders and the range of payment methods is narrow compared to some alternatives. However, these are minor complaints and not dealbreakers for us.

Summary

- Instruments: 13,500+ including 80+ forex pairs, stocks, indices, commodities

- Live Accounts: Standard, MT4, Professional, Corporate

- Platforms & Apps: MT4, TradingView, WebTrader, App

- Deposit Options: Bank cards, wire transfer, PayPal

- Demo Account: Yes

Pros & Cons

- Respected broker backed by the NASDAQ-listed StoneX group

- No minimum deposit making the broker accessible to beginners

- 99% of forex trades are executed in less than a second

- Tight spreads on currency pairs starting from 0.7 pips

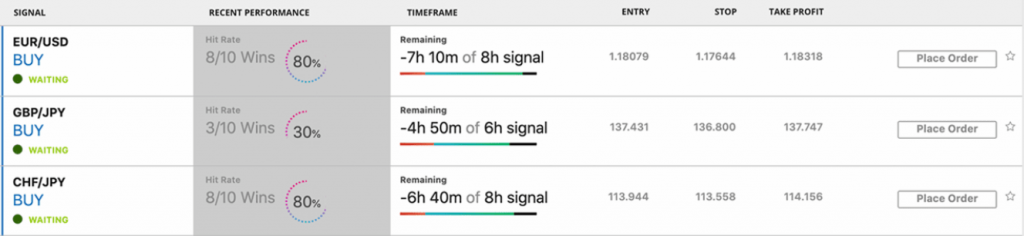

- SMART Signals tool to highlight trading opportunities

- Huge product portfolio with 13,500+ instruments

- High-quality education through the Academy

- Regulated by the FCA, ASIC and MAS

- Only around 300 assets are available in the MT4 account

- A $15 inactivity fee applies after 12 months of no trading

- There is no copy trading service

- There is no Islamic account

Is City Index Regulated?

We have no concerns about City Index’s regulatory status. The broker’s parent company, StoneX Group Inc, is regulated by the UK’s Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

These are among the most respected financial regulators, so we are confident that this broker adheres to the highest standards of client protection. This includes using segregated accounts, providing negative balance protection, and limiting leverage to protect retail investors.

It is also reassuring to see that the broker undergoes regular audits and provides access to investor compensation schemes in the case of bankruptcy, including up to £85,000 in compensation for UK clients through the Financial Services Compensation Scheme.

Forex Accounts

City Index offers two accessible accounts: Standard and MT4. Both have no minimum deposit, which is a bonus since some alternatives, including IC Markets, require $200.

The Standard account offers the best market access, with over 13,500 CFDs. You also get access to a powerful proprietary platform with additional trading tools.

However, the MT4 account offers more competitive spreads from 0.5 pips compared to the 0.8 pips in the Standard solution, as well as access to the industry’s leading forex platform – MetaTrader 4. My only real complaint with the MT4 account is that you can only access 300 of the 13,500 markets available on the Standard account, though there is still a good range of currency pairs.

Ultimately, which account is right for you will depend on whether you want to trade on the broker’s user-friendly web platform or MetaTrader 4, which supports algo trading, and whether you want lower fees in return for fewer tradable markets.

Unfortunately, City Index does not offer a swap-free account, so we recommend that Islamic traders consider an alternative like Pepperstone.

Professional and Corporate accounts are also available upon request.

How To Open A Live Account

I found it straightforward to sign up for an account with City Index. The registration process only takes a couple of minutes to complete:

- Enter your email address in the application form

- Enter personal details such as your country of residence and name

- Choose an account type

- Provide your address

- Enter your employment status, financial details and trading experience

- Confirm your account details and open your account

Note you may need to provide documents so that the broker can verify your identity. City Index will you know once they have approved your documents so you can start trading.

Trading Fees

Trading fees at City Index are competitive, especially on the MT4 account. During our tests, we got spreads of 0.7 pips on the EUR/USD and 0.9 pips on the AUD/USD, which stand up well against competitors such as AvaTrade.

Except for share CFDs, all CFDs are commission-free. For UK, European, Asian and Australian shares, you can expect a 0.08% commission, whilst US shares have a 1.8 CPS (cost per sale).

| Currency Pair | Minimum Spread | Average Spread |

|---|---|---|

| EUR/USD | 0.7 | 0.8 |

| AUD/USD | 0.5 | 0.9 |

| USD/JPY | 0.6 | 0.8 |

| GBP/USD | 1.1 | 1.8 |

| EUR/GBP | 1 | 1.7 |

Non-Trading Fees

We are also pleased to see no deposit or withdrawal fees, which makes moving funds simple and affordable.

This broker does charge a fee on inactive accounts after 12 months. The fees are $15 per month, which is a little higher than competitors like XTB ($10), but not a major issue in our opinion.

Other fees to be aware of are the overnight swap fees charged on positions held open past the end of a trading day. Traders should also keep in mind that triple rate swap fees are charged on a Wednesday.

Payment Methods

Deposits

One weak point of City Index is the small selection of payment methods, with only credit/debit cards, bank transfers and PayPal supported. We think it’s unfortunate that e-wallets such as Neteller and Skrill aren’t available, since these are commonly offered by competitors.

Processing times vary depending on the method you choose, with PayPal and cards the fastest and often processing instantly in our experience. In contrast, bank transfers can take several working days.

Supported currencies include USD, GBP, EUR, AUD and CZK, which is an advantage for those looking to avoid currency conversion fees in major trading hubs.

How To Make A Deposit

I find funding my City Index account easy thanks to the user-friendly members area:

- Log in to the client portal

- Click the white ‘Add Funds’ icon on the top-right-hand side of the page

- Choose the deposit type you want to use

- Enter the amount you want to transfer

- Confirm the deposit

Withdrawals

Withdrawals can be made with the same payment methods as deposits and we like that no fees are charged (except third-party fees). This isn’t the case with some brokers so City Index performs well here.

We found that withdrawal times vary between payment methods, but are around the industry norm. Most bank transfers or credit card withdrawals take up to a few business days, depending on your bank.

Forex Assets

City Index’s suite of forex assets is on the larger side of brokers we review. The broker boasts an impressive range of 84 currency pairs including majors, minors and exotics. Dedicated forex traders will be able to access all the below pairs and more:

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Similarly, City Index’s selection of non-forex instruments is among the highest we have seen. With over 13,500 assets including shares, indices, commodities, metals, bonds and options, as well as the ability to speculate on interest rates, traders of all stripes are catered for.

Indeed, using the Standard account allows us to build a diverse portfolio covering a range of asset classes and strategies.

You can trade:

- Shares: 4700+ shares such as Amazon, Tesla and Netflix

- Indices: 40+ indices including the FTSE 100, Germany 40 and US Tech 100

- Commodities: 20+ commodities including oil and coffee

- Bonds: Including UK Long Gilt, US T-Note and Euro Bund

- Metals: Metals including gold, silver and platinum

- Options: 40+ markets including forex and indices

My only criticism is that the selection of assets available on the MT4 account is much smaller at around 300 instruments.

Execution

City Index uses a hybrid execution model – it is a dealing-desk broker, meaning it acts as the counterparty to clients’ trades, but the pricing is sourced from liquidity providers and electronic communication networks (ECNs).

While there can be a conflict of interest as orders are executed ‘in-house’ in the dealing-desk model, in this case, we are satisfied with the broker’s approach.

Also during our tests, execution speeds were excellent, coming in at 20ms – we view anything below 100ms fast.

Leverage

Leverage varies depending on your location and account.

In the UK, EU and Australia, for example, leverage up to 1:30 is available, in line with legal requirements. Clients based elsewhere or classified as professional traders may be able to access higher rates up to 1:400.

Traders should note that City Index has a margin call of 120% and a margin close-out is triggered at 100%.

Platforms & Apps

The forex broker offers three excellent trading platforms: the popular MetaTrader 4 (MT4), TradingView and a proprietary web platform.

The proprietary solution and TradingView are both highly user-friendly and packed with powerful features. For example, I can use over 100 pre-included technical indicators as well as 100,000+ community indicators in TradingView. These platforms also have a more modern and sleek feel which I think lends to a more enjoyable experience compared to MT4.

Still, MetaTrader 4 remains the most popular forex trading software. And while I don’t rate the interface, the customizable workspace, advanced technical analysis features and support for automated trading are hard to beat. It is just a shame that only around 300 assets are available.

I have listed some of my favorite features from each platform below:

Web Trader

- Access to SMART Signals with performance analytics

- Customizable workspace with 10+ chart types

- Integrated market news from Reuters

- Custom watchlists and price alerts

- One-click trading capabilities

- 80+ technical indicators

MetaTrader 4

- 4 pending order types (buy limit, buy stop, sell limit and sell stop)

- 2,000 free indicators and 700 paid-for indicators

- 30 in-built technical indicators

- Single-thread strategy testing

- Expert Advisors (EAs)

- 24 graphical objects

- 9 timeframes

TradingView

- 100+ pre-built indicators, 50+ drawing tools and 100,000 community indicators

- 12+ customizable charts including Kagi, Renko and Point & Figure

- 8 charts per tab with synchronized time intervals and symbols

- A social trading community for discussions

- Integrated market news from Reuters

- Access to Pine Script coding language

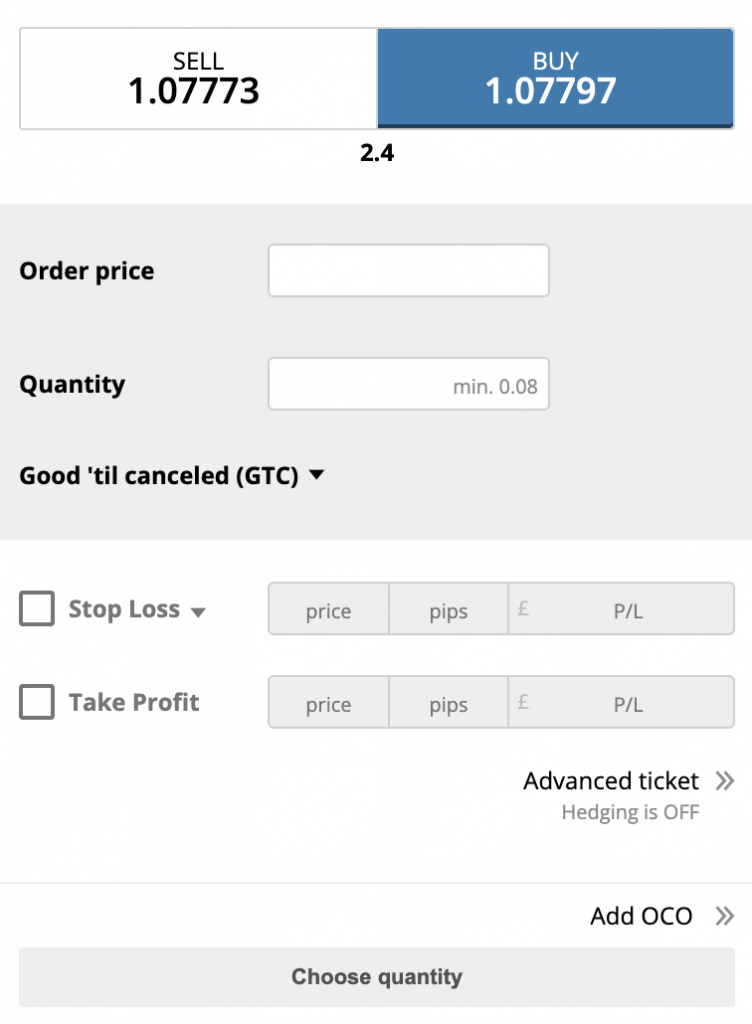

How To Make A Forex Trade

Placing a trade in City Index’s proprietary platform is easy. In my opinion, the streamlined process rivals the likes of MT4:

- Log in to your client portal

- Click the ‘Browse Markets’ tab on the left-hand side of the page

- Choose the asset you want to trade

- Click on the ‘Buy’ icon and choose the quantity and conditions

- Confirm the trade

Forex Tools

City Index excels when it comes to additional forex tools and plugins. There is an excellent selection of charting and algorithmic features that will serve beginners and experienced traders alike.

My only complaint is that there is no VPS or copy trading, which would set this broker apart from competitors like IG Group.

Nonetheless, I enjoy using the following:

- Market 360: Advanced charts over multiple timeframes with real-time market news and margin requirements

- SMART Signals: Algorithmic monitoring of 36 markets to highlight potential trading opportunities and patterns

- Trading Central: In-depth analysis, research portal and strategy testing with historical data

- Advanced Charts in TradingView: 80+ customizable indicators, drawing tools and workspaces

- Alerts: Customizable alerts in multiple areas including prices, trades and orders

My personal favorite is the SMART Signals. Available in the broker’s proprietary platform, the tool utilizes years of historical data to scan the markets. This allows me to tap into potential opportunities without having to do all the legwork myself.

Forex Research

City Index also ranks highly for its forex research. I like that the real-time market news is thorough and regularly updated, sorted by market as well as by the most trending topics.

Trading ideas, weekly projections and expert-led insights are also offered, giving traders a well-rounded suite of research tools that I think stand up well to similar brokers.

Forex Education

Equally impressive is the suite of educational resources offered by City Index. The free Academy features a range of comprehensive articles, videos, mini-tests, a glossary of financial terms and webinars suitable for beginners up to advanced traders.

I particularly rate the free courses which are packed with easily digestible trading lessons which you can work through at your own pace.

In my opinion, this versatile library of resources puts City Index on a similar level to leading educational brokers such as eToro.

Demo Account

City Index offers a demo account which provides a risk-free environment to practice strategies and browse the broker’s services.

The demo account offers $10,000 in virtual funds but note that there is a time limit of 12 weeks on the account. This is a little disappointing but not the shortest demo duration we have seen.

How To Open A Demo Account

I found it easy to open a demo account with City Index. The process took me less than one minute:

- Click on the ‘Try a Demo’ icon on the home page of the broker website

- Enter your name, email address and phone number

- Note down the username and password provided

- Log in to the client portal with the details provided

Bonus Offers

In line with rules set by the FCA, ASIC and other regulators, City Index does not offer any bonus rewards or incentive schemes.

This is to be expected from a well-regulated broker, so we don’t view this as a downside.

Customer Service

I am always impressed with the customer service at City Index, with reliable support available 24/5 through a variety of avenues including live chat, a ticket submission point, telephone or email.

I tested the broker’s live chat on several occasions over a day and received helpful responses within 2 minutes each time. I also sent an email query and received a response within 24 hours, which is in line with leading forex brokers.

The brokerage also provides a useful FAQ page, which is a decent place to start if you have a basic query.

You can get in contact through:

- Live chat: Contact page of the broker’s website

- Email: support.uk@cityindex.com

- Telephone: 02031941801

Company Details

City Index is a multi-award-winning online forex broker. The firm was founded in 1983 in the UK and now has three global offices and over a million clients.

The firm is also part of the renowned StoneX Group, an American Fortune 100 financial services company listed on the NASDAQ. This is a reassuring sign for us that the brokerage is well-established and legitimate.

The broker has won numerous awards including Best CFD Provider at the ADVFN International Financial Awards 2023 and Best Trading Platform at the Online Money Awards 2022.

Trading Hours

The trading hours offered by City Index vary depending on the instrument you are trading. For example, forex can be traded 24 hours Monday to Friday.

Full information on trading hours and market events can be found on the broker’s website. There is also a useful trading calendar which makes all schedule changes clear.

Who Is City Index Best For?

City Index has plenty to offer traders at all experience levels. The $0 minimum deposit, free demo account and excellent educational materials will serve beginners, while the powerful platforms, thousands of markets, and fast execution speeds will be valuable to experienced traders.

City Index will also appeal to forex traders familiar with MetaTrader 4, though the range of instruments is narrower.

FAQ

Is City Index Legit Or A Scam?

City Index is a legitimate forex broker. The firm has been in operation for over 40 years and is part of the NASDAQ-listed StoneX Group. The broker has also won dozens of industry awards.

Can I Trust City Index?

City Index is a trustworthy broker. Reviews and ratings from other users are generally positive and we did not uncover any reports of scams or unfair trading practices in our research. The broker also has excellent regulatory credentials.

Is City Index A Regulated Forex Broker?

Yes, City Index holds a license with the UK’s Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

Is City Index A Good Or Bad Forex Broker?

City Index is a very good forex broker. Traders get access to an impressive selection of 84 forex pairs with no minimum deposit and a choice of trading accounts.

Fees are also competitive, with spreads from 0.7 pips on the EUR/USD. In addition, the educational resources, forex research and extra trading tools place City Index alongside top brokers.

Is City Index Good For Beginners?

We would recommend City Index to beginners. The 12-week demo account, $0 minimum deposit and low fees mean beginners can start trading easily. There are also plenty of educational resources available to help beginners learn through the Academy.

We would like to see a copy trading service offered, but this is a minor complaint.

Does City Index Offer Low Forex Trading Fees?

City Index’s trading fees are competitive. We got spreads of 0.7 pips on the EUR/USD and 0.9 on the AUD/USD during our evaluation, which is in line with or cheaper than most competitors.

Does City Index Have A Forex App?

Yes, City Index offers both a proprietary app and MT4 to mobile traders, available for download on iOS or Android devices.

On-the-go traders can benefit from account management features, news feeds, and mobile-optimized charts. You can also create custom watchlists and enable convenient push notifications.

How Long Do Withdrawals Take At City Index?

Similar to most forex brokers, withdrawal times vary depending on the payment method you choose. For example, funds will typically be returned to your account within a few days if using credit/debit cards.

Can You Make Money Trading Forex With City Index?

City Index offers competitive spreads in both accounts, as well as low non-trading fees which will help to keep costs down. Execution speeds are also fast, helping to reduce slippage.

However, making money from forex trading is speculative and not guaranteed, regardless of the brokerage. We always recommend that traders approach forex trading with a sensible risk management strategy.