Deriv.com

-

💵 CurrenciesUSD, EUR, GBP, AUD

-

🛠 PlatformsMT5

-

⇔ Spread

GBPUSD: From 0.5 EURUSD: From 0.5 GBPEUR: From 0.5 -

# Assets30+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer-

Our Opinion On Deriv

Deriv.com is a popular binary options and CFD broker. The platform stands out for its high leverage up to 1:1000 and proprietary trading products, including multipliers and synthetic indices. We rate the 24/7 binary options trading opportunities and high payouts up to $50,000. Our team also appreciate the fast sign-up process and low minimum deposit.

On the downside, Deriv.com is not licensed by a top-tier regulator. There is also no copy trading or welcome promotions, which are available at alternative binary options brokers.

Summary

- Instruments: 100+ including Binary Options, CFDs, Multipliers, Forex, Stocks, Commodities, Synthetic Indices

- Live Accounts: Standard

- Platforms & Apps: Deriv Trader for binary options, MetaTrader 5 (MT5) for CFDs

- Deposit Options: Bank cards, e-wallets and wire transfers

- Demo Account: Yes

Pros & Cons

- Wide range of options timeframes from 15 seconds to 365 days

- Excellent choice of payment methods with no transfer fees

- Very high leverage up to 1:1000 on CFDs and multipliers

- User-friendly platforms with sophisticated charting tools

- Best in the industry for synthetic indices

- Payouts up to 100% on binary options

- Mobile app for on-the-go trading

- Low minimum deposit of $5

- 24/7 trading 365 days a year

- Weak regulation in some jurisdictions

- No copy trading platform

- Not available to US traders

Is Deriv.com Regulated?

Deriv is regulated by several offshore authorities, including the Malta Financial Services Authority (MFSA), the Vanuatu Financial Services Commission (VFSC), the British Virgin Islands Financial Services Commission (FSC) and the Labuan Financial Services Authority (LFSA).

We don’t consider these particularly reputable as they don’t enforce the same stringent measures as trusted bodies like the UK Financial Conduct Authority (FCA). With that said, most binary options brokers operate with limited regulatory oversight, due to the nature of the industry. Also, our researchers didn’t find any history of scams or security breaches and were pleased to see several safeguards in place:

- Segregated client accounts: Deriv maintains segregated client accounts, whereby customer funds are kept separate from the company’s operational funds. This means that, in the event of insolvency, client funds can be returned.

- Investor compensation scheme: Deriv is part of the Investor Compensation Scheme (ICS). In case of broker insolvency, the ICS may provide compensation to eligible clients.

- SSL encryption: Deriv uses Secure Sockets Layer (SSL) encryption technology to protect the confidentiality and integrity of traders’ personal information and financial data.

Live Accounts

Deriv offers one live account. This provides access to the broker’s full suite of trading products, including options, multipliers and CFDs.

The minimum deposit is low at $5, making it accessible to rookie traders. I also like that the broker supports popular base currencies (USD, EUR and GBP), making it easy for global traders to manage their accounts.

On the negative side, there are no account tiers which can be found at rivals like IQCent. While I don’t consider this a dealbreaker, it does mean traders with more capital won’t get perks for making larger deposits, such as higher payouts and faster withdrawals.

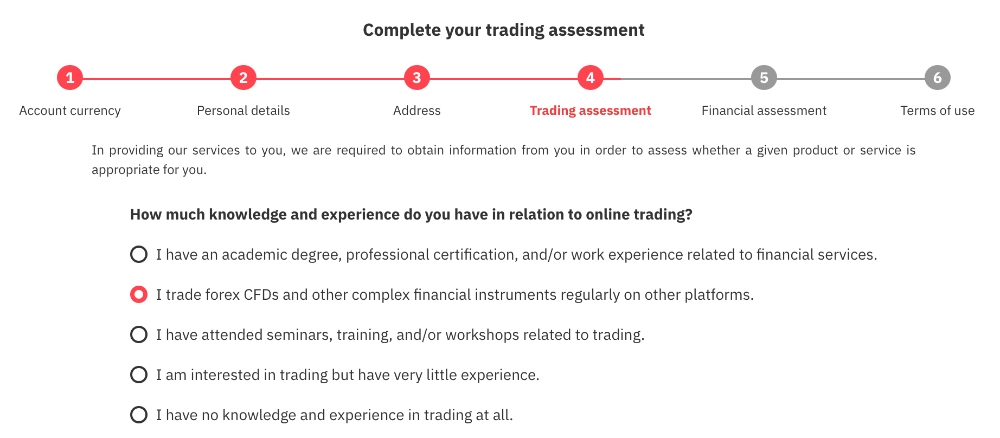

How To Open A Deriv Account

I found the sign-up process at Deriv smooth. It took me less than 10 minutes to register for an account following these steps:

- Fill in the registration form by choosing an account currency, submitting your personal details, and completing the trading and financial assessments

- Complete the verification process and submit supporting documents, such as identification and proof of address

- Deposit funds into your live account to start trading

Trading Fees

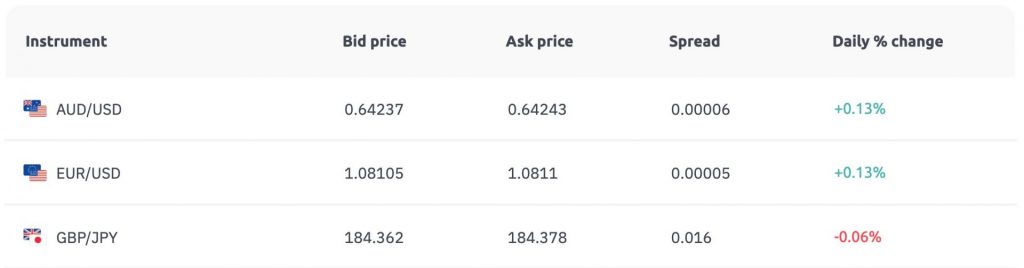

Trading fees at Deriv.com compare well to other brokers.

There is no fee when you trade binary options. Instead, Deriv generates revenue from losing contracts. We explain how these products work in more detail below.

Fees on other trading products are competitive. During testing, we got competitive floating spreads from 0.5 pips on the EUR/USD and 0.6 pips on the AUD/USD. This compares well to other commission-free trading accounts.

Non-Trading Fees

Our team is pleased to see there are no deposit or withdrawal fees.

However, there is a $25 inactivity fee for accounts that are unused for more than 12 months. While this may disappoint casual investors, it is common practice in the industry.

Payment Methods

Deriv stands out for its wide selection of fast and fee-free deposit and withdrawal methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies.

We unpack supported currencies, payment limits and processing timelines below.

| Payment Method | Supported Currencies | Min – Max Deposit | Min – Max Withdrawal | Deposit Speed | Withdrawal Speed |

|---|---|---|---|---|---|

| Visa | USD, EUR, GBP | 10 – 10,000 | 10 – 10,000 | Instant | 1 Working Day |

| Visa Electron | USD, EUR, GBP | 10 – 10,000 | 10 – 10,000 | Instant | 1 Working Day |

| Maestro | USD, EUR, GBP | 10 – 10,000 | 10 – 10,000 | Instant | 1 Working Day |

| Mastercard | USD, EUR, GBP | 10 – 10,000 | Not Available | Instant | Not Available |

| Skrill | USD, EUR, GBP | 10 – 10,000 | 10 – 10,000 | Instant | 1 Working Day |

| Neteller | USD, EUR, GBP | 10 – 10,000 | 10 – 10,000 | Instant | 1 Working Day |

| Jeton | EUR | 5 – 1,000 | 5 – 1,000 | Instant | 1 Working Day |

| EPS | USD, EUR, GBP | 25 – 100 | Not applicable | Instant | Not Available |

| Giropay | USD, EUR, GBP | 25 – 100 | Not Available | Instant | Not Available |

| Przelewy24 | USD, EUR, GBP | 25 – 100 | Not Available | Instant | Not Available |

| Rapid Transfer | USD, EUR, GBP | 25 – 100 | Not Available | Instant | Not Available |

Note the availability of payment methods may vary depending on your location.

How To Make A Deposit

The process to fund your Deriv account is straightforward:

- Log in to your Deriv account

- Click on the ‘Deposit’ button or go to the ‘Cashier’ section of the platform

- Choose the preferred payment method from the list of options

- Enter the deposit amount you wish to transfer

- Provide any additional information or details required for the selected payment method. This may include entering your card details, selecting the e-wallet account, or providing a wallet address for cryptocurrencies

- Once the deposit is processed and confirmed, the funds will be credited to your Deriv trading account

- You can verify the deposit by checking your account balance or transaction history within the Deriv platform

Binary Options

Deriv’s digital options will appeal to investors looking for an easy-to-understand trading product. Digital options are available 24/7 with payouts up to 50,000 USD.

While there are several contract variations, the general premise is that you speculate whether the value of an underlying asset, such as the EUR/USD, will rise or fall over a specified timeframe. If your prediction is correct you will win a pre-determined payout. If your prediction is incorrect, you will lose your stake.

- Up/Down: Deriv’s two basic digital options ask traders to predict whether the price will increase or decrease by contract expiry (Rise/Fall) or end above or below a specified price target (Higher/Lower)

- In/Out: Two ‘range’ digital options allow traders to speculate whether an asset’s price will stay within a specified range

- Matches/Differs: Traders can use this contract to profit from predictions about what the last digit of the last tick of a contract will be

- Even/Odd: Bet on whether the last tick of a contract will be odd or even

- Over/Under: Bet on whether the last digit of the last tick of a contract will be higher or lower than a specific number

- Reset Call/Reset Put: Predict whether a contract’s exit spot will end up higher or lower than the entry spot or the spot at a reset time

- High/Low Ticks: Predict which of a series of five ticks will be highest or lowest

- Touch/No Touch: Predict whether or not an asset’s price will touch a price target at any time during the contract

- Asians: Predict whether the last tick of a digital option will be higher or lower than the average of all ticks throughout the contract

- Only Ups/Only Downs: Predict whether the price of an asset will continually rise or fall over consecutive ticks

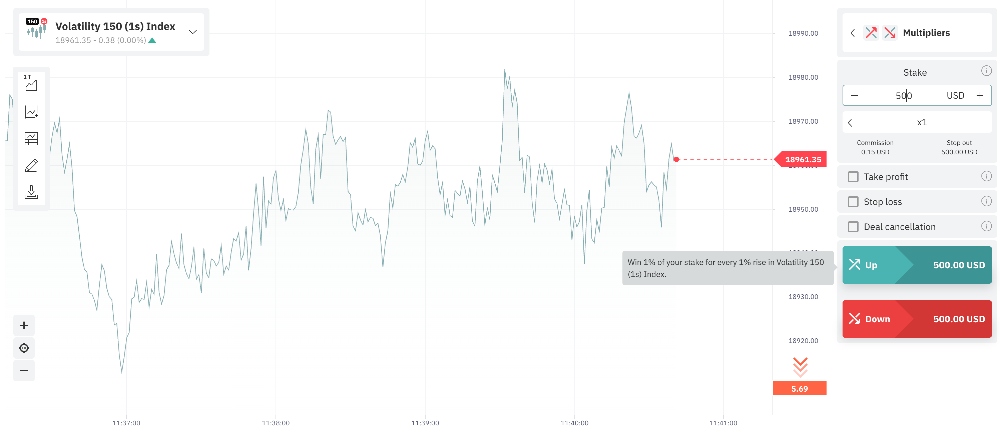

Multipliers

Deriv’s multipliers provide a way of placing leveraged trades without the risk of losing more than your outlay.

In essence, a multiplier contract works in the same way as a CFD but with an in-built stop loss that prevents losses from exceeding your initial stake.

So, if you open a $50 multiplier contract on the EUR/USD pair with 1:500 leverage, and the Euro’s value suddenly crashes, you will only lose the $50 you put down.

Forex Assets

Deriv offers a decent selection of currency pairs for CFD and binary options traders.

When we evaluated the broker, there were 28 forex assets, including EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CNY and ASD/CHF, plus crosses and minors with MEX, SEK, ZAR and POL.

A smaller list of 14 currency pairs is available to trade as multipliers, with majors and crosses but no minors.

While some alternatives like Pocket Option (50+) offer more currency pairs, we think there is enough market coverage to satisfy most aspiring forex traders. The choice of derivative products will also serve different trading styles.

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

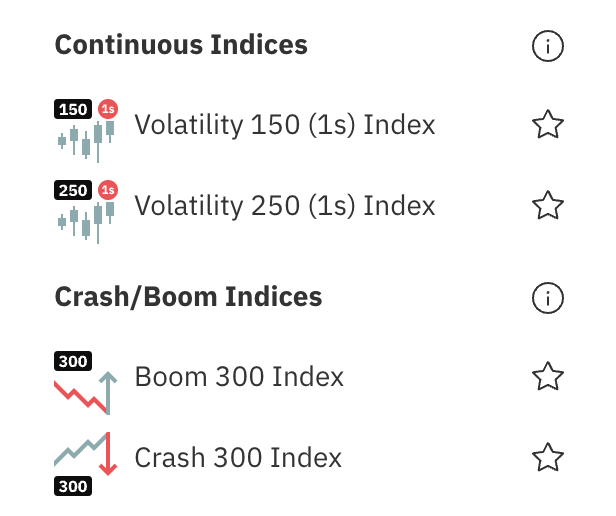

A key benefit of trading at Deriv.com for us is the excellent range of additional markets. As well as more cryptos than most alternatives, the broker leads the industry when it comes to synthetic indices, which are available 24/7 and simulate real market conditions.

- Stocks & Indices: Major indices including the S&P 500, Dow Jones 30, Nasdaq 100, FTSE 100 and Hang Seng 50

- Cryptocurrencies: 31 popular digital currencies including Bitcoin, Ethereum, Litecoin and Ripple

- Commodities: Energies and metals including gold, silver, crude oil, natural gas, copper and platinum

- Derived: Trade prices from real-world simulated markets, with derived indices and forex baskets

Execution

Deriv is a Straight-Through Processing (STP) broker. This means you get access to the interbank forex market and liquidity providers, facilitating tight spreads and fast execution.

The broker offers several execution modes on its platforms:

- Instant Execution: Our trades are executed at the price displayed on the trading platform. This allows us to enter positions quickly and at the current market price without delays or re-quotes.

- Market Execution: Our trades are executed at the best available market price, which may differ from the price displayed when we place the order. Market execution is often used in highly liquid markets.

- Pending Order Execution: A pending order allows us to set a specific price level at which we want to enter the market. There are different types of pending orders available, such as buy limit, sell limit, buy stop, and sell stop. Once the market reaches the specified price level, the pending order is triggered and executed.

Leverage

Deriv offers high leverage up to 1:1000, which is more than many alternatives. But while this can help increase profits, it can also lead to large losses so we recommend that beginners in particular use risk management tools.

It is also worth noting that leverage available may vary depending on your location and regulatory requirements.

Platforms & Apps

Deriv excels when it comes to the variety of apps and platforms available. The broker offers several solutions for CFD and binary options trading, with many rivals offering a single web-based platform.

DMT5

Deriv MetaTrader 5 (DMT5) is a powerful platform for trading CFDs.

I have been impressed with the extensive range of charting features, analytical tools, and customizable templates. I also find the automated trading capabilities a step above the tools available at many alternatives.

DTrader

DTrader is a proprietary web-based platform developed by Deriv.

After testing the solution, I recommend this for traders seeking an easy-to-use interface. It has a clean look and feel with a straightforward widget on the right where you can place orders.

I also rate that you can download your layouts and analysis for offline use.

DBot

DBot is an innovative platform that helps you automate trading strategies.

What stands out for me is the straightforward drag-and-drop functionality, which means you can create and deploy trading bots without coding knowledge.

Mobile App

Deriv also offers mobile applications for iOS and Android devices, providing traders with convenient access to their accounts and the ability to trade on the go.

For me, it’s important that the Deriv app provides essential functions such as real-time price quotes, interactive charts, account management features, order placement and execution, trade history, and account balance information.

I also like that you can set up price alerts and notifications to stay updated with market movements and trading opportunities.

Forex Tools

Many of Deriv’s forex tools come pre-packaged within the MT5 platform. This includes trading signals and Expert Advisors (EAs).

However, I do like the variety of trading calculators available, including margin calculators, swap calculators, and pip calculators. These are useful for planning trades and understanding costs before you open positions.

On the negative side, the broker trails alternatives when it comes to copy trading, with no solution provided. There is also no VPS for serious forex traders.

Forex Research

I have been disappointed by the market research available.

While there are some analyst reports and market news, they don’t stack up to many competitors. They also aren’t updated frequently enough to be of real value for seasoned traders.

Forex Education

Deriv scores better in terms of education. Traders can access training materials via articles and videos.

After reviewing the content, there are some useful resources, particularly for beginners looking to learn basic trading strategies and understand what influences key currency pairs.

On the negative side, the educational resources don’t match the depth and quality of tools at alternatives like eToro.

Demo Account

Deriv offers a free demo account so you can familiarize yourself with the platform’s features and trading environment.

I am particularly pleased that Deriv’s demo account does not have a time limit, so I can keep testing new ideas in a risk-free environment.

How To Open A Demo Account

- If you already have a Deriv account, log in using your credentials. If you are a new user, click on the ‘Sign up’ or ‘Create an Account’ button

- Select the demo account option during the registration process

- Fill in your name, email address and preferred password

- After submitting the registration form, you may need to verify your email address by clicking on the link sent to your registered email

- After verification, sign in to your Deriv account and look for the demo account option on the trading platform or dashboard

Bonus Offers

Deriv does not offer any welcome bonuses, unlike many binary options brokers.

However, we don’t view this as a serious drawback – financial incentives can encourage bad trading habits and are prohibited by many regulators.

Trading Restrictions

Whilst we did not experience any strategy restrictions while using Deriv, we did note the maximum daily turnover limits which cap the volume of contracts that you can purchase on any given day.

Your account’s trading limits can be viewed in your account settings.

Customer Service

Deriv offers multilingual customer support to assist traders 24/7 via live chat, WhatsApp or the community forum. The broker is also active on several social media platforms.

Importantly, our team have been impressed with the customer service provided. We tested the live chat function several times and received helpful responses within 5 minutes each time.

Our only minor complaint is that there is no telephone or email support.

Company Details

Deriv, formerly Binary.com, was founded in 1999 by Jean-Yves Sireau. It started as a platform for binary options trading, eventually expanding its product portfolio to include CFDs on forex, commodities, cryptocurrencies, and more.

In 2020, the company rebranded itself as Deriv to better reflect its commitment to offering a broader range of trading options to its clients. Over 2.5 million traders have signed up with the brokerage.

The broker operates multiple offices across Europe, Malaysia, the Middle East, Africa and South America and boasts a large global presence, with more than 1,000 employees of over 50+ nationalities in 16 countries.

Trading Hours

Since Deriv offers synthetic assets and crypto, clients can trade 24/7 every day of the year, regardless of holidays.

Trading hours of other assets depend on the market, with important market hours listed below.

- Forex: Sunday 9:05 pm – Friday 8:55 pm (GMT)

- Stocks and indices: Monday to Friday 7:00 am – 3:30 pm (GMT)

Who Is Deriv.com Best For?

Deriv is an excellent choice for traders of all levels due to its diverse range of trading instruments, user-friendly platforms, and flexible trading products.

It is very unusual to find a broker that offers binary options, multipliers and synthetic indices alongside CFDs, and we think this unique product portfolio is a significant strong point for this broker.

The broker is also well-positioned to meet the needs of beginners with an easy-to-learn web platform, low starting deposit, and free demo account.

FAQ

Is Deriv Legit Or A Scam?

Deriv is a legitimate broker with millions of registered clients. The broker is licensed in multiple jurisdictions and our team did not find evidence that Deriv is running a scam.

Can I Trust Deriv?

Deriv is an offshore firm and therefore has a lower trust score than traditional forex brokers.

With that said, Deriv has established itself as a credible broker with unique products and a competitive environment for trading binary options.

Is Deriv A Regulated Forex Broker?

Deriv is regulated by the Malta Financial Services Authority (MFSA), Vanuatu Financial Services Commission (VFSC), British Virgin Islands Financial Services Commission (FSC) and Labuan Financial Services Authority (LFSA).

Is Deriv A Good Or Bad Forex Broker?

We consider Deriv a good forex broker. It offers an almost unrivalled selection of trading products with binaries, multipliers and CFDs, an excellent trading platform, and a wide range of payment methods.

While the broker’s education and research trail some alternatives and there is no copy trading platform, these are minor complaints.

Is Deriv Good For Beginners?

Deriv is well-suited to beginners. It offers an unlimited demo account, a $5 minimum deposit, and an intuitive web platform.

Does Deriv Offer Low Forex Trading Fees?

Deriv offers competitive forex trading fees. There are no commissions on forex CFDs with tight spreads that came in at 0.5 pips on the EUR/USD during testing.

For binaries, the broker makes its money through losing contracts and therefore does not charge any direct fees.

Does Deriv Have A Forex App?

Yes, Deriv has a dedicated mobile app that allows traders to access their accounts and trade forex on the go.

The mobile app is available for both Android and iOS devices and offers many of the same features found in the desktop applications.

How Long Do Withdrawals Take At Deriv?

Generally, withdrawals are processed within one working day, which is competitive. However, the actual time for funds to reflect in your account often depends on the specific payment provider.

Can You Make Money Trading Forex With Deriv?

Deriv offers high payouts up to $50,000 on its digital options. Fees are also competitive on forex CFDs while the platforms and tools are reliable.

Still, most retail traders lose money so make sure you adopt suitable risk management practices, such as stop-loss orders.

Article Sources

Deriv (BVI) Ltd BVIFSC License