Best FCA-Regulated Forex Brokers

Explore our list of the top forex brokers regulated by the UK’s Financial Conduct Authority (FCA). We rank the best forex platforms for different trading styles and needs. We also explain why UK traders should choose an FCA-regulated forex broker for their trading activities.

List of Best FCA Forex Brokers

These are the 5 best FCA-regulated forex brokers based on our in-depth reviews:

- Pepperstone: Best Overall FCA Forex Broker

- eToro: Best For Beginners

- XTB: Best Forex Trading App

- CMC Markets: Best Forex Investment Offering

- Eightcap: Best For Algo Trading

| Pepperstone | eToro | XTB | CMC Markets | Eightcap | |

|---|---|---|---|---|---|

| FCA-Regulated | Yes | Yes | Yes | Yes | Yes |

| Firm Reference Number (FRN) | 684312 | 583263 | 522157 | 173730 | 921296 |

| Minimum Deposit | $0 | $50 | $0 | $0 | $100 |

Pepperstone: Best Overall FCA Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, JPY, CHF

-

🛠 PlatformsMT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.2 -

# Assets60+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend Pepperstone

Having thoroughly tested its trading services, we found Pepperstone to be a comprehensive solution for forex traders at every level.

It offers an excellent selection of industry-leading platforms for aspiring investors and a large product portfolio and Active Trader program for high-volume traders. Throw in some of the lowest fees in the game, and you have our top all-round FCA-regulated forex broker.

Pros/Cons Of Pepperstone

Pros

Trusted forex broker with excellent reputation and FCA authorisation

Having explored various platforms, we understand the importance of choosing a reliable forex broker. Pepperstone, with its FCA authorisation and a stellar reputation serving over 400,000 clients, ticks all the boxes for trustworthiness.

What adds to Pepperstone’s credibility is its authorisation from respected bodies like the ASIC and CySEC. It’s not just about the FCA; it’s a testament to a forex broker that adheres to high standards across multiple jurisdictions.

High-quality forex trading tools serving different traders

Pepperstone’s suite of trading tools separates it from the crowd. Whether you’re comfortable with MetaTrader (MT4 and MT5), prefer cTrader for day trading, or seek top-tier charting with TradingView – Pepperstone caters to all trading styles.

For copy traders, there is also DupliTrade and support for PAMM (Percentage Allocation Management Module) accounts, allowing traders to invest in the strategies of experienced traders.

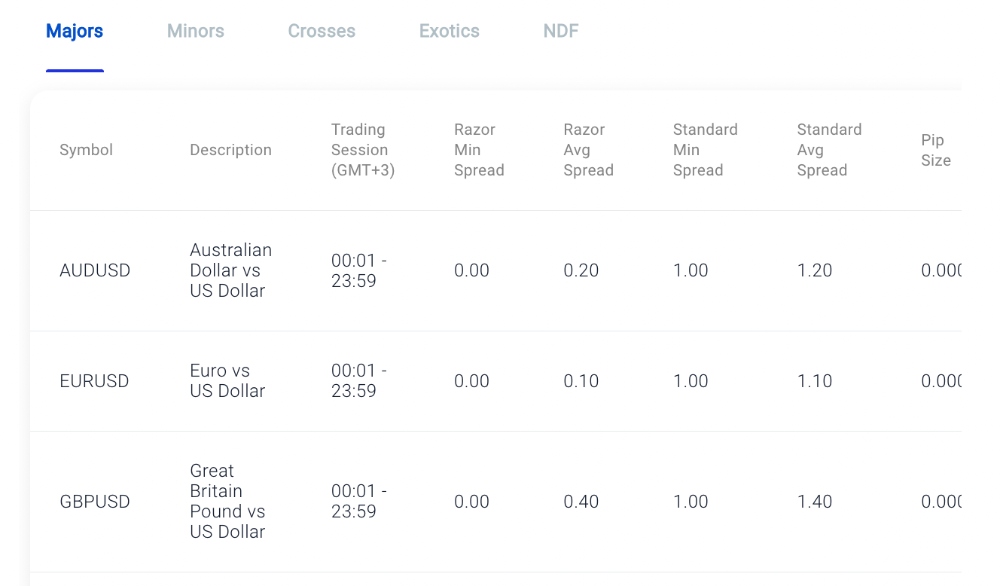

Low trading and non-trading fees

We’ve examined Pepperstone’s fee structure, and it ranks highly. With spreads as low as 0.0 pips on major currency pairs and an Active Trader program providing up to 30% spread discounts based on trading volumes, Pepperstone excels in affordability.

Low non-trading fees, including no inactivity fees and free deposits/withdrawals, further position it as one of the most cost-effective FCA-regulated brokers.

Cons

No proprietary mobile trading app

In our tests, we noted the absence of a proprietary mobile app. While Pepperstone provides reliable third-party apps like MT4, MT5, cTrader, and TradingView, we consider an in-house application one of the key ways forex brokers can separate themselves.

Slow sign-up process for new traders

Our experience navigating Pepperstone’s sign-up process revealed a noteworthy hurdle. It took us close to 30 minutes to complete all the required steps, including employment, finance, and experience details, along with an appropriateness test.

In comparison, alternatives like CMC Markets, offer a faster onboarding experience – taking us less than 10 minutes.

Why Is Pepperstone Better Than The Competition?

Our comprehensive analysis reveals a broker that effectively combines essential elements for forex traders. It’s not just about access to top-tier platforms or low fees; it’s the integration of copy trading and automated services, all regulated by the FCA, that makes Pepperstone stand out.

Who Should Choose Pepperstone?

Pepperstone isn’t tailored for a specific niche; it caters to a wide spectrum of forex traders. Whether you’re a seasoned trader seeking powerful software, reliable execution, and fee rebates, or a novice looking to copy trade, Pepperstone has something for everyone.

Who Should Avoid Pepperstone?

While Pepperstone offers numerous advantages, we acknowledge that some beginners may find its sophisticated third-party software a bit challenging. For those seeking a simpler interface, platforms like eToro might be more suitable.

eToro: Best For Beginners

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD

-

🛠 PlatformsTradingCentral

-

⇔ Spread

GBPUSD: 2 pips EURUSD: 1.5 pips GBPEUR: 1.5 pips -

# Assets49

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer-

Why We Recommend eToro

eToro has earned our recommendation as a leading forex broker, standing out with a substantial user base of over 30 million traders, a transparent pricing structure, and exceptional resources tailored for those new to trading.

Our evaluation into what makes eToro the best FCA-regulated forex broker for beginners has been a first-hand journey, and below, we unpack the factors that make eToro our top pick.

Pros & Cons of eToro

Pros

Strong oversight from trusted regulators including the FCA

eToro’s regulatory oversight by trusted authorities like the FCA, ASIC, CySEC, and the MFSA is a significant advantage. Our confidence in recommending eToro stems from its adherence to high regulatory standards, ensuring a secure trading environment.

Our research also uncovered no reports of security breaches or scams, further reinforcing eToro’s credibility.

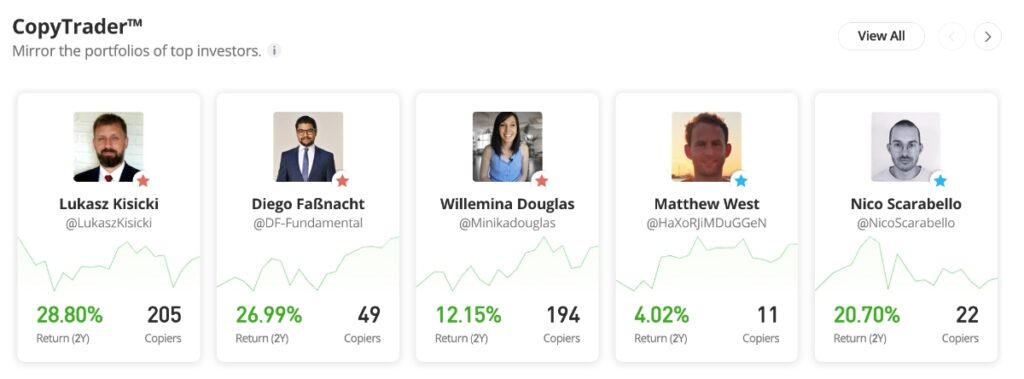

Forex copy trading platform with social investing feed

eToro is best known for its social trading platform and we are huge fans of this feature. We have found it an excellent way for forex traders to share market insights, analysis, and strategies with the community and learn from each other.

The copy trading element, in particular, is best-in-class, offering ease of use and a diverse range of strategy providers with clear metrics aligning with individual trading goals.

Transparent pricing structure with no hidden fees

We like that eToro is up-front about fees, most of which are competitive with no charges for deposits and copy trading. Withdrawals must be a minimum of $30 and cost $5 – although traders with high amounts deposited get discounted rates.

eToro’s spreads, starting from 1.0 pip for forex pairs and 1.5 pips for GBP/EUR, may not be the tightest but remain affordable. The commission-free model is also a draw for beginners.

Cons

Withdrawal fees and no GBP deposits

A drawback for British traders is eToro’s base currency being USD. This results in inconvenience and conversion fees for managing accounts and trading activity in GBP.

The $5 withdrawal charge, while not uncommon, is also a point of disappointment, especially considering most of our other shortlisted forex brokers have no withdrawal fees and GBP support.

Limited support for high-volume forex traders

We think eToro’s pricing structure and platform are great for newer or less frequent traders as there are zero commissions and the platform is easy to use. However, experienced traders are likely to be frustrated by the average spreads and the lack of support for algo trading tools like expert advisors.

Why Is eToro Better Than The Competition?

eToro stands out because of its stellar reputation, huge client base and market-leading social investing tools.

Who Choose eToro?

We think eToro shines for beginners. The platform’s user-friendly interface makes it easier for newcomers to navigate the world of forex trading.

Moreover, eToro’s copy trading feature excels as a valuable tool for hands-off investors.

Who Should Avoid eToro?

While eToro offers a wealth of advantages, it’s important to recognize its limitations. Traders aiming for high-tempo strategies like forex scalping may find eToro’s account setup and basic platform less suited to their needs.

UK traders looking to manage their account in GBP should also choose another forex broker from our list.

XTB: Best Forex Trading App

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: 0.1 EURUSD: 0.2 GBPEUR: 0.1 -

# Assets45+

-

🪙 Minimum Deposit$0

-

🫴 Bonus OfferNo

Why We Recommend XTB

Today more than ever, traders need to be able to access markets while on the move, and we think XTB’s app makes it the best FCA-regulated forex broker for traders who make this a priority.

Learn why XTB is our top FCA forex broker for mobile trading.

Pros & Cons Of XTB

Pros

Excellent xStation platform optimized for mobile trading

XTB’s proprietary xStation is a standout platform among the multitude we encountered in our review of FCA-regulated forex brokers. Packed with features, including 45+ indicators and essential forex tools, it offers a comprehensive trading experience.

The forex app, in particular, impresses us, matching the power and ease of use found in the full version. Recognizing the growing interest in mobile app performance, XTB’s mobile platform is a significant plus.

Fair pricing with low spreads available

We rate XTB’s pricing structure as one of the fairest on the market. Non-trading fees are low with deposits typically free, with the exception of Paysafecard, which incurs a 2% fee.

The €10 inactivity fee also doesn’t apply until a year of no trading – much longer than the 3-6 months we typically see at forex brokers.

Trading fees are also competitive, with forex spreads starting from 0.8 pips on the EUR/USD, surpassing alternatives like eToro (1.0 pip).

Top-rate educational resources

XTB’s free training videos and tutorials include a good range of valuable content for forex traders looking to enhance their skills and knowledge.

We like that the educational content is organised intuitively by subject and we especially appreciate the range of free e-books for XTB clients as they cover both essential and advanced forex trading topics.

Cons

The single account type limits its appeal for specialized strategies

XTB’s limitation to a standard, commission-free account may deter active day traders seeking the tightest spreads offered by ECN forex brokers.

The absence of varied account types limits its appeal for traders with specialized strategies.

No third-party platform support

We enjoy using XTB’s xStation platform, but forex traders who are familiar with popular platforms like MetaTrader 4 or cTrader will be disappointed not to have these options in the UK.

Ultimately, if you don’t gel with the xStation software, there is no alternative.

Why Is XTB Better Than The Competition?

XTB’s xStation app stands out from the crowd. Available on iOS and Android devices, its clean design, intuitive navigation, and integrated features, including training videos, make it one of the best we’ve used.

The simplicity for beginners and powerful tools for seasoned investors contribute to XTB’s appeal.

Who Should Consider XTB?

For forex traders seeking the smoothest mobile trading experience, XTB is a top choice. The app is best-in-class with easy-to-learn features for beginners and powerful charting and analysis tools for seasoned investors.

Who Should Avoid XTB?

Traders who have a strong preference for a well-known platform like MT4 or cTrader will not find what they are looking for at XTB.

XTB also isn’t best for serious day traders with no specialized ECN account offering raw spreads.

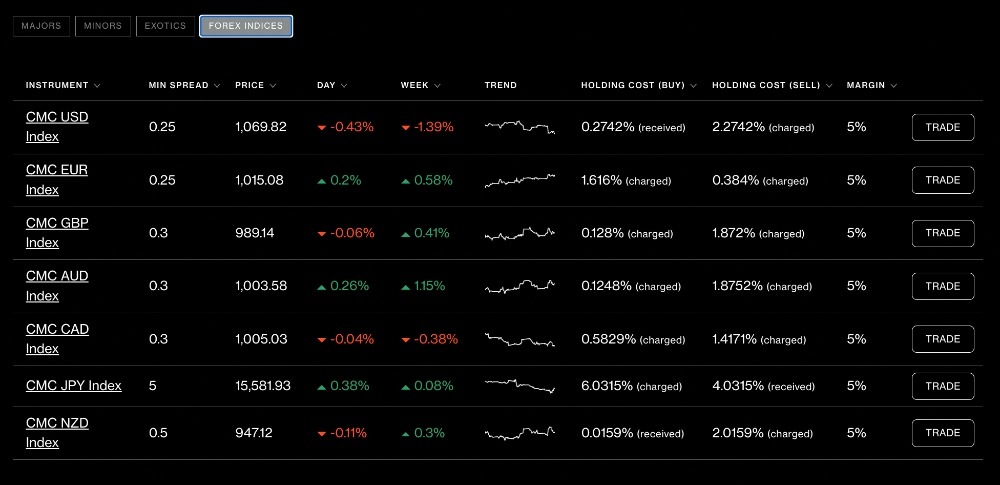

CMC Markets: Best Forex Investment Offering

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, SEK, PLN

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.7 GBPEUR: 1.1 -

# Assets330+

-

🪙 Minimum Deposit$0

-

🫴 Bonus Offer-

Why We Recommend CMC Markets

We think CMC Markets is worth your time as it is a trusted, FCA-regulated forex broker. We especially like this broker’s range of forex assets, which is second to none.

We unpack the reasons CMC Markets makes our shortlist below.

Pros & Cons Of CMC Markets

Pros

Multi-regulated, trusted forex broker

CMC Markets is a respected FCA forex broker in its own right, but we feel that its licences with other reputable financial regulators really boost the brand’s credibility. Besides the FCA, it is regulated by the ASIC, MAS , and CIRO.

Trade thousands of markets including 330+ currency pairs

With over 12,000 CFDs covering a huge range of markets including more than 330 currency assets, this tops any FCA-regulated forex broker we have reviewed.

The selection of volatile exotics is particularly strong, providing opportunities to speculate on the currencies of emerging economies.

We have also been impressed with the suite of currency indices, offering diversified exposure to popular currencies, including the GBP. These products are only available at a select few brokers.

FX Active account offers excellent trading conditions

We scrutinised the trading accounts at CMC Markets and recommend FX Active for serious traders. Spreads start from 0.0 pips on six majors with a competitive commission. Traders also get a 25% spread discount over the Standard account on more than 300 currency pairs.

With access to both MetaTrader 4 and the broker’s in-house platform, it’s a great option for forex traders.

Cons

Narrow range of payment methods

Although we rate the near-instant deposit speeds, CMC Markets offers a limited choice of payment solutions with bank cards, wire transfers and PayPal. There is no support for popular e-wallets like Skrill, Neteller and Sofort.

As a comparison, XTB offers over 10 popular payment methods.

No 24/7 customer support

While customer support response times are fast based on our tests (typically less than 30 minutes via email), the customer service team are only open during the week, while many rivals offer weekend support.

Fortunately, this is a minor complaint as CMC Markets is available during key forex trading sessions.

Why Is CMC Markets Better Than The Competition?

CMC Markets is unrivalled in its forex investment offering, with over 300 forex pairs and 6 currency indices. This is more than every other FCA-regulated forex broker we have tested.

Who Should Consider CMC Markets?

CMC Markets caters to a wide range of traders, but especially those looking for a diverse selection of assets and volatile currency pairs.

Its FX Active account also makes it a great pick for serious traders looking for low costs in return for high volumes.

Who Should Avoid CMC Markets?

We think beginner traders looking for a simple account system might prefer the streamlined account structure offered by a forex broker like eToro.

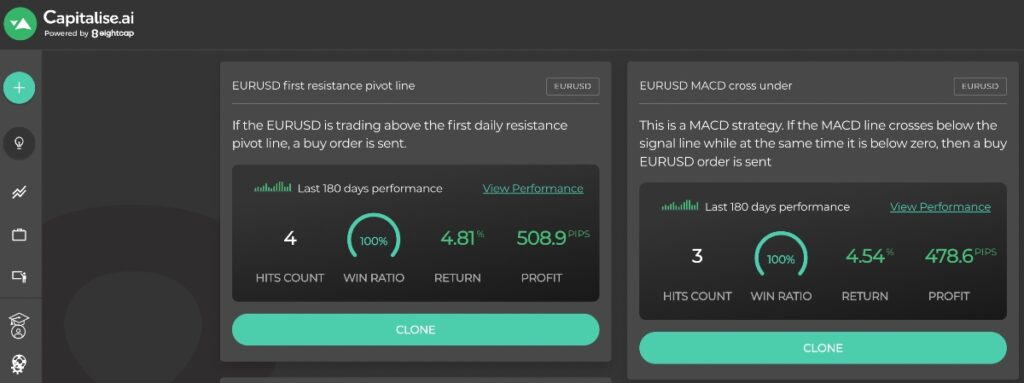

Eightcap: Best For Algo Trading

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, NZD, SGD

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets50+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Why We Recommend Eightcap

We recommend Eightcap because it offers top-tier algo trading tools, especially the Capitalise.ai platform which allows traders to build automated trading solutions with no coding experience.

We explain why we chose Eightcap as one of the best FCA-regulated forex brokers below.

Pros/Cons Of Eightcap

Pros

Build algo trading strategies using plain English

We have been very impressed with Eightcap’s Capitalise.ai platform, which makes it straightforward to create automated trading solutions with no coding background.

We found that you can develop, test and deploy bots based on a variety of fundamental factors and technical indicators, using everyday English.

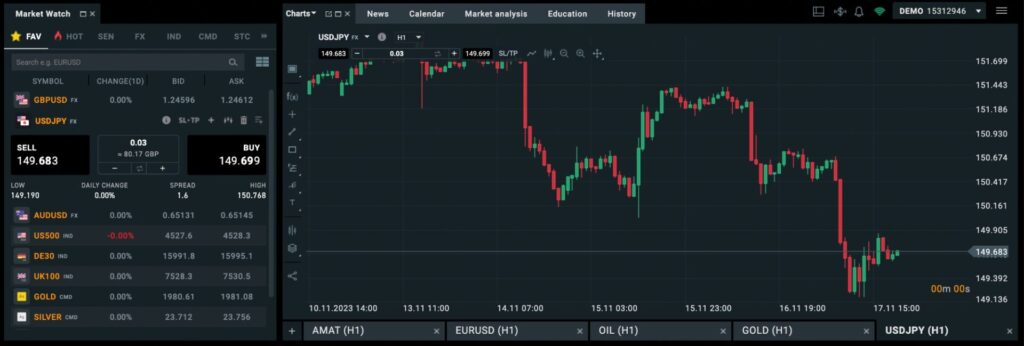

Access to TradingView software and Pine Script coding language

Eightcap supports the powerful trading platform – TradingView, which is home to one of the largest social trading communities.

The charting package we have also been impressed with, boasting over 100 technical indicators, 12 charting types and custom timeframes, outgunning rivals like MT4.

Importantly, it can also be used for algo trading – clients can automate setups in the public library using the Pine Script programming language.

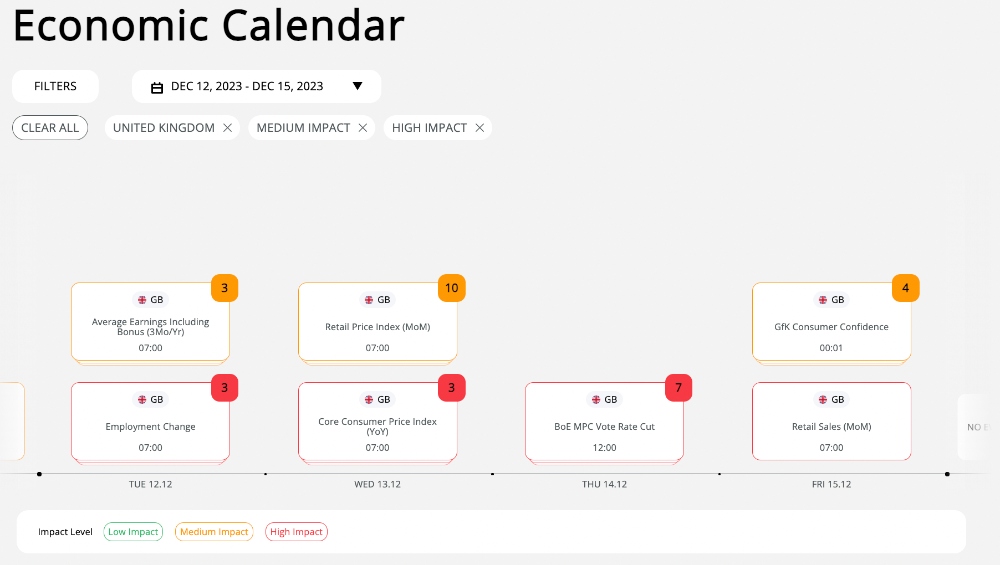

AI-powered tools to help generate trading ideas

The other feature we highly rated while using Eightcap is the AI-enabled economic calendar from Acuity. As well as a more intuitive display than the standard economic calendars we see at forex brokers, it offers additional insights that can help spark trading ideas.

For example, it gives you an indication as to how the market may respond to an event, how large that response might be and how quickly the market might respond.

Cons

No forex copy trading platform

While Eightcap offers some good tools to support trading ideas (TradingView network and Acuity calendar), it lacks a copy trading platform, which we increasingly see at leading forex brokers.

This is a shame as this type of feature would make the broker a strong all-rounder, with specialist tools for aspiring investors.

The demo account expires after 30 days

While not a major complaint, we discovered that the Eightcap demo account expires after 30 days.

We favour forex brokers, such as CMC Markets, with unlimited demo modes, as they allow traders to continuously test and refine strategies in a risk-free setting throughout their trading journey.

Why Is Eightcap Better Than The Competition?

Eightcap excels for its beginner-friendly algo trading tools in Capitalise.ai, which is only available at a handful of forex brokers, even fewer of which are regulated by the FCA.

Who Should Consider Eightcap?

Our review shows that Eightcap is best for investors looking to build algo trading strategies without coding requirements in a secure, FCA-regulated trading environment.

Who Should Avoid Eightcap?

Traders looking for the best forex demo account should avoid Eightcap – there are restrictions, including the availability period.

Users looking to mirror the trades of other forex investors should also choose a different broker like eToro. While Eightcap provides access to a social investment network in TradingView, you cannot replicate strategies at a click.

Why UK Traders Should Choose an FCA-Regulated Forex Broker

Security of Funds

Choosing an FCA-regulated broker protects your funds through client fund segregation and the Financial Services Compensation Scheme (FSCS). In case of a broker’s insolvency or financial difficulties, these measures help safeguard your funds.

Fair Trading Practices

FCA-regulated forex brokers must adhere to strict guidelines that promote fair trading practices. They must provide accurate pricing, execute orders promptly, and maintain a transparent trading environment.

They are also required to limit leverage to 1:30 on major forex pairs and 1:20 on minor forex pairs, plus provide negative balance protection to retail investors. These measures help limit the size of losses that you can accumulate while trading on margin.

Dispute Resolution

You can also access the Financial Ombudsman Service (FOS) for dispute resolution when trading with an FCA-regulated broker. This can be invaluable in resolving any issues between you and your forex brokerage.

Reputation and Trust

FCA-regulated brokers are widely regarded as trustworthy and reliable due to the stringent regulatory environment in which they operate. By choosing a forex broker regulated by the FCA, you can trade confidently, knowing that your brokerage is held to a high standard of accountability and oversight.

Review Methodology

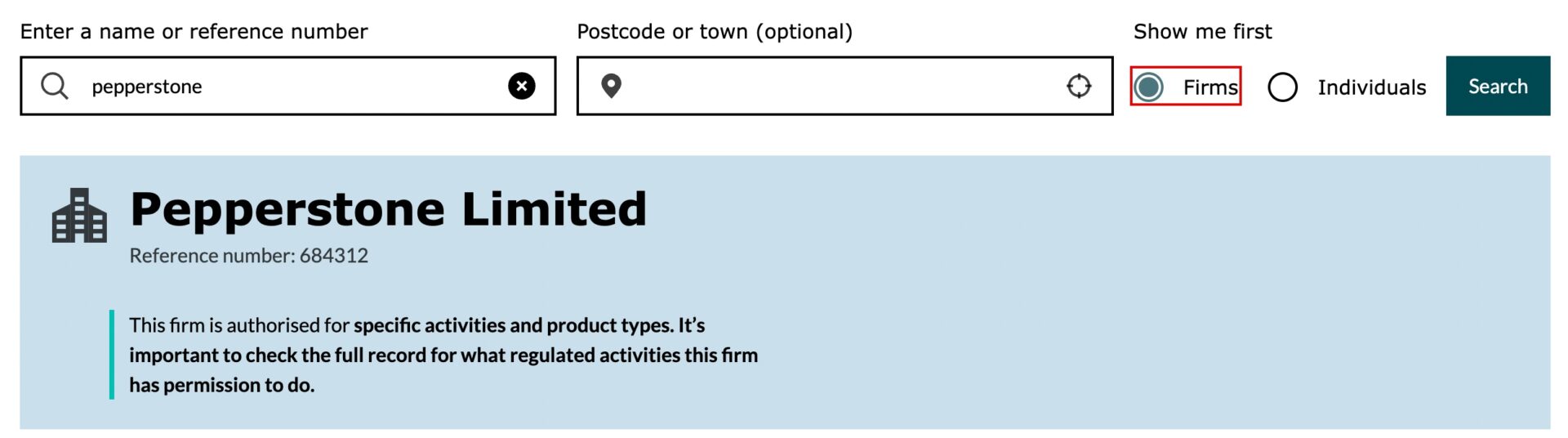

To find the top UK-regulated forex brokers, our first step was to verify the firm’s licence was valid on the FCA’s Financial Services Register.

We then compared how shortlisted brokers stood up in several key categories: Fees (balancing low fees with the quality of tools and products), investment offerings (favouring firms with a wide range of currency pairs), accounts (considering the entry requirements and availability of specialized accounts for different trading styles), trading platforms (testing software for usability and features).

This allowed us to identify the 5 top forex brokers regulated by the FCA as well as consider which type of trader they are best for.

FAQ

Do Forex Brokers Accepting UK Clients Have To Be Regulated By The FCA?

Yes, forex brokers offering their services to UK-based clients must be authorized and regulated by the FCA.

How Can You Check Whether A Forex Broker Is Regulated By The FCA?

All FCA-regulated forex brokers have a firm registration number (FRN) that can be checked against the financial services register on the FCA website. Simply input the firm’s name or licence number (usually visible at the bottom of a broker’s website) in the search bar and check that its licence is valid.

How Does The FCA Protect Forex Traders?

The FCA establishes rules and guidelines that forex brokers must follow to maintain a fair and transparent trading environment. These rules cover various aspects of a broker’s operations, such as capital requirements, risk management, client funds segregation, and disclosure of information.

The FCA actively monitors compliance with these rules and takes enforcement actions against brokers found to be in breach of regulations. Enforcement actions can include fines, license suspension, or even license revocation.

How Much Leverage Can FCA-Regulated Brokers Offer For Forex?

The maximum leverage available from FCA brokers is 1:30 on major forex pairs and 1:20 on minor forex pairs. These limits apply to retail traders – elective professionals can access higher leverage, typically 1:500.