FxPro

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN

-

🛠 PlatformsMT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade

-

⇔ Spread

GBPUSD: 2.39 pips (Ave) EURUSD: 1.58 pips (Ave) GBPEUR: 1.74 pips (Ave) -

# Assets70+

-

🪙 Minimum Deposit$100

-

🫴 Bonus Offer-

Our Opinion On FxPro

FxPro is a leading forex broker with 70+ currency pairs and ultra-fast execution speeds. We like the choice of reliable trading software, including MetaTrader, cTrader and the FxPro App. Another bonus for our experts is the strong oversight from reputable regulators. Our only major criticism is the fairly high fees on some instruments. Overall though, FxPro is an excellent choice for online forex traders.

Summary

- Instruments: 2100+ including forex, stocks, indices, metals, energies, futures, and spread betting

- Live Accounts: MT4 Instant & MT4 Fixed, FxPro MT4, MT5, cTrader, FxPro Edge, Islamic, and Corporate

- Platforms & Apps: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and FxPro App

- Deposit Options: Bank cards, wire transfers, and e-wallets

- Demo Account: Yes

Pros & Cons

- Safe forex broker with licenses from FCA, CySEC, FSCA and SCB

- Excellent reputation with 2M+ accounts in 170+ countries

- Straightforward account opening process

- User-friendly trading platforms and apps

- Choice of fixed and variable spreads

- Multilingual support available 24/5

- < 13 ms execution speeds

- 100+ industry awards

- Relatively high fees on some CFD instruments

- Spread betting is only available in the UK

- Limited bonuses and promotions

- Traders from USA not accepted

- No copy trading

Is FxPro Regulated?

We are pleased to see that FxPro is heavily regulated in the various countries where it has a presence. This makes the brand an attractive option for traders looking for a secure and reliable forex broker.

FxPro is essentially split into four entities, each of which is authorized by a relevant regulator. This includes the global, Bahamas-registered subsidiary which offers higher leverage up to 1:200 due to more relaxed regulatory requirements.

Regulation details:

- FxPro UK Ltd – Authorized by the UK Financial Conduct Authority (FCA), license number 509956

- FxPro Global Markets Limited – Authorized by the Securities Commission of the Bahamas (SCB), license number SIA-F184

- FxPro Financial Services Ltd – Authorized by the Cyprus Securities and Exchange Commission (CySEC), license number 078/07

- FxPro Financial Services Limited – Authorized by the South African Financial Sector Conduct Authority (FSCA), license number 45052

Retail customers of FxPro are covered by safety measures that we rate highly, including negative balance protection and funds held in segregated accounts with top-tier institutions.

It is also reassuring to see that FxPro UK Limited is a member of the Financial Services Compensation Scheme (FSCS) and that FxPro Financial Services Limited is a member of the Investor Compensation Fund (ICF), meaning traders covered by these services can claim monetary reimbursement in the case of business failure.

Importantly, our experts found no reports that FxPro has been involved in historical scams, fraud, or major security breaches. This is backed up by the limited number of customer complaints concerning withdrawal problems or safety issues online.

Forex Accounts

We like the straightforward account structure at FxPro, which varies according to the trader’s chosen platform and pricing model. This makes it easy to sign up and start trading forex and CFDs on your preferred trading software.

The main differences between the account types are the assets and fee structures, but all profiles share the same $100 minimum deposit. Our team also appreciate that each account provides No Dealing Desk (NDD) execution and eight base currencies, making FxPro accessible to traders in various regions.

It is good to see that Muslim traders are also catered for with an Islamic account available on request. The swap-free account essentially waives interest charges, providing a halal trading solution. In addition, corporate and joint accounts are available.

On the downside, we see the lack of rewards or incentives for individuals trading in large volumes as a bit of a letdown. FxPro could improve its rating by offering fee rebates and other perks.

We highlight the key differences between the accounts below:

MT4 Instant & MT4 Fixed

- Hedging

- Instant execution

- Minimum trade size 0.01 lots

- Rollover fees for positions held overnight

- Trade forex, commodities, shares, indices, and futures

- Floating or fixed spreads (fixed on 10 popular forex pairs)

- Good for price transparency

FxPro MT4

- Hedging

- Market execution

- Floating spreads

- Minimum trade size 0.01 lots

- Rollover fees for positions held overnight

- Trade forex, commodities, shares, indices, and futures

- Good for forex traders

MT5

- Floating spreads

- Market execution

- Hedging or netting

- Minimum trade size 0.01 lots

- Rollover fees for positions held overnight

- Trade forex, commodities, shares, futures, and indices

- Good for non-forex traders

cTrader Account

- Hedging

- Floating spreads

- Market execution

- Minimum trade size 0.01 lots

- Rollover fees for positions held overnight

- Trade forex, commodities and indices

- Good for scalpers

FxPro Edge Account

- Hedging

- Floating spreads

- Market execution

- Minimum trade size 0.01 lots

- Rollover fees for positions held overnight

- Trade forex, commodities, futures, shares, and indices

- Good for multi-asset trading

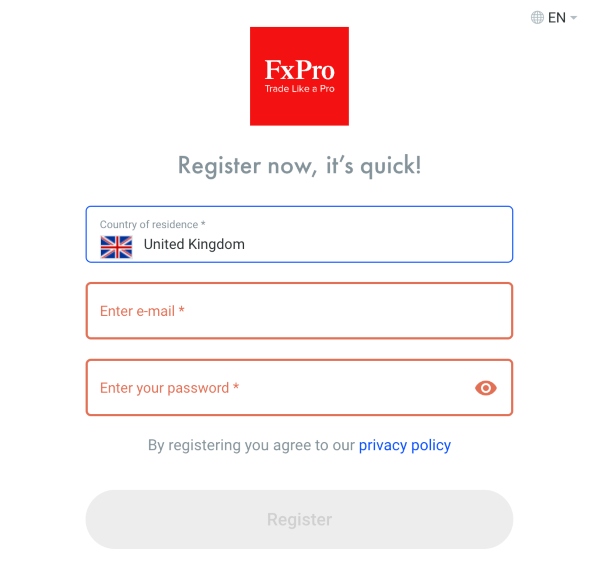

How To Open An FxPro Account

I was able to open a live trading account in a matter of minutes using the straightforward joining process. My tip is to have your identity verification and proof of residency documents to-hand.

- Sign up for a live FxPro account using the registration form

- Add your country of residence and email address and create a password

- Select ‘Register’

- Validate your email address

- Click ‘Accounts’ from the side menu and choose ‘Upload Your Documents’ from the top menu

- Add identity verification and proof of residency documentation

Trading Fees

While FxPro’s spreads and commissions are generally competitive on popular forex pairs, trading fees are relatively high on some other assets.

Marked-up spreads, which are floating and may change depending on market conditions, are available on most of the broker’s trading accounts. The exception to this is the MT4 Fixed Account which provides fixed spreads on popular currency pairs, typically around 1.91 pips on the EUR/USD. Our team finds that this is slightly higher than the 1.55 pips generally available on the floating spread solution, though there is less price certainty.

We particularly like the cTrader account for short-term strategies like scalping owing to the tighter spreads of around 0.5 pips on the EUR/USD and 0.7 pips on the USD/JPY. With that said, commissions apply when trading forex and metals on the cTrader solution, though these are reasonable at $35 per million.

Ultimately, FxPro isn’t top of the pile when it comes to trading fees, but we do appreciate the choice of pricing models which means clients can find a solution that best suits their trading strategy and needs.

Non-Trading Fees

Our team are pleased to see that most of the broker’s additional features are free, with not many extra charges to worry about. For instance, we rate that Trading Central is provided at no cost and that deposits and withdrawals are free.

The key charges to be aware of are the $10 inactivity fee after six months of no trading and the $30 monthly charge to use FxPro’s VPS server.

Note, compliance with tax obligations and payments are your responsibility.

Payment Methods

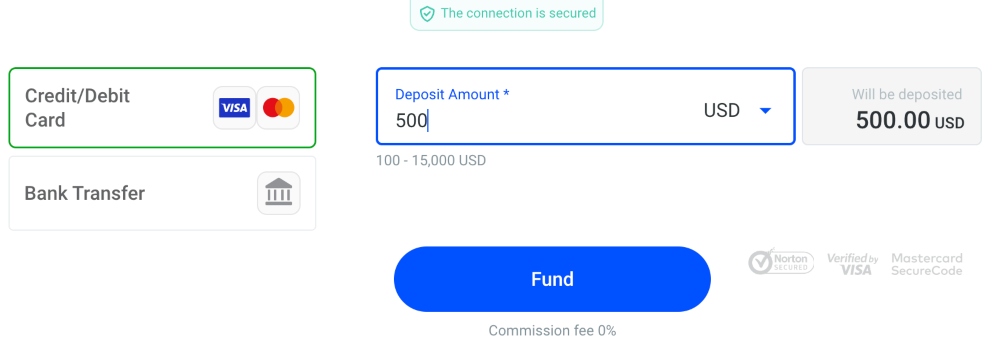

I like that FxPro makes it easy to fund a live account through a range of accessible payment methods. With bank transfers, Visa and Mastercard credit/debit cards, plus e-wallets like PayPal, Skrill, and Neteller available, the only popular solution not supported is crypto payments.

I did find that e-wallets are the best pick for fast deposits, with funds typically processed within 10 minutes. In contrast, wire transfers can take several working days.

Another bonus is the $100 minimum deposit or equivalent currency, which is low enough to appeal to beginners and those on a budget.

How To Make A Deposit

- Log in to the FxPro Direct portal

- Select ‘Wallet’ from the top menu and then ‘Deposit’

- Choose a payment method and input the funding amount

- Complete the payment details on the screen and confirm the transaction

I think the FxPro Wallet, which allows traders to load and transfer funds between accounts instantly is a particularly useful addition. The vault can also hold funds in eight base currencies (USD, EUR, GBP, CHF, PLN, JPY, AUD, and ZAR). To transfer funds from the wallet to an FxPro account:

- Sign in to the FxPro Direct client dashboard

- Select the ‘Transfer’ icon

- Choose the wallet as the source account and then the live trading account to fund

- Enter the value to transfer

- Select ‘Confirm’

- If the wallet and account currencies are different you will need to confirm the transfer along with any conversion fees.

Withdrawals must be processed back to the initial payment solution. I’m glad that FxPro aims to process all requests within a few hours, though the time taken for funds to be received does vary between methods.

One drawback worth pointing out is the fee of up to 2.6% for Neteller and Skrill withdrawal requests if no trading has taken place. In my experience, the best forex brokers do not charge for this so it’s worth being aware of.

Forex Assets

We are impressed with the wide range of forex instruments. In total, there are more than 70 currency pairs available to trade via CFDs. This includes all the majors, plus a good selection of minor and exotic pairs.

FxPro’s offering is also competitive vs alternatives such as XM (50+ pairs) and AvaTrade (50+).

| Forex Pair | Available | Forex Pair | Available |

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

We also rate the selection of non-forex instruments. FxPro offers more than 2000 CFDs on stocks, indices, metals, energies, futures, and cryptos (location dependent). This provides plenty of opportunities to speculate on global markets and emerging sectors.

Supported instruments include:

- Shares – Speculate on 1000+ US, UK, and EU stocks such as American Airlines, BT Group, Adidas, and Walmart

- Commodities – Trade eight spot metals including gold, silver, and platinum, plus three spot energies such as Brent oil and natural gas

- Indices – Trade 18 major stock indices as spot CFDs. This includes the NASDAQ 100, Hong Kong 50, and Japan 225

- Futures – Trade futures contracts on 22 popular commodities and indices including the S&P 500, DAX 30, and gold

- Cryptocurrencies – Speculate on 10+ digital currencies including Bitcoin, Ethereum, Litecoin, and Ripple

Unlike some competitors, FxPro also facilitates spread betting for UK clients. These derivatives offer a straightforward bet on rising and falling prices while using a multiplier to boost potential returns (and losses). Profits from spread bets are also tax-free.

Note that FxPro does not offer binary options.

Execution

FxPro uses a No Dealing Desk (NDD) model whereby orders are sent directly to the forex market.

The NDD approach provides retail investors with lightning-fast execution speeds and minimal slippage. In fact, the majority of positions are filled in less than 13 milliseconds, which is noticeably faster than many forex brokers. Our team is also reassured to see that trading servers are fibre connected with top-tier banking institutions.

FxPro Leverage

Our team finds that the leverage provided by FxPro is pretty standard and aligns with regulatory restrictions in respective trading jurisdictions. EU and UK traders, for example, can access 1:30 leverage on major forex pairs and 1:20 on minor pairs.

With that said, we recommend considering the global entity for higher leverage. Retail traders registered under FxPro Global Markets Ltd can access leverage up to 1:200 on forex majors. Of course, the downside of higher leverage is the increased risk of large losses.

We also think the dynamic leverage model available on the MT4, MT5, and FxPro platforms is interesting. The feature essentially reduces the leverage available on futures, indices, and stocks as the trade size increases. For example, major index futures between 0 and 100 lots can be traded with leverage up to 1:20, while this drops to 1:10 for position sizes between 100 and 150 lots. Ultimately, the system can be an effective way to protect against significant losses.

The stop-out level is 50% for all account types.

Platforms & Apps

I am impressed with the selection of trading platforms available at FxPro. This includes a proprietary WebTrader and third-party terminals MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. With that said, I think the lack of futures, shares, or crypto trading on the cTrader platform is a shame. Overall though, there is a platform for all types of traders, regardless of experience level.

My favorite solution is FxPro Edge. The bespoke terminal offers a more modern design and feel than MetaTrader. It also offers more customization in features like the Quant Strategy Builder. I particularly like that the platform can be used directly through major web browsers without comprising functionality. Alternatively, the app is available for free download to iOS and Android (APK) devices.

Yet while I am a fan of FxPro’s proprietary software, some traders will prefer the tried-and-tested MT4, MT5, and cTrader solutions. They are all available for free download to Windows or Mac devices, as well as offering web accessibility and mobile applications. Importantly, these platforms are all reliable, powerful and home to a catalog of analysis features.

Based on my experience, I have pulled out the key features and differences between the platforms:

FxPro Edge

- 15 timeframes

- One-click trading

- Quant custom indicator

- Four pending order types

- Access to all six asset classes

- Integrated economic calendar

- 50+ technical indicators and drawing tools

- Six chart types including candlestick, Heiken Ashi, and dots

How To Make A Forex Trade

The easiest way to place a forex trade is directly from an online chart. Simply right-click on the graph and select ‘Create New Order’ to bring up a new window. Add the order details such as risk parameters, volume, and order type and select ‘Place Order’.

Alternatively, you can open new forex positions by clicking on the ‘Buy’ or ‘Sell’ icons from a watchlist.

MetaTrader 4

- 9 timeframes

- One-click trading

- Price quote history

- MQL4 coding language

- Four pending order types

- 30 integrated technical indicators

- Trading Central integration with plug-in

- Three chart types; line, candlestick and bar

- Access to expert advisor (EA) auto strategy trading builder and robots

MetaTrader 5

- 21 timeframes

- One-click trading

- MQL5 coding language

- Six pending order types

- Integrated economic calendar

- 38 integrated technical indicators

- Trading Central integration with plug-in

- Three chart types; line, candlestick and bar

- Access to expert advisor auto strategy trading builder and robots

cTrader

- 26 timeframes

- One-click trading

- C# coding language

- Six pending order types

- Depth of market data (DoM)

- Integrated economic calendar

- 55+ integrated technical indicators

- Trading Central integration via chart targets

- Four chart types; line, candlestick, dots and bar

Forex Tools

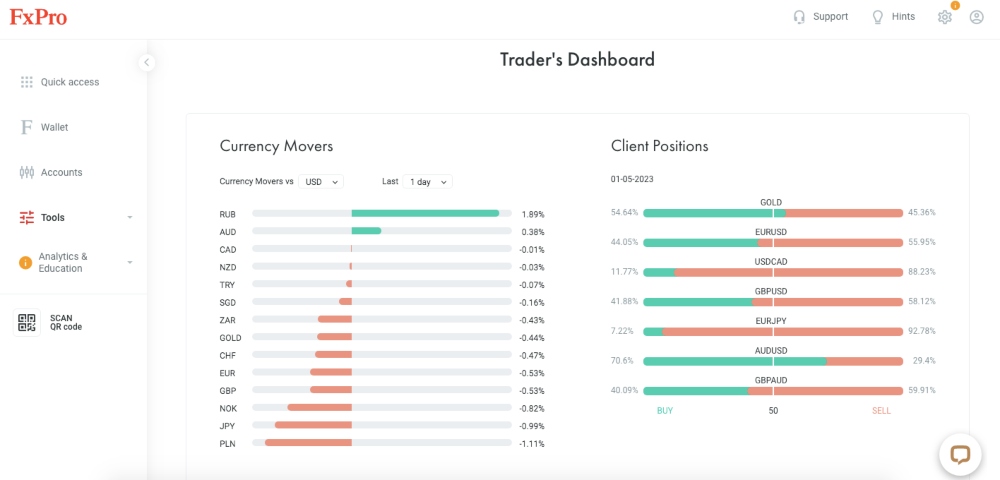

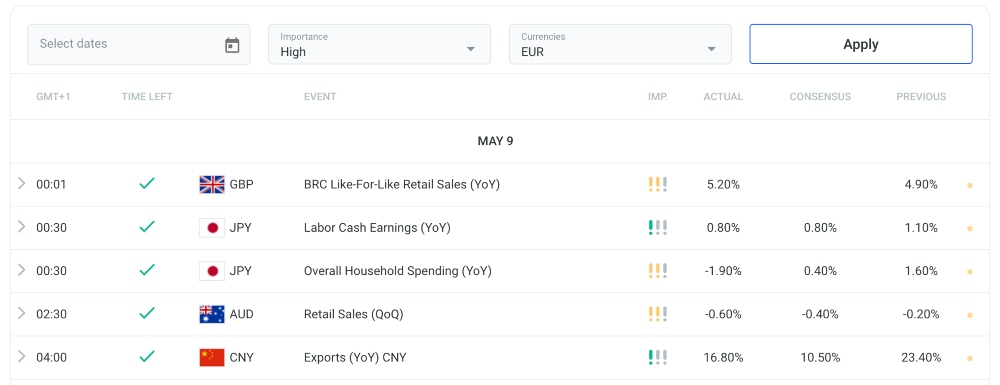

FxPro doesn’t fall short when it comes to additional forex trading tools either. We rate the range of features available to support trading decision-making and market entry timings.

One of our favorite sources is the Trader’s Dashboard, which can be accessed from the ‘Tools’ section of the broker’s website. It shows you the performance of popular currencies with information on market sentiment and price movers. We also like that this data can be integrated into platform charts or used alongside the economic calendar.

Another useful feature worth highlighting is the Virtual Private Server (VPS). With 24/7 server connectivity, 2650 MB RAM and 30 GB disk space, clients can run automated forex strategies without downtime or interruption. Servers are also connected to tier-one banking institutions providing liquidity via Quotix. To get started:

- Select the VPS hosting service from the client dashboard

- Choose the FxPro account to link and agree to the fee by ticking the VPS subscription box

- Select ‘Submit’

- Account login information and instructions will be sent to the registered email address

- Follow the link and complete the account information in the Beeks FX VPS pop-out window

- Select ‘Download RDP File’ and launch the application

- Add the password and select ‘Ok’

Our team also like that Trading Central is available free of charge. The award-winning research tool scans the forex market 24/7 providing forecasts, market projections, pattern recognition, and technical analysis. It essentially provides trading ideas, signals, and market sentiment data to help you make more informed decisions. We particularly like that we can integrate the tool within the MT4/MT5 platforms.

Other useful tools include:

- Live market news

- Economic calendar

- Company earnings calendar

- Pip, profit, lot, and leverage calculators

The one key omission for me is the lack of copy trading. This can be a real boost for newer traders or those who have limited time to research forex trades. Copy trading tools are also provided by many of the best forex brokers today.

Forex Education & Research

FxPro’s online forex trading academy ticks most of our boxes for educational content, which it divides into beginner and advanced levels, all available for free to registered traders. We are pleased to see tutorials for all skill levels, and though there is a lot more information in the beginner category, this is to be expected.

Our experts also rate the learning broadcast, with information published in a ‘flash card’ style that makes the learning process more digestible and user-friendly. Topics include how to use automated trading systems, the basics of support and resistance levels, and understanding margin requirements. Additionally, we recommend spending some time testing your forex knowledge using the online tests.

All this, in addition to integrated YouTube videos, streams of weekly webinars, a library of keywords and a glossary of common forex trading phrases, makes for a formidable educational resource that can benefit many traders.

Although the academy isn’t as extensive as that offered by eToro with blog-style forums, podcasts, and in-person seminars, we are confident the data and materials will satisfy most aspiring forex traders.

FxPro Demo Account

We are happy to see that FxPro offers a free demo account with real market conditions and live pricing. Demo accounts are a great learning tool for beginners.

The paper trading profile can be loaded with up to $100,000 in virtual cash, with a choice of eight account base currencies. In addition, all platforms including MetaTrader 4 (MT4) can be used in demo mode. The simulator profile also has a 180-day time limit which is plenty of time to test the broker’s trading software plus new forex strategies.

How To Open A Demo Account

Only basic registration details are required to sign up for a demo account, and I was able to open one in minutes.

- Select the ‘Register’ icon from the FxPro website

- Add your country of residence and email address and create a password

- Select ‘Register’

- Validate your email address used to register for the account

- Select ‘Open Demo Account’ from the account summary interface

- Select a server, base currency, leverage, and virtual fund balance, and select ‘Complete’

I also appreciate that you can register/login to a demo profile from the mobile app while getting access to additional features such as educational content and trading calculators.

Bonus Offers

We are not surprised to find that FxPro doesn’t offer any financial incentives or rewards such as welcome no deposit bonuses to new customers – UK and other major regulators restrict these. We do feel, though, that this is a disadvantage for global traders, who can find bonuses at other popular forex brokers.

Instead of promotions, FxPro markets its superior execution and no dealing desk intervention as competitive advantages. And while we agree that these are benefits, along with the suite of extra tools and features, a loyalty scheme and trading competitions would be nice additions.

Customer Service

My experience with FxPro’s customer support team has been positive. Customer service is available 24/5 in 17 languages while contact methods include live chat, email, and telephone. I would recommend live chat in the first instance – you normally get through to an agent within a couple of minutes. I also find what I need from the FAQ hub within the online ‘Help Center’.

To get in contact with FxPro:

- Email – support@fxpro.com

- Live Chat – Bottom right icon of the webpage

- Cyprus Office Address – Karyatidon 1, Ypsonas 4193, Limmasol

- UK Office Address – 13-14 Basinghall Street, London, EC2V 5BQ

- Monaco Office Address – 26, Boulevard des Moulins, Monaco, 98000

- UAE Office Address – Dubai Design District, Building Number 2, Office 113

- Telephone – 08000463050 (UK), +35725969200 (Cyprus), +44(0)2031515550 (Monaco), +12426032224 (Bahamas) or +971(0)44243023

FxPro is also active on social media including Twitter, LinkedIn, Instagram, and Facebook. Here you can find the latest company news plus daily technical analysis.

Company Details

Our experts are pleased that FxPro’s company details are transparent and easily found online – an important mark of a reliable brokerage.

The firm was founded in 2006 and has grown to become a recognized brand in the online trading industry. FxPro operates four entities that provide trading services on a global scale. This includes authorization in the UK, Cyprus, South Africa, and the Bahamas. FxPro has a headquarters office presence in each location and additional offices in Dubai, UAE.

FxPro is available in 170+ countries with over two million client accounts. Its popularity is also evidenced by the 445 million orders that have been placed through the firm. FxPro’s no-dealing desk model can transmit up to 7000 orders per second.

The brand has also been recognized with 100+ awards, including successive wins of the Financial Times Best Broker and the CFI Best FX Execution Global Broker.

FxPro is also involved with several sponsorship partners including AS Monaco FC Formula 1 and a deal with the AFC Champions League and Watford Football Club (FC).

Trading Hours

FxPro follows standard marking opening hours. The foreign exchange market is open 24/5, with three main trading sessions. This includes the New York Exchange open from 12 PM to 8 PM (GMT) and the London Exchange open from 7 AM to 4 PM (GMT).

Holiday trading hours and upcoming market close dates are published in the ‘Tools’ section of the FxPro website and reflected within the platform interface. Note, the MT4 server time operates on a GMT +2/+3 DST zone.

Who Is FxPro Best For?

FxPro ticks several of our boxes. A wide-ranging product list, excellent trading platforms and fast execution times make this a leading forex broker that is suitable for both beginner and experienced traders. The choice of accounts and pricing models also lends itself to a variety of forex trading strategies.

It is a shame that copy trading is not available for beginners or those looking for a hands-off approach to online trading, but this is one of our few gripes. Overall, FxPro is a top-ranking forex broker.

FAQ

Is FxPro Legit Or A Scam?

FxPro is a legitimate global broker. The company is licensed and regulated by four financial authorities and adheres to top-tier security protocols. Our experts are comfortable that FxPro is a relatively safe forex broker.

For peace of mind, you can also check the brand’s published annual reports to monitor the stability of the company. This includes revenue and any company ownership changes.

Can I Trust FxPro?

Yes, FxPro is a trustworthy forex broker, providing online trading services for over 15 years. There have been no security breaches or reports of fraudulent activities while most customer reviews and ratings are positive. FxPro has also picked up more than 100 awards for its products and services.

Can You Make Money Trading Forex With FxPro?

It is possible to make money trading forex with FxPro. Trading fees are competitive with a choice of pricing structures, ultra-fast execution speeds, and reliable trading platforms.

However, our experts are quick to point out that many retail traders lose money. As a result, there is no guarantee you will make money. An effective strategy and sensible approach to money management will be required.

Does FxPro Offer Low Forex Trading Fees?

FxPro’s forex trading fees are reasonable. Clients can choose between fixed spreads with no commission or variable spreads with a $3.50 commission per lot. However, with an average spread of around 1.4 pips with the floating spread model, we do see lower fees elsewhere.

Is FxPro A Regulated Forex Broker?

Yes, FxPro is regulated by four trusted financial authorities; the FCA, CySEC, FSCA, and SCB. We are also reassured to see that retail traders benefit from negative balance protection and that client funds are held in segregated accounts.

Is FxPro A Good Broker For Beginners?

Our team is confident that FxPro is a suitable forex broker for beginners. The $100 minimum deposit is relatively low while the broker offers a free demo account and a rich education center. The only notable absence for new investors is a copy trading platform.

Does FxPro Have A Forex App?

Yes, FxPro offers a mobile app, available for free download to iOS and Android devices. I like the simple navigation of the mobile application with full account management and forex trading directly from charts. The app is also secure, operating with top-tier encryption and offering two-factor authentication (2FA) login protection.

How Long Do Withdrawals Take At FxPro?

FxPro processes all withdrawal requests within a few hours during standard business hours, though total transaction times vary between methods. Typically, traders can expect to receive their funds within several working days, which is similar to other popular forex brokers.

Is FxPro A Market Maker?

FxPro is a no-dealing desk (NDD) brokerage, so traders benefit from fast order executions and reduced slippage. Our team finds that the broker is able to fill the majority of positions in less than 13 milliseconds, which is impressive.

On the downside, this means the firm usually takes its cut from a mark-up on spreads which are higher than some competitors.