Best Halal Forex Brokers

Halal forex brokers offer trading accounts that comply with Islamic principles. No swap charges apply to these accounts to prevent Muslim traders from accruing interest and breaking Sharia Law.

To evaluate and rank the best forex brokers for Islamic traders, our team considered:

The availability of a swap-free account

The presence of swap replacement fees

The trading platforms and forex tools

The broker’s regulatory status

List of 5 Best Halal Forex Brokers in 2025

These are the top 5 Islamic forex brokers based on our findings:

- eToro: Best Overall Halal Forex Broker

- Forex.com: Best Forex Market Coverage

- AvaTrade: Best MetaTrader Forex Broker

- FP Markets: Best ECN Forex Broker

- FXTM: Best Low Deposit Forex Broker

| eToro | Forex.com | AvaTrade | FP Markets | FXTM | |

|---|---|---|---|---|---|

| Swap-Free Account | Yes | Yes | Yes | Yes | Yes |

| Swap-Free Period | Unlimited | Unlimited | 5 Days | 10 Days | 7 Days |

| Swap Replacement Fee | No | No | Higher Spreads | Administration Fee | Administration Fee |

| Minimum Deposit | $1000 | $100 | $100 | $100 | $50 |

| Currency Pairs | 40+ | 80+ | 50+ | 60+ | 50+ |

| Trading Platforms | Own | MT4, MT5, TradingView, Own | MT4, MT5, Own | MT4, MT5, cTrader | MT4 |

| Regulated | Yes | Yes | Yes | Yes | Yes |

eToro: Best Overall Halal Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD -

Platforms

TradingCentral -

⇔ Spread

GBPUSD: 2 pips EURUSD: 1.5 pips GBPEUR: 1.5 pips -

# Assets49

-

Minimum Deposit

$10 -

Bonus Offer

-

Why We Recommend eToro

We recommend eToro because it offers a swap-free account with no additional fees, access to a beginner-friendly trading platform, and more than 45 forex pairs.

eToro is a hugely respected forex broker with dozens of awards and over 25 million clients. It is also regulated by tier-one regulators, including the FCA and ASIC.

Below we explain why eToro is the best all-round halal forex broker.

Pros/Cons of eToro

Pros

Competitive fees and no additional charges to compensate for zero swaps

eToro does not penalize Muslim traders with administration fees or inflated spreads to account for the loss of overnight fees. This is a serious benefit over many alternatives.

Spreads and commissions are also generally competitive. You can expect a 1-pip spread on the EUR/USD based on our tests.

You can open a swap-free account in a couple of easy steps

We appreciated the straightforward process of opening an Islamic trading account at eToro. You simply register for a live account, make a qualifying deposit and then submit a document that proves your faith to the broker’s customer support team.

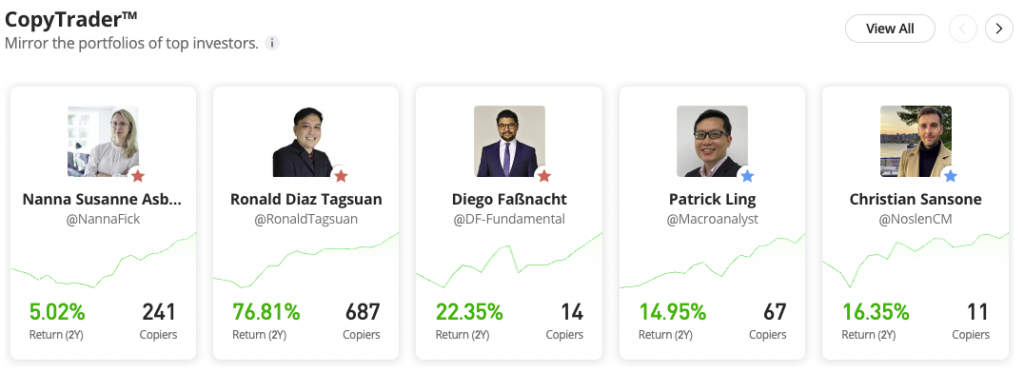

Market-leading copy trading platform with excellent community features

eToro’s best-in-class social investing platform allows users to copy the trades of experienced investors and join a global community. I especially like that you can engage in direct discussions about forex trading ideas using the platform’s integrated social feed.

Cons

eToro’s Islamic account requires a $1000 minimum deposit

eToro requires a $1000 minimum investment to open a halal trading account. This is the highest starting deposit out of the Islamic forex brokers we evaluated and may make the firm less accessible to some beginners.

Why Is eToro Better Than The Competition?

eToro stands out for its social trading platform, which is best-in-class. There is also no limit to the swap-free period nor a swap replacement fee, both of which are common at many alternatives.

Who Should Choose eToro?

eToro will serve traders looking to speculate on popular currency pairs through a user-friendly web platform or app.

Choosing eToro is also a smart move for hands-off investors. The platform makes it easy to learn from and follow the strategies of experienced forex investors.

Who Should Avoid eToro?

Muslim traders on a budget should avoid eToro – the $1000 minimum deposit is the highest we have seen.

It also won’t suit traders looking for advanced charts – the trading platform doesn’t rival alternatives like MetaTrader 4 when it comes to technical analysis.

Forex.com: Best Forex Market Coverage

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD, JPY, CHF -

Platforms

MT4, MT5, eSignal, TradingView, AutoChartist, TradingCentral -

⇔ Spread

GBPUSD: 1.0 EURUSD: 1.0 GBPEUR: 1.0 -

# Assets80+

-

Minimum Deposit

$100 -

Bonus Offer

-

Why We Recommend Forex.com

We recommend Forex.com for Muslim traders because it offers 80+ forex pairs, very tight spreads and swap-free accounts with the same benefits as standard accounts.

Below we explain why Forex.com is one of the top halal forex brokers.

Pros/Cons of Forex.com

Pros

Flexible and accessible accounts with no swap-free time limit

Forex.com is one of the most accessible halal brokers, with no administration fees or inflated spreads and commissions to compensate for the lack of swap fees.

Unlike other brokers we tested, you can also trade swap-free for an unlimited period.

Strong market coverage with 80+ currency pairs

The broker’s Islamic account offers a very wide selection of forex assets, with 82 currency pairs, making it a great option for serious traders. This is supplemented by over 4,500 CFDs in stocks, indices, metals and futures.

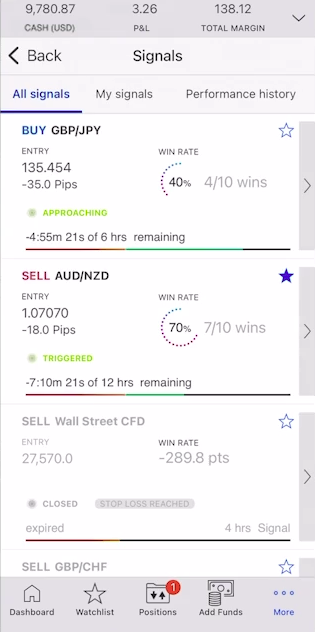

Excellent forex tools including TradingView, Capitalise.ai and SMART Signals

Forex.com offers some of the best forex trading tools available today. TradingView and Capitalise.ai allow me to perform technical analysis and implement automated trading strategies, while the SMART Signals engine helps me uncover new trading opportunities. I particularly like that I can add forex signals to my watchlist in one tap.

Cons

Limited information readily available about Islamic accounts

Forex.com could improve its transparency around Islamic trading accounts. The forex broker publishes limited information about its swap-free account, instead you have to speak to customer support.

It took us several conversations to get the information we needed to decide whether to open a halal forex account.

Why Is Forex.com Better Than The Competition?

Forex.com stands out for the wide range of forex assets and high-quality trading tools available to Muslim traders.

We also rate that with just a $100 minimum deposit, there are no restrictions on Islamic accounts nor swap replacement fees.

Who Should Choose Forex.com?

Active traders should choose Forex.com – it offers more currency pairs than nearly every alternative, fast execution speeds of 50ms, and a rebate scheme for high-volume traders.

The suite of in-house platforms and third-party tools is also among the best we have seen.

Who Should Avoid Forex.com

US traders looking for negative balance protection should avoid Forex.com, as the broker does not provide this.

Visit Forex.comAvaTrade: Best MetaTrader Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD -

Platforms

MT4, MT5, AlgoTrader, TradingCentral, DupliTrade -

⇔ Spread

GBPUSD: 1.5 EURUSD: 0.9 GBPEUR: 1.5 -

# Assets50+

-

Minimum Deposit

$100 -

Bonus Offer

Welcome bonus 20% up to 10.000$

Why We Recommend AvaTrade

We recommend AvaTrade because of its commitment to providing Muslim investors with competitive trading conditions. With a fast sign-up process, 50 currency pairs, and access to reliable MetaTrader platforms, AvaTrade offers an excellent environment for forex traders of all stripes.

Below we explain why AvaTrade is one of the best Islamic forex brokers.

Pros/Cons of AvaTrade

Pros

Flexible swap-free solution with halal trading conditions

AvaTrade makes Islamic allowances for its Standard account, rather than offering a specialist Islamic profile. This flexibility means that Muslim traders can still access all of the features in the Standard account.

AvaTrade also removes potentially problematic products, such as cryptos and exotic currencies like ZAR, TRY and RUB, from its Islamic solution.

Industry-leading forex trading tools including MT4 and MT5

AvaTrade stands out for its excellent suite of forex trading software, from MetaTrader 4 and MetaTrader 5 to the broker’s proprietary Web Trader, as well as additional tools like DupliTrade for social trading.

With more platforms and apps than most Islamic forex brokers we evaluated, traders will find tools to suit their trading style.

50 currency pairs with transparent fees

With dozens of forex assets and tight spreads, AvaTrade offers good coverage of the foreign exchange market with competitive pricing.

AvaTrade also offers diversification opportunities without the accumulation of swaps. Traders can speculate on more than 1000 stocks, indices and commodities – more than other halal brokers in our list.

Cons

The swap-free period is limited to 5 days

AvaTrade sets a comparably low 5-day time limit on its swap-free period for Muslim traders, after which you must pay overnight fees.

This is a downside since several Islamic forex brokers that we assessed allow clients to trade with zero swap fees for an unlimited period.

There is a 1 pip extra charge for Muslim traders

AvaTrade’s Islamic trading solution comes with a 1 pip extra fee. During testing, we got a 2 pip spread on the EUR/USD – 1 pip as standard plus 1 pip for Muslim traders.

This is in effect a swap replacement fee, which isn’t the highest charge we have seen but it is worth being aware of.

Why Is AvaTrade Better Than The Competition?

AvaTrade is one of the most heavily regulated and respected forex brokers with swap-free trading conditions. The firm has over 400,000 traders and licenses from the ASIC, FSA, FSCA, and FSB, among other regulators.

AvaTrade is also one of the few forex brokers to automatically restrict access to the most volatile products for Muslim traders.

Who Should Choose AvaTrade?

Islamic traders of all experience levels should choose AvaTrade. Swap-free trading is available on 50 currency pairs with a choice of powerful trading software.

AvaTrade will also serve different trading styles, with no restrictions on scalping, hedging or algo strategies.

Who Should Avoid AvaTrade?

Muslim traders planning to hold positions for more than 5 days should choose another forex broker, as AvaTrade charges swap fees after this. eToro is a good option here.

Casual forex traders should also consider another broker as AvaTrade charges a $50 inactivity fee after three months.

FP Markets: Best ECN Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, CAD, AUD, JPY, TRY, CHF, PLN, CZK, THB, VND -

Platforms

MT4, MT5, AutoChartist, TradingCentral -

⇔ Spread

GBPUSD: 1.9 EURUSD: 1.1 GBPEUR: 1.7 -

# Assets60+

-

Minimum Deposit

$100 -

Bonus Offer

-

Why We Recommend FP Markets

We recommend FP Markets because it offers two ECN swap-free accounts with tight spreads, a wide selection of 70 forex pairs and high-quality trading software.

We explain why FP Markets is one of the best Islamic forex brokers below.

Pros/Cons of FP Markets

Pros

You can open a swap-free account in 3 straightforward steps

Our team appreciated the quick and easy process to open a halal trading account at FP Markets.

You simply need to register for a MetaTrader 4 or MetaTrader 5 account, then email onboarding@fpmarkets.com and request they switch it to an Islamic account. You will also need to provide an official document that proves your faith.

Forex traders get very low spreads from 0.0 pips

FP Markets offers some of the most attractive pricing for active forex traders through its ECN-model Islamic accounts. Our tests found that rates drop to as low as 0.0 pips when liquidity is high. You also pay a fairly low $3 commission per lot.

Excellent forex trading platforms including MT4, MT5 and cTrader

With access to MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader, forex traders get customizable charts, advanced technical analysis tools, and algorithmic trading capabilities.

We also rate the Trader’s Toolbox, which offers various features, including a Correlation Matrix that shows the correlation between forex assets over a specified period.

With a $100 minimum deposit, clients looking to implement automated trading strategies also get free access to a VPS.

Cons

10-day time limit on selected swap-free instruments

Unlike other halal forex brokers we reviewed, FP Markets applies a 10-day swap-free time period, after which Muslim traders will incur fees from $1 per lot, per night.

Why Is FP Markets Better Than The Competition?

FP Markets is a standout broker thanks to its tight ECN spreads and powerful third-party platform and tool support. It is also hassle-free to open an Islamic trading account with the forex broker.

Who Should Choose FP Markets?

Forex traders looking for ECN pricing with spreads from 0.0 pips should choose FP Markets. The broker will also serve algo traders thanks to its sophisticated trading platforms and free VPS.

Who Should Avoid FP Markets?

Beginners and those looking for traditional spread-only pricing will be better off with an alternative forex broker, such as AvaTrade.

FXTM: Best Low Deposit Forex Broker

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

Currencies

USD, EUR, GBP, PLN, CZK, NGN -

Platforms

MT4, AutoChartist -

⇔ Spread

GBPUSD: 0.3 (var) EURUSD: 0.1 (var) GBPEUR: 0.2 (var) -

# Assets50+

-

Minimum Deposit

$50 -

Bonus Offer

30% up to $100 via Exinity Ltd

Why We Recommend FXTM

We recommend ForexTime (FXTM) because it offers a beginner-friendly Micro account, transparent fees and high-quality educational materials. The forex broker also helpfully removes volatile assets for Muslim traders.

Our team discuss below why FXTM is a top pick for beginners below.

Pros/Cons of FXTM

Pros

A Micro account with a low $50 minimum deposit

FXTM’s swap-free Micro account allows those on a budget to trade forex in smaller volumes with just a $50 starting deposit – the lowest of all the Islamic forex brokers we evaluated.

We also appreciate that FXTM removes volatile instruments, such as exotic currencies, reducing the risk of exposure to non-Sharia-compliant markets for newcomers.

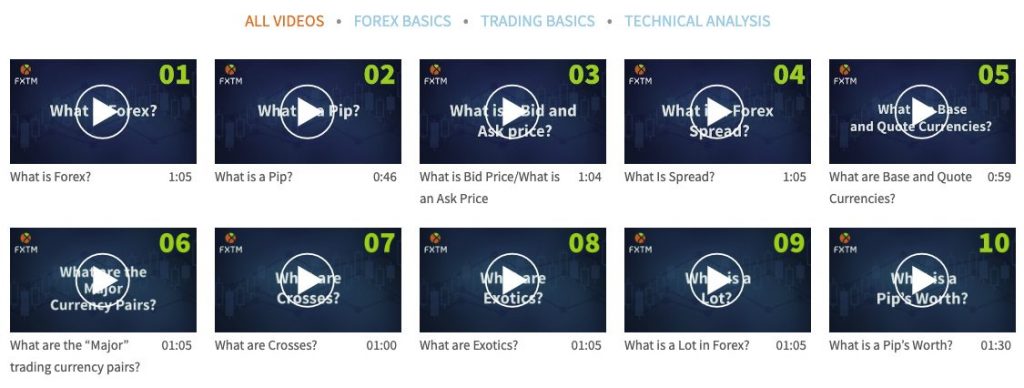

High-quality education and market analysis

FXTM offers excellent educational materials, including webinars in its Global Knowledge Hub and trading guides. We particularly rate the broker’s extensive library of forex trading videos which are informative and easily digestible.

These can all help new traders get up to speed with how the foreign exchange market works and trading tips.

6 forex indices are available for broader market exposure

FXTM is the only halal forex broker we assessed to offer currency indices. These measure the strength of one currency against a basket of other major currencies and lower the risks of speculating on a single currency pair.

Six forex indices are available: USD, GBP, EUR, JPY, AUD, and NZD.

Cons

Withdrawal fees for wire transfers and bank cards

FXTM charges fees if you want to withdraw profits using several popular payment methods. This includes a €10 fee on bank transfers and €2 on credit and debit cards. These charges can be avoided at several alternatives.

Why Is FXTM Better Than The Competition?

FXTM’s swap-free trading account is one of the most accessible for new traders with a $50 minimum investment. Exotic currency pairs are also automatically removed for Muslim traders.

FXTM also stands out for its educational materials, which are the best of every Islamic forex broker we reviewed.

Who Should Choose FXTM?

Beginners should choose FXTM. The minimum deposit is low, micro lot trading is available, and the educational resources stand above competitors.

Who Should Avoid FXTM?

Forex investors looking for additional trading opportunities shouldn’t choose FXTM – it trails alternatives when it comes to market access, especially in terms of stocks. AvaTrade is a better option.

What To Look For In A Halal Forex Broker

To find the best forex brokers with Islamic accounts, we considered several factors:

Swap-Free Accounts

Islamic accounts should be swap-free so you don’t pay any interest charges on positions held overnight.

As well as confirming that a swap-free account is available, we check for any limitations on the swap-free period or eligibility requirements. In our experience, the top brokers offer swap-free trading for several days, or even better – for an unlimited period.

Some of the best halal forex brokers also take Sharia compliance further by restricting access to volatile instruments, such as exotic forex pairs and omitting haram equities, such as stocks from the tobacco and gambling industries.

Swap Replacement Fee

We have found that some brokers will compensate for the loss of interest charges by increasing spread quotes or charging an administration fee on Islamic accounts.

Importantly, we check that any additional fees are transparent and competitive. We also favor halal brokers that don’t charge any swap replacement fees, such as eToro and Forex.com.

Trading Conditions

The top halal forex brokers offer the same trading platforms, markets and tools as standard accounts.

While some instruments may have been removed to comply with Islamic principles, we check that Muslim traders still have access to dozens of popular currency pairs and don’t lose access to other useful features, such as VPS hosting.

Regulation & Safety

We only recommend Islamic forex brokers that we trust. As well as looking for reports of scams or security concerns, we check that firms are regulated by reputable financial bodies, such as the Australian Securities & Investments Commission (ASIC), UK Financial Conduct Authority (FCA) and Cyprus Securities & Exchange Commission.

Trading forex with a well-regulated broker will help keep your trading profits safe and provide a degree of protection should the brokerage run into financial difficulties.

Our Methodology

Our team researched, compared and ranked multiple forex brokers with Islamic accounts. We considered several key metrics, including the availability of a swap-free account, the presence of swap replacement fees, the quality of the platforms and tools, access to the foreign exchange market, and trader safety.

Our findings have been fact-checked and where appropriate, verified with the forex broker in question. This gives us confidence that our top 5 Islamic forex brokers offer good value for Muslim traders with accessible joining requirements.

FAQ

Which Is The Best Halal Forex Broker?

eToro is the best halal forex broker, offering access to a swap-free account with no additional fees, 45 currency pairs, a user-friendly platform and a market-leading social investing network.

Runners up in our rankings are Forex.com, AvaTrade, FP Markets and FXTM.

Is Forex Trading Legal In Islam?

Forex trading is halal if you open an Islamic-friendly trading account. These have been designed for Muslim traders and do not charge any interest and limit access to contentious instruments, such as exotic currency pairs.

What Is A Swap-Free Account In Forex?

A swap-free account does not charge interest, known as swaps, on positions held overnight. This is to prevent Riba and comply with Sharia Law for Muslim traders.

How Do I Open An Islamic Forex Account?

You will first need to register with a forex broker that offers an Islamic account, such as eToro, Forex.com or AvaTrade.

Then you typically need to send a copy of an official document that shows your faith to the broker’s customer support team, who will subsequently activate your Islamic account.