NinjaTrader

-

💵 CurrenciesUSD

-

🛠 PlatformseSignal

-

⇔ Spread

GBPUSD: 1.6 EURUSD: 1.3 GBPEUR: 1.6 -

# Assets50+

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer-

Our Opinion On NinjaTrader

NinjaTrader is a US-regulated brokerage that specializes in futures trading. We consider it an excellent choice for active traders with flexible pricing plans and sophisticated algorithmic trading tools. On the negative side, beginners may find the software a steep learning curve and the demo account expires after just two weeks.

Summary

- Instruments: Futures, forex, indices, commodities and crypto

- Live Accounts: Standard with three pricing plans

- Platforms & Apps: Desktop, web and mobile app

- Deposit Options: Bank cards, wire transfers and ACH transfers

- Demo Account: Yes

Pros & Cons

- Thousands of add-ons including Order Flow visualizer and community indicators

- Lower commissions than competitors starting from $0.09 per contract

- Algorithmic trading via the NinjaScript programming language

- Fast account opening that takes less than 10 minutes

- Intraday margins from $50 for micro contracts

- 100+ technical indicators and drawing tools

- Regulatory oversight from CFTC and NFA

- 24/7 emergency trade desk support

- Trusted broker with 800,000+ clients

- Trading some instruments like stocks requires a partner broker

- Lifetime and monthly subscriptions are costly for casual traders

- Advanced tools and features may confuse beginners

- Demo account is limited to two weeks

- $30 bank wire withdrawal fee

- $25 inactivity fee

Is NinjaTrader Regulated?

We are comfortable that NinjaTrader is a legitimate and trustworthy broker, regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

NinjaTrader holds its funds in segregated accounts so client money is kept separate if the broker runs into financial difficulties.

We also found no evidence of security breaches or scams in NinjaTrader’s history which further boosts its trust score.

Forex Accounts

NinjaTrader offers a single account with three pricing plans, reducing fees in the monthly and lifetime plans:

- Free Account: The free account allows you to pay as you trade with no monthly fee. Commissions are $0.35 per micro contract and $1.29 per standard contract.

- Monthly Subscription: For $99 per month, traders can reduce their per-trade commissions to $0.25 per micro contract and $0.99 per standard contract.

- Lifetime Account: For active traders, a one-time payment of $1,499 earns you unlimited trades with commissions at $0.09 per micro contract and $0.59 per standard contract.

Ultimately, the commissions are low compared to alternatives and the paid accounts provide good value for active traders with larger budgets.

How To Open An Account

I didn’t experience any issues signing up for a NinjaTrader account. It took me less than 10 minutes and requires a few simple steps:

- Complete the application form, including personal details, financial information, and trading experience

- Verify your identity and submit your government-issued ID and proof of address

- After your application is approved, fund your trading account with the minimum deposit

- Download the NinjaTrader platform. Alternatively, you can use the web version or the mobile app

- Start trading online

Trading Fees

NinjaTrader is one of the lowest-cost futures brokers.

This is especially true for traders that can afford the one-time payment of $1,499 in return for commissions of $0.09 per micro contract.

Forex spreads compare fairly well to alternatives. While they start from 1.1 pips on popular majors like the EUR/USD and USD/CHF, we found they average around 1.4 and 1.8 pips, respectively.

It is important to note that spreads and/or commissions will vary if you trade forex on the NinjaTrader software at partner brokerages.

Non-Trading Fees

NinjaTrader scores lower when it comes to non-trading fees.

There is a $25 inactivity fee if you don’t place any trades for a month. This kicks in faster than most forex brokers, who normally levy a charge after three to six months of inactivity.

There may also be fees to integrate third-party add-ons and charges depending on market data access and trade management.

However, it is the withdrawal fees that stand out. While deposits are free, there is a $7 charge for checks and $30 for domestic wire transfers. There is also a 1% currency conversion fee.

Payment Methods

I like that there is no minimum deposit, reducing the entry barrier.

On the negative side, the range of deposit options and processing times trail the best forex brokers. Most alternatives offer a larger selection of payment methods, including e-wallets, with near-instant deposits.

Deposit options and associated timelines at NinjaTrader:

- ACH: 1-2 business days if made before 1:00 pm CST

- International wire transfer: 2-4 business days

- Domestic wire transfer: 1-2 business days

How To Make A Deposit

The deposit process at NinjaTrader is straightforward and secure:

- On your profile go to ‘Transfer’ and then ‘Fund’

- Select the payment method you wish to use

- Specify the amount you wish to deposit into your account

- Select the currency you wish to deposit in, such as USD

- Review the deposit details and confirm the transaction. If you are using an external payment method like a wire transfer, follow any additional instructions from your payment provider

Forex Assets

NinjaTrader offers 17 popular currency futures listed on the Chicago Mercantile Exchange (CME) and ICE Futures US. This includes the Euro, British Pound, and Swiss Franc. We also rate that there is access to the US Dollar Index, for diversified exposure to the USD.

However, NinjaTrader does not offer forex CFDs, which are popular with many retail traders. With that said, you can trade forex CFDs on the NinjaTrader platform through partnered brokers, such as Forex.com.

Non-Forex Assets

NinjaTrader offers an excellent range of non-forex futures contracts on several global exchanges, including the CME, NYMEX, COMEX, CBOT and Eurex.

Overall, we are satisfied with the diverse selection of index, commodity and crypto futures available. Very few brokers rival NinjaTrader when it comes to the range of futures contracts.

You can trade:

- Index futures: 25+ popular equity and synthetic indices, including the S&P 500, NASDAQ and Dow Jones

- Agricultural futures: 15+ agricultural futures listed on the ICE, CBOT and CME exchanges, including coffee, soybean and corn

- Interest rate futures: 15+ interest rates including the 10-Year Treasury Note and Euro Bund

- Energy futures: 10+ energies contracts, including crude oil, gasoline and natural gas

- Crypto futures: Bitcoin and Ethereum are available via micro and standard contracts

- Metals futures: 12+ gold, silver and copper contracts available on the COMEX, NYMEX and ICE Futures US

- Volatility futures: Access the Spike Volatility Index on the MIAX exchange

Leverage

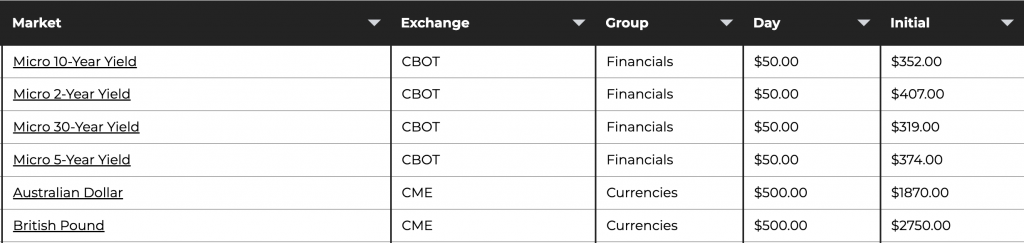

NinjaTrader offers competitive intraday margin rates from $50 for micro contracts such as the Micro E-Mini S&P and $500 for popular futures markets, such as the E-mini Dow.

Initial margins are set by the individual exchange and are required 15 minutes prior to the session close, for those holding positions into the next trading session.

Traders should note that they must meet the margin requirement at all times, otherwise NinjaTrader may liquidate your position. Violation fees apply starting from $25.

Platforms & Apps

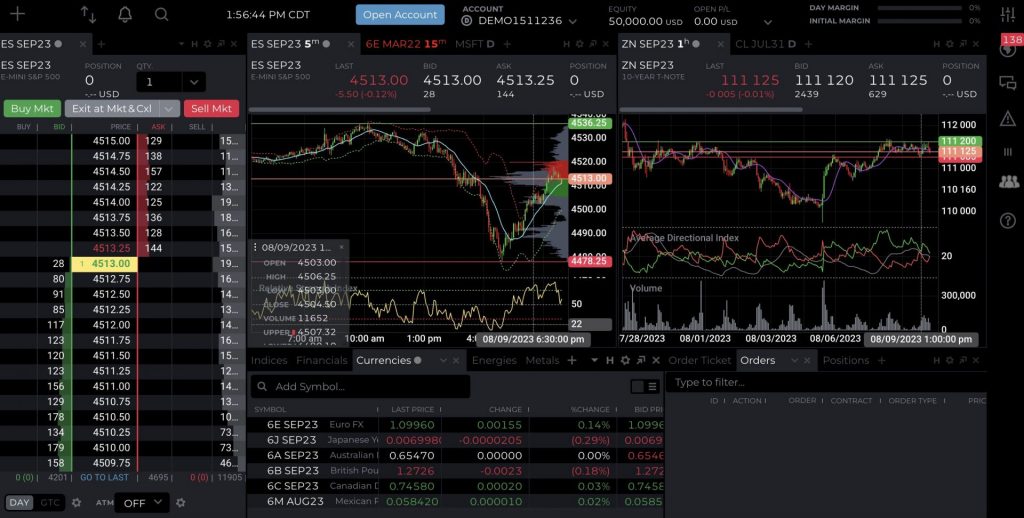

I rate the NinjaTrader 8 platform. The software stands out for its ease of use alongside powerful technical analysis features, algorithmic trading tools and customizable interface.

After testing the desktop, web and mobile versions of NinjaTrader 8, I found that the best trading experience is through their flagship desktop software. I can use the convenient multi-monitor view and access an impressive 1,000+ additional trading tools.

I also like that you could have an account on several devices simultaneously due to the cloud-based trading infrastructure.

Some of my favorite features include:

- Advanced risk management with stop orders, target orders, and self-tightening trailing stops

- Advanced charting capabilities with multiple layouts and timeframes

- Sophisticated automation tools using C#-based framework

- Rich historical data with tick-by-tick replay functionality

- Over 100 technical indicators and drawing tools

- SuperDOM (depth of market)

- Order flow visualization tool

There is also a mobile app for those who prefer to trade on the go. Available on both Android and iPhone devices, I appreciate that all the key web platform features are present in the mobile app.

How To Make A Forex Trade

I find opening a position in the platform very easy and comparable to popular third-party platforms like MetaTrader 4 (MT4).

To make a trade:

- Open the trading platform

- Choose the instrument you want to trade and open the relevant chart

- Place your forex trade using NinjaTrader’s order entry window

- You can specify the currency pair, order type, trade size, and risk parameters including stop-loss and take-profit

Forex Tools

The automated trading tools are the most impressive feature at NinjaTrader based on my experience.

Experienced coders can create custom strategies using NinjaScript, the platform’s proprietary programming language. Alternatively, there are hundreds of pre-built add-ons available within the platform.

The Order Flow visualization feature is particularly useful. Available as an add-on for $59 per month, the tool allows you to identify buy and sell pressure to confirm market movement. With a range of advanced overlays, traders can view volumetric bars, VWAP, cumulative delta and more.

Forex Research

NinjaTrader offers some market analysis, including real-time updates and news feeds.

However, I would appreciate more expert-led market insights and technical analysis. This will bring it in line with popular brokers like Forex.com.

Forex Education

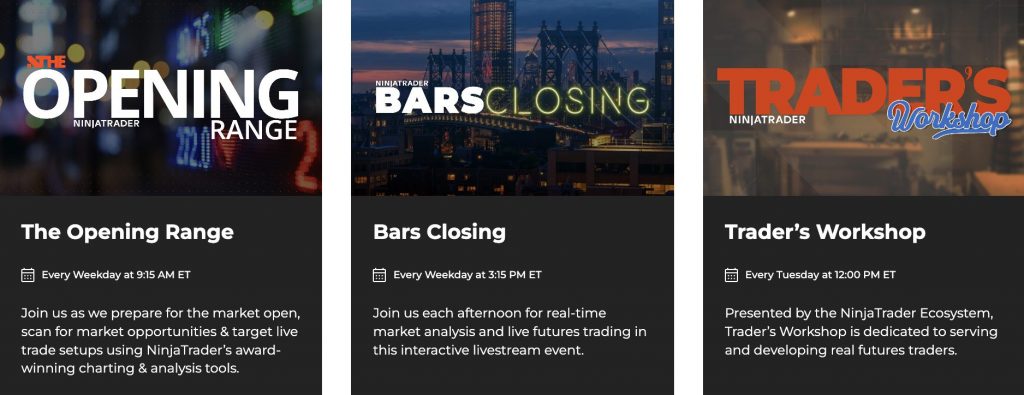

NinjaTrader score better in terms of its educational resources. We rate the range of topics covered from futures trading basics to more advanced strategy guides.

There are also some handy video guides, as well as weekly educational live streams which I think are informative and engaging.

Finally, there is an in-depth blog with how-to guides, useful updates on the market and some trading tips.

There is an FAQ section and a user forum too, though I think these are a little light on detail and the forum often doesn’t have conclusive answers.

Demo Account

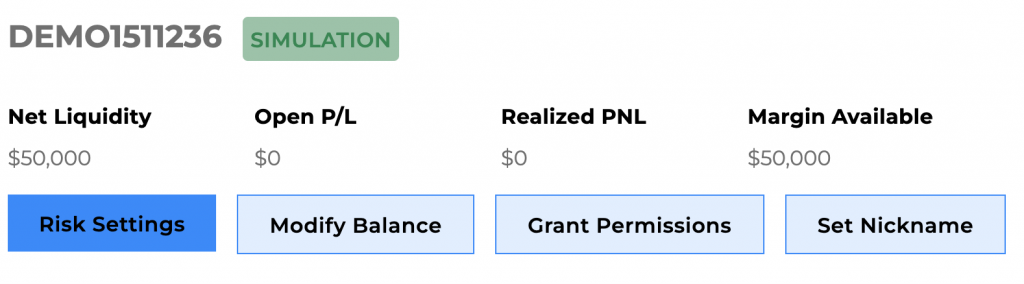

NinjaTrader offers a free demo account. It is sufficient to practice on and gauge whether or not the platform is suitable for your trading style.

However, we are disappointed that the free trial is only available for two weeks – much less than the typical time frame at alternatives. Newer traders may struggle to get to grips with the platform in this period.

How To Open A Demo Account

On a positive note, the sign-up process for the demo account is fast and easy, taking me less than two minutes:

- Select ‘Get Started’ on the website

- Enter your email address and verify

- Enter a username and password and create your account

- Select ‘Try risk-free simulated trading’

- Enter your details including your name and mobile number

- Select whether you want to trade on the desktop software or web solution

- You will be taken to the platform and provided $50,000 in virtual funds

Bonus Offers

NinjaTrader does not offer welcome bonuses or ongoing promotions.

Our team doesn’t consider this a serious drawback – financial incentives are often prohibited by regulators and come with restrictive withdrawal conditions.

Instead, we judge brokers more heavily on their accounts, pricing and trading tools.

Trading Restrictions

There are no restrictions on strategies at NinjaTrader based on our experience.

Scalping, hedging, automated trading and day trading are permitted.

Customer Service

NinjaTrader offers 24/5 customer support as well as a 24/7 trade desk for emergencies.

I have been particularly impressed with the live chat service, which is very quick to respond compared to alternatives. The automated chatbot does a good job of providing relevant answers and further details.

- Telephone: 1-800-496-1683

- Email: support@NinjaTrader.com

Company Details

Founded in 2003, NinjaTrader (NinjaTrader LLC) is an online brokerage and software provider.

With over 800,000 users and more than 600 developers across 150 countries, the firm has built a strong reputation in the futures trading market.

It is also reassuring to see the multiple awards, including the Top Trading Software as well as the Best Brokerage for Trading Futures.

Trading Hours

Futures markets trade nearly 24 hours a day, 5 days a week, from Sunday to Friday.

With that said, individual exchange hours vary and can be found on the broker’s website. For example, you can trade crude oil futures on the CME exchange from Sunday to Friday, 5:00 pm to 4:00 pm CT.

Who Is NinjaTrader Best For?

We recommend NinjaTrader for active futures traders and algorithmic traders.

The platform’s NinjaScript programming language and vast library of trading tools are excellent. In addition, high-volume traders can sign up for monthly or lifetime subscriptions to access very low fees.

Regulation from the NFA and CFTC also makes NinjaTrader a reliable choice for traders seeking a regulated US broker.

FAQ

Is NinjaTrader Legit Or A Scam?

NinjaTrader is a legitimate broker and trading platform used by hundreds of thousands of traders. Our team found no evidence of scams or fraudulent activities in their research. The company also has over 20 years of experience in the online trading space.

Can I Trust NinjaTrader?

We consider NinjaTrader a trustworthy broker. It has a long history and a strong reputation in the industry. The brokerage is also overseen by the NFA and CFTC, two highly respected regulators.

Is NinjaTrader A Regulated Forex Broker?

NinjaTrader is regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the US. These are both heavily respected regulators and a good sign that the brokerage is legitimate.

With that said, the regulatory status of forex brokers integrating the NinjaTrader platform can vary, so make sure to pick a reputable broker to help keep your funds safe.

Is NinjaTrader A Good Or Bad Forex Broker?

NinjaTrader offers an excellent platform for active and algorithmic traders with competitive pricing and reliable execution. The flexible pricing plans and strong US credentials also make it a good option.

On the negative side, the withdrawal fees are higher than many alternatives and the demo account expires after just two weeks.

Is NinjaTrader Good For Beginners?

NinjaTrader is not the best option for beginners. There are limited educational resources and the simulator account closes after two weeks. The advanced trading software and automation tools are also geared towards experienced traders.

Does NinjaTrader Offer Low Trading Fees?

NinjaTrader offers low fees for high-volume traders that can afford the monthly or lifetime subscription, which is $99 per month or $1,499. Commissions then come in as low as $0.09 per micro contract.

However, traders should also note the additional fees in the form of add-ons, platform charges, inactivity penalties, and withdrawal fees. Forex brokers that integrate the NinjaTrader software may also have their own pricing structures.

Does NinjaTrader Have A Forex App?

NinjaTrader offers its own proprietary app which we tested. Overall, we think it offers a similar user experience to the desktop software which, although not as feature-rich, is still highly functional and allows you to trade on the go.

How Long Do Withdrawals Take At NinjaTrader?

During our testing, withdrawal times varied between payment methods, typically taking between 1 and 3 business days. Whilst not the fastest, this puts it in line with most online brokers.

Can You Make Money Trading Forex With NinjaTrader?

NinjaTrader offers low fees and powerful trading software for active futures traders. However, there is no guarantee that you will make money. Success depends on various factors, including market conditions, trading strategies, risk management and your skill.