NordFX

-

💵 CurrenciesUSD

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: From 0.4 EURUSD: From 0.0 GBPEUR: From 0.2 -

# Assets33

-

🪙 Minimum Deposit$10

-

🫴 Bonus OfferPro accounts can participate in the 100,000 USD Super Lottery

Our Opinion On NordFX

NordFX is an established forex broker that offers trading on 33 currency pairs via fixed- and floating-spread accounts. We like the broker’s flexible pricing model and wide range of payment methods, which will serve both beginners and experienced traders. Our team also rated the smooth sign-up process, which took us less than 5 minutes.

On the negative side, the forex broker’s unregulated status is a weak point. NordFX also offers a slim product portfolio compared to many brokers we review.

Summary

- Instruments: 100+ including 30+ forex pairs, stocks, indices, crypto, investment funds

- Live Accounts: Fix, Pro, Zero, Savings

- Platforms & Apps: MetaTrader 4 (MT4)

- Deposit Options: Bank cards, wire transfers, e-wallets

- Demo Account: Yes

Pros & Cons

- Zero-pip spreads available in the ECN account

- Around-the-clock customer support is provided

- VPS available for 24/7 uninterrupted connectivity

- PAMM account and copy trading solution

- Trading tournaments with cash prizes

- Weekly market analysis and forecasts

- Execution speeds of 0.5 seconds

- High leverage up to 1:1000

- Limited investment offering with around 100 instruments

- Not regulated by a top-tier financial body

- Average spreads on the Standard account

- No MetaTrader 5 (MT5) access

- High copy trading fees

Is NordFX Regulated?

NordFX is regulated by the Vanuatu Financial Services Commission (VFSC) as VFX Capital VU INC. Unfortunately, this isn’t a well-regarded regulator, which limits the legal protections available to clients.

We consider this the main drawback of trading forex with NordFX, especially when compared to well-regulated brokers like eToro, which is regulated by the FCA of the UK, the CySEC in Europe, and other bodies.

Forex Accounts

NordFX scores well when it comes to account types, with a variety of solutions to satisfy most strategies and budgets.

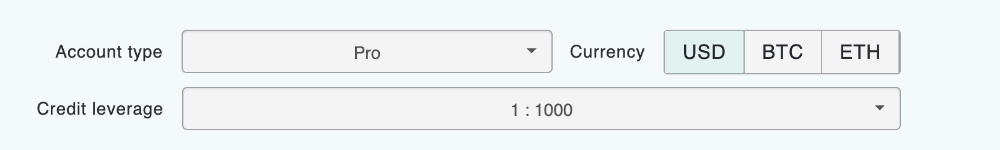

These include a Fix account geared toward beginners and low-capital traders with fixed spreads from 2 pips and a low $10 minimum deposit; a Pro account with floating spreads from 0.9 pips and no commission fees, and a Zero account that offers raw ECN spreads from 0.0 pips with a 0.0035% commission for each side of the trade.

All in all, we think these trading terms are competitive and we are pleased to find that, with a $100 minimum deposit on the Pro and $500 on the Zero account, all accounts should be accessible to most traders.

Our team is also pleased with the inclusion of a Muslim-friendly swap-free account. Traders can apply for this by emailing support@nordfx.com.

Here is a comparison of the account types:

| Fix Account | Pro Account | Zero Account | |

|---|---|---|---|

| Trading Instruments | 28 currency pairs, 13 crypto pairs, metals, CFD indices & stocks | 33 currency pairs, 13 crypto pairs, metals, CFD indices & stocks | 33 currency pairs, 13 crypto pairs, metals, CFD indices & stocks |

| Minimum Deposit | $10 | $100 | $500 |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 |

| Order Execution | Instant | Market | Market |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Margin Call / Stop Out Level | 40% / 20%, can be increased to 200% an hour before market closing without notice | 40% / 20%, can be increased to 200% an hour before market closing without notice | 60% / 40%, can be increased to 200% an hour before market closing without notice |

| Quote Precision | 4 digits | 5 digits | 5 digits |

How To Open An Account

I had no trouble opening a NordFX account thanks to the intuitive registration process, which I completed in a few minutes following these steps:

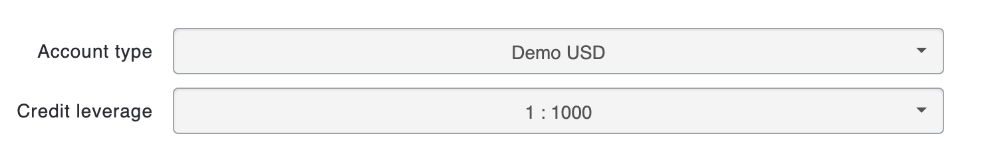

- Provide your details including your full name, email address, phone number, and confirm your chosen account type and leverage in the application form

- You will be given login details for MT4, including two passwords (a phone and login)

- Download the MT4 platform and complete full KYC verification to gain full access to the trading platform

- You can access your NordFX account as soon as your documents are verified

Trading Fees

NordFX offers competitive floating spreads, with the 0.3 pip average we got on EUR/USD while trading on Zero account providing good value.

The 1.2 pips on EUR/USD we were quoted while trading on the Pro account is less impressive, though they are about average when compared to other popular forex brokers, and are just shy of the 1.13 pips on the same pair at IG, for example.

Alternatively, beginners may prefer the pricing certainty you get with the Fix account, which offers fixed spreads, coming in at 2 pips on the EUR/USD. While not the widest fixed spreads we see, they are slightly less competitive than the 1.91 pips available at FxPro for the same currency pair.

Non-Trading Fees

There is no inactivity fee, which is an advantage over many alternatives. However, we are disappointed to see that some of the payment methods incur a charge, which we outline below.

As account balances are only in USD, BTC or ETH, currency conversion fees may apply, though this is not taken by NordFX but by the payment system.

With swap-free accounts, traders will also be charged a daily flat rate in place of interest depending on the currency or asset type, with charges imposed after a 10-day grace period.

Payment Methods

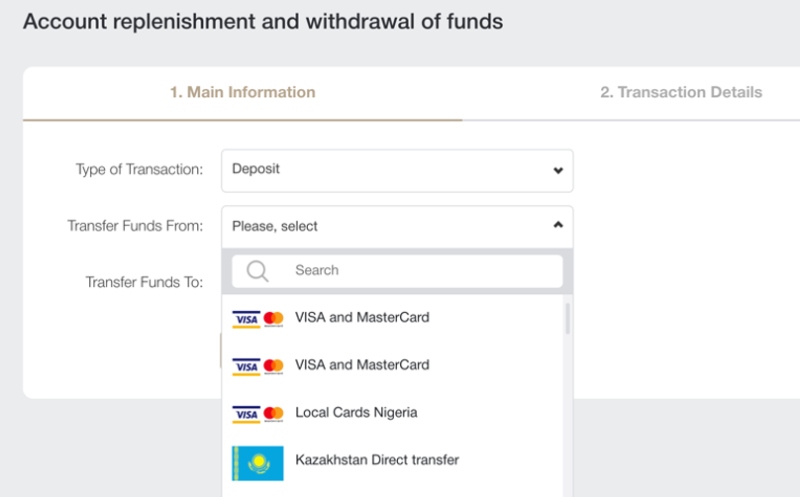

NordFX offers an excellent range of payment methods. I can fund my account with debit and credit cards, bank transfers, and a good selection of e-wallets, including Skrill, WebMoney and Perfect Money.

Most funding solutions also offer instant processing, apart from bank transfer which can take 3 to 5 working days, so I would avoid this if you want to start trading quickly.

I would also avoid WebMoney, Neteller, Perfect Money and PayToday as these all incur a fee, typically a percentage of the deposit amount up to 4.95%.

Unfortunately, I found that withdrawing money from NordFX comes with downsides. While withdrawals are fast with most payment methods – up to 1 working day for the majority of e-wallets and instant with PayToday, there are steep fees. Charges can be up to 4% of the amount + $7.50 with Visa and Mastercard, and 5% for Neteller.

With many top forex brokers offering free withdrawals, including XM and Forex.com, I consider this a notable drawback of trading with NordFX.

How To Make A Deposit

I can fund my NordFX account quickly using the broker’s intuitive funding page:

- Log in to your account

- Click the dollar sign under the home sign on the left menu section of the screen

- Press ‘funds deposit’

- Select the type of transaction (deposit, withdrawal, internal transfer etc.), your payment method, and choose which account to deposit the money into

- Confirm your personal details and the amount you wish to deposit

Forex Assets

NordFX offers 33 forex pairs for online trading, including majors, minors, and exotics. While this will serve most aspiring traders, the best forex brokers we review offer at least 40 pairs, with leading brokers offering 60+ or 70+ and some supporting hundreds.

While it is not necessary to have such a wide selection of forex pairs to be a good broker, we feel that 33 will limit the appeal of NordFX for some serious traders.

The table below gives a breakdown of some popular pairs that are featured (or not) by NordFX.

| Currency Pair | Available | Currency Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | USD/CAD | Yes |

| GBP/USD | Yes | USD/CNY | No |

| USD/JPY | Yes | USD/CHF | Yes |

| AUD/USD | Yes | USD/HKD | No |

Non-Forex Assets

We also find the non-forex assets available at NordFX to be fairly limiting, with around 100 CFDs in total including a handful of cryptos, commodities and indices as well as 68 stocks.

This does not provide too much scope for diversification, and we think investors who care about non-forex trading will prefer a competitor like IG that offers thousands of instruments across a diverse range of asset classes.

Leverage

As NordFX is not overseen by top-tier regulatory bodies that typically enforce rules limiting leverage, the broker is free to offer high leverage of up to 1:1000 on forex pairs.

This may be an advantage to experienced and confident traders, who can use such high leverage to maximize profits from winning traders, but since losses are also magnified we urge new and less confident traders to use strict risk management strategies.

Platforms & Apps

Our experts are happy to see that NordFX supports MetaQuotes’ MetaTrader 4 (MT4).

This is an industry-leading platform for good reason, and I regularly use MT4 to trade forex. For me, the platform’s excellent functionality and support for automated trading make it one of the best ways to execute forex trades.

MT4 includes a comprehensive range of indicators, drawing tools, multiple timeframes, various order types, automated strategy support, real-time alerts, and risk management tools.

The highly customizable workspace is also important for me. I can move and manage widgets to find an optimal layout.

Forex Tools

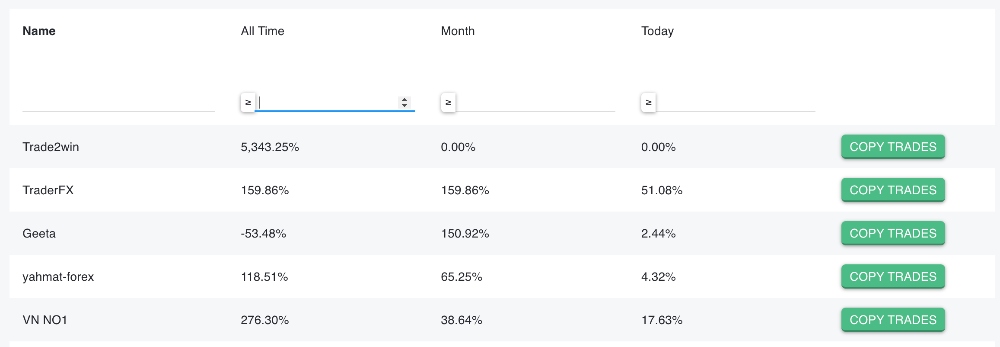

NordFX has some decent options when it comes to forex trading tools, and we are glad to see the inclusion of both VPS and copy trading since these appeal to experienced and newer traders, respectively.

However, we do think it is disappointing that both these tools have fairly high charges.

The VPS, provided by Fozzy Forex VPS, is available for 9.95 EUR/13.95 USD per month. This is a discounted rate accessed with the ‘NordFX_fozzy’ promo code – but it is still expensive compared to the free VPS services provided by many good forex brokers we evaluate.

Additionally, we feel the 10% profit split charged by signal providers in the copy trading service is fairly steep, considering that many providers charge half that.

Besides these tools, NordFX provides a free trading calculator and an economic calendar, and we enjoyed using both of these tools.

We also find the blog useful and are pleased that it is updated weekly, though we feel the market research is some way behind competitors such as XTB in terms of depth.

Finally, there is a DeFi savings account where you can earn interest up to 3% and get a loan on invested capital. This requires a $500 minimum deposit and can be managed in USDT, DAI, BUSD and other stablecoins.

Forex Education

NordFX’s educational content is fairly good, with registered traders gaining access to a library of educational videos and articles that encompass diverse subjects from managing emotions in trading and applying the 5/15 rule to recognizing trends, calculating pips, understanding common terms, and implementing popular strategies.

We would like to see the inclusion of more varied content types, such as e-books, PDFs and interactive resources, but we do think the videos and articles are well made with diverse subjects to satisfy a range of traders.

Demo Account

NordFX offers a free demo account and we are pleased to see that it offers the same trading terms and features as a live account.

Demo accounts can be one of the most useful tools for sharpening your skills and learning new trading techniques, so we are pleased that NordFX does not impose a time limit on its paper-trading accounts.

Bonus Offers

NordFX regularly offers bonuses. This includes a Mega Lottery with a $100,000 prize pot. Clients can win lottery tickets by trading on the platform.

There is also an ongoing Refer a Friend promotion that rewards users who refer new clients with a bonus equal to 10% of the referral’s first deposit.

Customer Service

I find NordFX’s customer service reliable and prompt, and during my tests information was provided quickly and concisely from each of the broker’s multiple communications channels.

Traders can reach the broker quickly via live chat, or they can email support@nordfx.com for help. There are also multiple hubs across the world with hotline numbers available in each:

- Bangladesh: +447458197795

- China: +86 108 4053677

- Europe: +357-25030262

- India: +972559662836

- LATAM: +593-9-97-221410

- Sri Lanka: +972559661848

- Thailand: +66600035101

- UAE: +447458197293

Company Details

NordFX was established in 2008 and has since accumulated almost 2 million accounts worldwide as well as a host of awards, mostly in Asia.

It has branch locations worldwide but is headquartered and registered in Shefa, Vanuatu.

Trading Hours

NordFX’s trading hours depend on the asset being traded, though forex markets are open 24/5, from Sunday to Friday.

Who Is NordFX Best For?

New traders looking for price certainty will find NordFX’s fixed-spread account attractive, especially given the $10 minimum deposit. The unlimited demo account and education will also support beginners.

NordFX will also appeal to active traders looking for ECN pricing, high leverage and access to a VPS to run automated forex trading strategies.

Finally, hands-off investors will appreciate the copy trading service and PAMM solution.

FAQ

Is NordFX Legit Or A Scam?

NordFX has a decent reputation in the industry and it has good user reviews with millions of clients worldwide. This is a reassuring sign that it is a legitimate forex broker and not a scam.

Can I Trust NordFX?

We found our experience with the broker to be smooth with transparent fees, high-quality trading tools and reliable customer support. As a result, we consider NordFX a trustworthy forex broker.

On the downside, its offshore status with weak regulatory oversight does lower its safety score.

Is NordFX A Regulated Forex Broker?

NordFX is regulated by the Vanuatu Financial Services Commission (VFSC). This is not known as a stringent financial regulator, and clients should not expect similar protections to those guaranteed by a tier-one regulator like the UK’s FCA or Australia’s ASIC.

Is NordFX A Good Or Bad Forex Broker?

NordFX has the makings of a good forex broker, with competitive fees, a good range of tools, and flexible trading accounts. It has also won multiple awards.

To improve its rating further we would like to see stronger regulatory credentials and no withdrawal fees.

Is NordFX Good For Beginners?

Yes, NordFX is suitable for beginners. The minimum deposit is low at $10, there is an unlimited demo account and fixed spreads for pricing certainty. There is also a copy trading solution and PAMM account where you can benefit from the experience of seasoned investors.

Does NordFX Offer Low Forex Trading Fees?

NordFX offers competitive trading fees, including fixed and floating spreads, depending on the account type. Fixed spreads start from 2 pips while floating spreads start from 0.0 pips. We compared typical spreads to leading alternatives and NordFX scored well.

Does NordFX Have A Forex App?

No, NordFX does not have a proprietary trading app. However, it uses MT4 as a trading platform which can be downloaded to your mobile or tablet device.

Does NordFX Accept US Clients?

NordFX does not accept clients from the United States due to regulatory restrictions.

How Long Do Withdrawals Take At NordFX?

Typically NordFX processes withdrawals within several business days, but some methods offer instant processing, including PayToday, while many e-wallets offer withdrawals within one working day.

Can You Make Money Trading Forex With NordFX?

It is possible to make money trading forex with NordFX, but as with any broker, no client is guaranteed to profit – that depends on the skill of the trader and market conditions.