Sage FX

-

💵 Currencies

-

🛠 PlatformsMT4

-

⇔ Spread

GBPUSD: 0.9 EURUSD: 0.9 GBPEUR: 2.5 -

# Assets28

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer$1,500 trading competition

Our Opinion On Sage FX

Sage FX is an offshore forex broker with ECN and STP accounts. Our team are impressed with the low spreads from 0.1 pips and accessible minimum deposit of $10. The prop trading service with funded accounts up to $200K is also a fairly unique feature.

Looking at the downsides, Sage FX’s unregulated status raises safety concerns for us. During testing, the TradeLocker platform also didn’t match reliable software like MetaTrader 4. Finally, the customer support and market research trails the best forex brokers we use.

Summary

- Instruments: 130+ including 57 forex pairs, stocks, indices, commodities, and crypto

- Live Accounts: Standard, VAR, PRO, Mini Pairs

- Platforms & Apps: TradeLocker Beta

- Deposit Options: Bank cards, e-wallets, cryptocurrencies

- Demo Account: Yes

Pros & Cons

- Multiple accounts cover beginners and experienced as well as high- and low-volume forex traders

- Funded trading accounts with up to $200K and a 90/10 profit split

- Two-factor authentication (2FA) for added account security

- Low minimum deposit of $10 accessible for new traders

- Tight spreads from 0.1 pips on forex assets

- Crypto deposits accepted

- Fast withdrawal times

- The TradeLocker platform is still in the development phase and trails MetaTrader 4

- Below-average customer support during testing with no telephone assistance

- Narrow investment offering with <200 assets

- Unregulated status reduces safety rating

- Limited forex tools and market research

- No Islamic account for Muslim traders

Is Sage FX Regulated?

We are disappointed to find that Sage FX is not licensed by a trusted regulator. This means clients will not receive the same level of fund security and legal protection that regulated brokers can offer.

The attraction of unregulated forex brokers is that without regulatory restrictions, they can offer traders higher leverage, up to 1:500 in this case.

We are also reassured to some degree, to find that this broker offers negative balance protection and segregates client funds in separate accounts from the firm’s operating capital.

Forex Accounts

Sage FX offers four forex-friendly trading accounts, which we feel cover different bases well. The Standard account will suit most retail traders, the Mini Pairs account is designed for entry-level investors trading in small volumes, the VAR Commissions account will appeal to users seeking commission-free trading, and the Pro Deposits solution will serve traders looking for tight spreads from 0.1 pips.

All the accounts have a competitively low minimum deposit of $10, except the PRO Deposits account which has a $500 minimum investment.

Sage FX is also one of the few brokers to offer funded trading accounts. If you can prove your skills in the evaluation phase you can get up to $200K in funding and split the profits 80/20, with a scaling plan up to 90/10.

On the negative side, the broker does not offer an Islamic account, unlike competitors such as eToro.

How To Open An Account

I found it simple to sign up for an account with Sage FX by following a few simple steps:

- Enter your name, email address and password in the application form

- Verify your email address by entering the code you receive

- Enter details such as your address and send documents for account verification (proof of ID)

- Click the ‘Trading Platforms’ icon at the top of the page

- Select ‘TradeLocker live’

- Log in to your TradeLocker account and start trading

Trading Fees

Sage FX offers reasonable trading fees that vary by account. The broker offers relatively low round-turn commissions on their Standard account ($8), PRO ($8) and Mini Pairs ($7) accounts and zero commission on their VAR account. These aren’t the lowest commissions we see but they stand up to many competitors.

The broker also offers tight spreads from 0.1 pips on its PRO account, comparing well with other forex brokers in the market.

The Standard account also offers competitive spreads, and during our tests, we were offered a spread of 0.8 pips on EUR/USD and 0.7 pips on GBP/USD – similar to the pricing at rivals such as AvaTrade.

Non-Trading Fees

We are pleased to find no deposit or withdrawal fees from Sage FX other than third-party fees. This makes moving funds simple.

Our team is also happy that this broker does not charge inactivity fees which compares well to competitors such as XTB with its $10 monthly charge.

Other fees to be aware of are the overnight swap fees that are charged on positions held overnight. Traders should also keep in mind that triple rate swap fees are charged on a Wednesday.

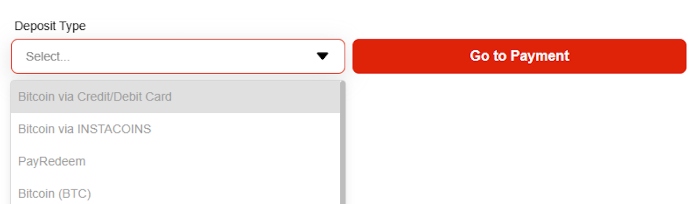

Payment Methods

Sage FX accepts a fairly good range of payment methods, including cryptocurrencies like Bitcoin and Ethereum, e-wallets such as Ripple and PayRedeem, and credit/debit cards. Our only minor complaint is that some solutions like PayPal are not supported and bank transfers are not available.

Processing times vary depending on the method you choose. For instant funding we recommend e-wallets.

We are happy with Sage FX’s selection of USD, GBP, EUR, AUD and CAD as base currencies as this allows traders worldwide to avoid currency conversion fees.

How To Make A Deposit

I find funding my account quick and easy through the cashier page, which takes just a few steps to access:

- Log in to the client portal

- Click on the ‘Deposit Funds’ icon on the left-hand menu

- Choose the payment method you want to use

- Enter the amount you want to transfer

- Confirm the deposit

I am pleased that no fees are charged for withdrawing except third-party fees – some rival brokers such as SuperForex do charge for withdrawals, so Sage FX is good value in this respect.

Withdrawal times vary between payment methods with e-wallets being instant while other methods may take a few days. These timelines are faster than many alternatives.

Forex Assets

Our team is satisfied with the range of forex assets offered, though it is not as extensive as some brokers on the market. Sage FX offers 57 currency pairs including major, minor and exotics.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

We are satisfied with the range of asset classes offered by Sage FX outside of forex, which will meet a variety of trading goals with the options available including indices, shares, commodities and cryptocurrencies.

However, we would like to see more depth in the tradeable assets – with only 130 available overall, Sage FX falls far behind leading competitors such as CMC Markets, which offers thousands of instruments for serious traders. The selection of shares is particularly narrow.

Supported assets include:

- Indices – 10 indices including the FTSE 100, DAX 40 and US 30

- Commodities – 3 commodities including oil and natural gas

- Cryptocurrencies – 23 cryptos including Bitcoin, Ethereum and Litecoin

- Shares – 38 shares such as Amazon, Apple and Google

- Metals – 5 metals including copper and gold

Execution

Sage FX’s execution model allows traders to access markets via an electronic communications network (ECN) and sources pricing straight from liquidity providers.

We feel this can often be a fairer model compared to market maker brokers, which act as counterparties to their clients. This is especially important when dealing with brokers like Sage FX, which do not have a reputable regulator overseeing their operations.

Leverage

Sage FX offers high leverage up to 1:500 which is well above the EU, UK and Australian cap for retail traders of 1:30.

Such high leverage allows investors more trading power and the chance of making more revenue from investments. However, traders should be aware that high leverage also comes with the risk of greater losses. With this in mind, we recommend employing risk management tools.

Traders should note that the forex broker has a margin call of 100% and a stop-out level that is automatically triggered when your account is below 70% of the required margin.

Platforms & Apps

I am disappointed with the platforms offered by Sage FX, which only supports TradeLocker Beta. This leaves traders without access to more popular platforms such as MetaTrader 4, MetaTrader 5, or cTrader.

On the positive side, TradeLocker is a dynamic new platform which accepts input from traders while in the development phase. It is available on desktops and iOS or Android mobile devices.

I rate the interface which has a clean design. The one-click trading mode makes it quick and easy to place trades while the 100+ charting tools and customizable indicators offer plenty for serious traders.

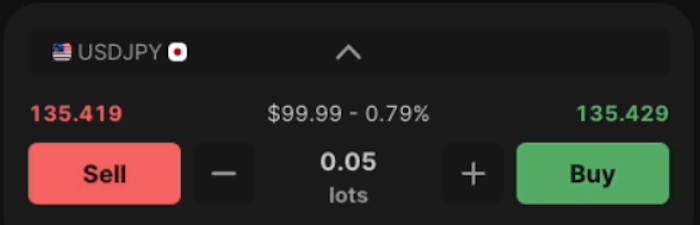

How To Make A Forex Trade

I enjoy using the slick TradeLocker platform thanks to the straightforward process of placing trades:

- Sign in to your TradeLocker Beta account

- Click on the currency pair you want to trade

- Choose the lot size you want using the plus/minus buttons

- Set the pending order and stop loss/take profit limits

- Click the green ‘Buy’ icon to confirm the trade

Forex Tools

Our team is disappointed to find no forex tools offered by Sage FX, which we feel sets the broker way behind many other brokers in a crowded market.

Unlike rivals such as Pepperstone, there are no copy trading functions, no VPS service for efficient automated trading and no access to third-party tools like Autochartist.

Forex Research

Our experts are also disappointed by the small selection of features available to traders to help them make forex trading decisions.

While we find the real-time market newsfeed helpful, no other research resources are available, setting the broker behind competitors. Analysis from experts and insight into market sentiment would be worthwhile additions.

Forex Education

We feel let down by the lack of educational content. Sage FX offers nothing in this field except a small selection of articles, which curtails the forex broker’s appeal to beginners.

We would like to see varied content such as webinars, an academy or e-books as these are available from competitors such as eToro.

Demo Account

Sage FX offers a fully functioning demo account, which is a good way for beginners to learn more about forex trading without financial risk.

The demo account also offers traders the chance to find out if TradeLocker will suit their trading style and has the features they need before risking real funds.

You can choose the account currency, leverage level and amount of paper funds when you sign up for a demo account.

How To Open A Demo Account

I found it easy to open a demo account, which only requires a few steps to get started:

- Click the ‘Sign Up’ icon on the top right-hand side of the broker’s website

- Enter your name, email address and password

- Verify your email address with the code sent

- Click the ‘Trading Platforms’ icon at the top of the page

- Select ‘TradeLocker Demo’

- Log in to your TradeLocker account and start trading

Bonus Offers

We were not offered any sign-up, deposit or other bonuses when we tested Sage FX.

While this might be disappointing for some traders, we do not rate a broker lower because of the lack of trading promotions – they are prohibited by leading regulators.

On the upside, Sage FX does provide a referral incentive, which lets traders earn rewards of up to $250 per referral depending on the volume each referral trades.

Customer Service

Sage FX lags behind the top forex brokers when it comes to customer support, offering few contact avenues with slow response times.

Traders are limited to a live chat button and a ticket submission point to contact the customer service team, which is not reachable by standard means such as telephone or email address.

Moreover, when we tested Sage FX, the live chat was not functioning and the response to our query came in relatively slowly, though it did reach us within 48 hours.

Company Details

Sage FX is an online forex broker that offers over 130 assets from 6 different classes and has 4 account types to allow different traders to reach their goals.

The company is based in the Marshall Islands, but unfortunately, there is little information available on the company’s history and other details.

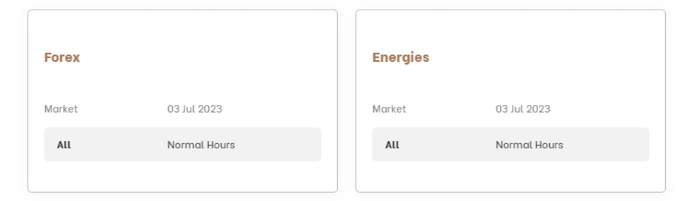

Trading Hours

The trading hours offered by Sage FX vary depending on the instrument you are trading. For example, forex can be traded 24 hours Monday to Friday.

Full information on trading hours and market events which change trading hours can be found on the broker’s website with a useful trading schedule calendar making any changes to standard hours clear.

Who Is Sage FX Best For?

Sage FX is a good option for forex traders seeking high leverage up to 1:500 on key currency pairs with ECN pricing and spreads from 0.1 pips.

The broker’s prop trading service will also appeal to experienced traders looking for funded accounts with up to $200k available and up to a 90/10 profit split.

FAQ

Is Sage FX Legit Or A Scam?

Sage FX is a legitimate forex broker. However, the firm’s weak regulatory status and relatively short history means it doesn’t have the track record of the best forex brokers.

Can I Trust Sage FX?

Sage FX offers some reassuring safeguards, including negative balance protection and segregated client accounts. The fact we didn’t find reports of scams during our research also boosts the broker’s trust score.

Is Sage FX A Regulated Forex Broker?

No – Sage FX is an unregulated forex broker. It does not hold a license with a reputable financial agency.

Is Sage FX A Good Or Bad Forex Broker?

Sage FX has several strengths. There are flexible accounts to suit different skill levels and trading setups, a low minimum deposit, funded accounts, plus fast deposits and withdrawals.

However, it trails the best forex brokers when it comes to trading platforms, market research, and reputation. The customer service also performed poorly during testing.

Is Sage FX Good For Beginners?

Sage FX is not the best forex broker for beginners. While the minimum deposit is low and there is a free demo account, the platform isn’t the best we have seen for new traders and the firm offers little in terms of education and support. eToro is a better option.

Does Sage FX Offer Low Forex Trading Fees?

Sage FX offers reasonable trading fees but not the lowest we have seen. There is a zero-commission VAR account and average commissions on the Standard account ($8), PRO ($8) and Mini Pairs ($7) accounts.

The broker also offers fairly tight spreads from 0.1 pips. For example, while using Sage FX, we got a spread of 0.8 pips on the EUR/USD and 0.7 pips on the GBP/USD.

Does Sage FX Have A Forex App?

Sage FX offers the TradeLocker Beta app to traders. The application can be downloaded for iOS or Android devices. The apps can be used to analyze the markets and execute forex trades on the move.

How Long Do Withdrawals Take At Sage FX?

Withdrawal times vary depending on the payment method you choose but are fairly fast. Once verified the funds will be returned to your account instantly in the case of e-wallets and within a few days with credit/debit cards.

Can You Make Money Trading Forex With Sage FX?

Sage FX is a forex broker with a good variety of currency pairs, multiple account types and reasonable fees.

However, your capital is at risk, regardless of the brokerage you trade with. With this in mind, make sure you have a risk management strategy.